The Algorithmic Thirst: Energy Use at U.S. Data Centers Amid the AI Boom—Localized Impacts and Societal Ripples

The explosion of artificial intelligence (AI) has created an industrial revolution of data processing, one that is fundamentally reshaping the physical landscape of the United States. As AI models become exponentially larger and more complex, the infrastructure required to train and run them—the data centers—has developed a seemingly insatiable appetite for electricity and water. While national energy statistics paint a broad picture of consumption, the reality on the ground is one of acute, localized stress, threatening regional electrical grids and intensifying debates over vital community resources. This analysis, grounded in the latest findings and research as of October 25, 2025, details what is known about this digital energy boom and its tangible consequences for American communities.

Localized Impacts on Regional Electrical Grids and Community Resources

The sheer concentration of data center development in specific geographic corridors means that the national energy statistics mask acute, localized pressures on regional infrastructure and vital community resources. The sudden, massive power draw of these facilities creates significant imbalances in the localized supply-demand equation, leading to tangible consequences for surrounding communities.

Geographic Hotspots Facing Significant Transmission System Stress

The impact on the electrical grid is not evenly distributed; instead, it is heavily felt in specific states or regions where data center construction has been aggressively clustered, often due to favorable regulatory environments, access to fiber optic networks, or desirable land conditions. In the U.S., just fifteen states accounted for approximately 80% of the total data center demand in 2023, with Northern Virginia, Texas, and California remaining dominant markets.

The scale of local consumption in these hotspots far outweighs the national average. For instance, in Northern Virginia’s famed “Data Center Alley,” these sites already consume roughly 25% of the region’s total electricity supply. In a high-growth scenario, this share could escalate to 50% for the region. Other states with significant data center presences are seeing figures that reach into the double digits of their local grid’s consumption. This concentration puts immediate, high-voltage strain on transmission lines and local substations, threatening grid stability and potentially necessitating costly, rapid infrastructure upgrades that local ratepayers may ultimately shoulder.

As of August 2025, the swift growth of AI data centers has been pushing the electrical grid to its limits, with energy regulators reporting that AI data centers are now central to grid planning and emergency strategies. The power draw from AI-related operations is no longer a marginal contributor to the energy mix. This situation has prompted grid operators in several states to issue emergency alerts to industrial and commercial users, urging them to reduce power use during critical hours to avert blackouts.

The Hidden Toll: Water Consumption and Scarcity in Data Center Operations

Beyond the visible electrical demand, there exists an equally pressing, though often less publicized, concern regarding water usage. The powerful computer hardware generates immense heat, necessitating substantial cooling efforts, which frequently rely on significant volumes of water. A single hyperscale data center can consume millions of liters of water per day for cooling. More specifically, a medium-sized facility can use up to roughly 110 million gallons of water annually, a volume equivalent to the water usage of approximately 1,000 households. Larger new AI-focused centers are projected to consume even more as they scale.

Disturbingly, the rush to build is placing these facilities in regions already under duress. In the U.S., roughly 40% of existing and planned data centers are situated in areas classified as facing “high” or “extremely high” water stress by the World Resources Institute, a figure that climbs to 43% for the largest facilities. From the drought-stricken suburbs of Phoenix to regions drawing from the stressed Ogallala Aquifer, data center developers are increasingly tapping into freshwater resources, putting nearby communities at risk. This diversion of clean drinking water becomes acutely problematic where prolonged drought and chronic scarcity already exist.

Moreover, the overall water footprint is exponentially larger when factoring in the water required to generate the massive amounts of electricity consumed, which primarily comes from water-intensive thermoelectric plants. This creates a complex nexus between the digital economy, water security, and environmental justice, with some activists noting that the cost of this digital acceleration is being borne by communities facing dry riverbeds—a resource that cannot be offset by carbon credits.

Historical Precedents and the Limits of Efficiency Improvements

The technology sector has a track record of overcoming scaling challenges through engineering ingenuity. However, as the complexity of AI workloads increases, there is a growing question as to whether historical efficiