Concluding Outlook on Long-Term Technological Trajectories: Solving the Grand Challenges

The short-term story of intelligent systems investment is undeniably about the hardware race and platform strength. But if we lift our gaze past the next earnings cycle, the *true* long-term success—the value that truly reshapes the world—will be determined by how effectively this technology is directed toward the broader societal and scientific challenges that lie ahead. This is the final, most valuable frontier.

Convergence with Scientific Discovery and Simulation. Find out more about AI stocks to buy for 2026 long-term outlook.

The most profound, enduring impact of these technologies will be felt in domains where complex, resource-intensive problem-solving has historically crawled along. Following the initial breakthroughs in areas like protein folding, **materials science** is emerging as the next major target for AI-driven discovery. AI-powered platforms are now capable of simulating molecular interactions at quantum levels, compressing discovery timelines from decades down to mere months, promising accelerated timelines for creating everything from next-generation battery chemistries to revolutionary, low-carbon cement alternatives. This convergence is about closing the loop between prediction and creation, moving from theoretical models to tangible, physical reality. The ability to discover a *new* material with desirable properties using generative models, and then synthesize it via autonomous labs, represents a fundamental shift in the scientific method itself. Furthermore, the development of sophisticated **world models**—digital twins of reality—is accelerating the creation of hyper-realistic, real-time simulations. These simulations are invaluable for training autonomous physical systems, from industrial robotics to advanced vehicle operation, without the inherent risk and cost associated with real-world trial-and-error testing. These deep integrations into both the scientific method and physical automation represent the final, most valuable frontier for this technological era.

Key Takeaways and Actionable Insights for the Investor. Find out more about AI stocks to buy for 2026 long-term outlook guide.

As of January 19, 2026, the landscape demands a more nuanced, layered approach than the broad enthusiasm of the past. Here are your actionable takeaways:

- Demand Proof of Reasoning: When evaluating application-layer investments, prioritize models that demonstrably use internal chain-of-thought or logical deduction frameworks over those that only show impressive content generation. The market now rewards **analytical partner** functionality over mere mimicry.. Find out more about AI stocks to buy for 2026 long-term outlook tips.

- Look Past the GPU Designer: While the incumbent chip designer is vital, the next wave of financial upside may come from the **manufacturing linchpin** (the leading foundry) and inference-optimization startups. Resilience in the supply chain is the new beta.. Find out more about AI stocks to buy for 2026 long-term outlook strategies.

- Governance is Growth Capital: Do not view regulatory compliance as a cost center. Companies proactively building security, digital provenance, and ethical governance *into* their core platforms are building the necessary **public trust** to win contracts in sensitive, high-value sectors like finance and healthcare.. Find out more about AI stocks to buy for 2026 long-term outlook overview.

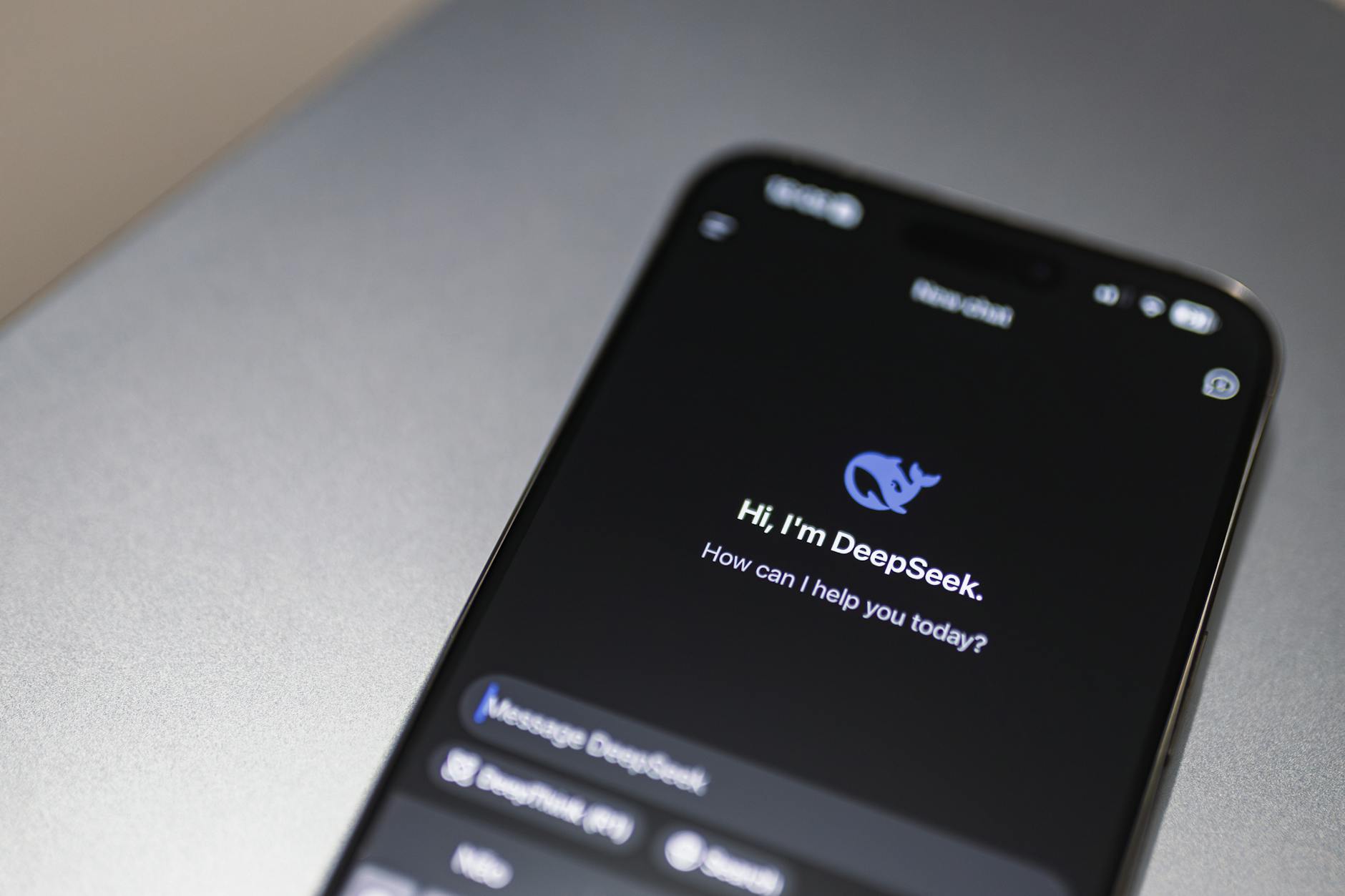

- The Open-Source Reality Check: The global dynamics have changed. The success of open-source models from East Asia means a significant portion of future application development, especially in emerging markets, will be built on foundations other than the US giants. Factor this *software fragmentation* risk into your platform evaluations.. Find out more about HBM supply chain constraints AI performance definition guide.

- Science is the New Market: The largest, most durable returns will come from technology that solves decades-old, resource-intensive problems. Monitor investment pipelines flowing into AI-driven **materials science** and closed-loop scientific discovery platforms—that is where true generational value will be unlocked.

This is a mature market now, defined by capital intensity, geopolitical scrutiny, and the challenge of real-world utility. The era of speculative frenzy is over. The age of execution—and solving the world’s hardest problems—has begun. What segment of this mature landscape—hardware enablement, scientific discovery, or regulatory compliance—do you believe holds the highest potential for asymmetrical returns over the next five years? Let us know in the comments below!