Corporate Strategy Under Scrutiny: Vertical Integration Revisited

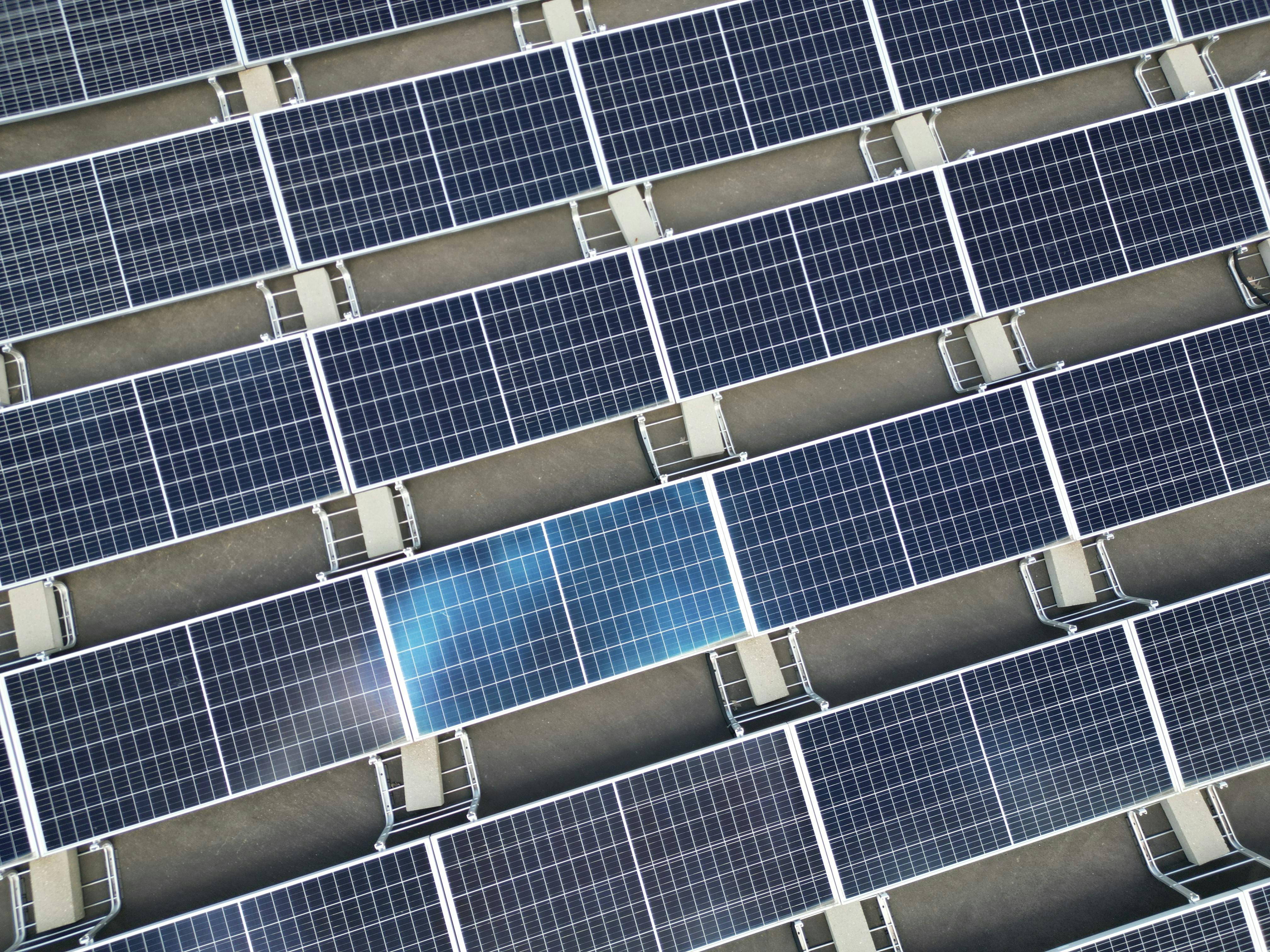

This reported outreach forces an essential re-examination of the long-held corporate philosophy regarding in-house manufacturing versus external partnership. For years, the leadership has often voiced ambitions toward achieving a high degree of self-sufficiency, suggesting a desire to control every aspect of the production process for critical components like solar modules to secure quality, cost, and supply.

Reassessing the Self-Sufficiency Mandate for Solar Modules

The current activity suggests a pragmatic pivot away from a purely insular approach. If a significant portion of the world’s leading, cost-effective solar technology production resides outside the organization’s direct control—and frankly, China dominates over 80% of the global polysilicon, wafer, cell, and module manufacturing capacity through 2026—then a strategic decision to leverage that existing mastery becomes necessary to meet an urgent scaling goal, like the stated 100 GW of US capacity. This is an acknowledgment that true expertise is distributed globally, and securing that external capability is often years and billions of dollars faster than building it entirely from scratch.. Find out more about Tesla SpaceX supplier visits Chinese solar stocks.

The Role of External Partnerships in Rapid Scaling

These visits signal a focused search for a strategic partner capable of immediately delivering scale and technological sophistication. In the realm of large-scale infrastructure, time-to-market is often just as critical as the final unit cost. By engaging with established Chinese manufacturing leaders who have already mastered the complex, high-volume production of cutting-edge HJT and Perovskite technologies, the associated enterprises can potentially bypass years of process refinement and capital expenditure. This reliance on established ecosystems is a strategic decision—be it temporary or permanent—to outsource complexity in order to accelerate overarching organizational energy goals.

Competitive Landscape Repercussions: Domestic and Global Fallout. Find out more about Tesla SpaceX supplier visits Chinese solar stocks guide.

A high-profile scouting mission by a leading American technology firm into the world’s most dominant solar manufacturing base inevitably sends shockwaves across the entire competitive environment. This creates both deep concern for some and a new set of opportunities for others.

Pressure on Western Solar Manufacturers

For established solar manufacturers operating in North America and Europe, this news introduces a significant element of downside risk. If the associated corporations successfully integrate high-efficiency, low-cost Chinese-sourced components into their own products, the resulting end-product pricing structure could severely undercut domestic alternatives operating under higher labor and regulatory costs. Analysts have noted that even the prospect of such a strategic shift could place a significant overhang on the share prices of Western solar firms, as investors begin to price in an elevated level of competitive pressure from a newly optimized, vertically integrated supply chain powerhouse.. Find out more about Tesla SpaceX supplier visits Chinese solar stocks tips.

This forces a critical strategic re-evaluation for any Western firm whose business model relies on competing solely on module efficiency against this potentially new, vertically integrated cost structure. As one source noted, Chinese modules are estimated to be half the price of those made in Europe and 65% less than those made in the U.S.. This gap is what the market is reacting to.

Anticipating the Next Moves from Asian Competitors

Conversely, for the Asian competitors who were not the direct focus of this initial outreach, the news confirms the intense strategic importance of their technological advancements and validates their years of massive investment in research and scale-up. The visit acts as a global spotlight, potentially attracting attention and investment from other multinational entities desperate to secure similar supply chain arrangements. The competitive dynamic within the Asian solar sector will likely intensify rapidly as companies race to demonstrate superior technical readiness and greater verifiable supply capacity to secure the highly coveted, multi-year procurement deals implied by this industry interest.. Find out more about Tesla SpaceX supplier visits Chinese solar stocks strategies.

Future Trajectories: What the Visits Signify for Industry Evolution

Ultimately, this episode is less about a single transaction and more about signaling a significant, structural shift in how massive energy projects will be sourced and executed over the next decade. It cements the global interdependence of high-tech energy ambitions and specialized, cost-efficient manufacturing execution.

Forecasting Near-Term Collaboration Frameworks. Find out more about Tesla SpaceX supplier visits Chinese solar stocks overview.

In the immediate future, we should expect a flurry of activity aimed at formalizing any preliminary understandings reached during these site inspections. This could manifest in various forms: long-term offtake agreements that guarantee volume purchases, or more profound, complex arrangements involving technology licensing or even joint venture structures designed to localize certain aspects of the specialized manufacturing processes. The speed at which these arrangements materialize will serve as a key indicator of the urgency behind the associated corporation’s energy deployment timeline. Keep an eye on the Chinese manufacturers’ capital expenditure reports—that will tell the real story.

Long-Term Impact on Global Energy Transition Timelines

The most profound implication lies in the potential to dramatically accelerate the global transition toward ubiquitous renewable energy. By tapping directly into the world’s most efficient and cost-effective solar manufacturing base, the barrier to achieving terawatt-scale clean energy deployment is significantly lowered. If this strategic alignment proves successful, it suggests that the timeline for achieving energy independence and decarbonization goals—both on Earth and potentially beyond—may be condensed substantially, driven by a powerful confluence of visionary technological demand meeting unparalleled manufacturing execution.

This episode marks a crucial juncture where strategic corporate scouting directly influences the macro trajectory of global energy infrastructure development. To summarize this moment and prepare for what’s next, here are the key takeaways:

- Market Validation is Complete: The immediate stock surge, with key indices climbing over 5%, confirms the market views this as a major win for the entire Chinese solar complex.

- Technology is King: The focus on HJT and Perovskites proves that advanced cell efficiency is the primary battleground for securing massive future contracts.. Find out more about Synergies between Tesla energy storage and solar sourcing insights information.

- Pragmatism Over Purity: The move signals a strategic flexibility to use global scale to meet domestic goals, overriding previous mandates for total self-sufficiency in core components.

- Actionable Insight: For any company in the solar supply chain not named in the initial reports, the next move is to aggressively demonstrate superior technical readiness or proven, scalable capacity; the race for the preferred partner role has officially begun.

What are your thoughts on this pivot? Is tapping into the existing Asian manufacturing dominance the only way to achieve terawatt-scale goals this quickly, or does it set a dangerous precedent for Western industrial autonomy? Let us know your take in the comments below—we’re watching this story unfold in real-time.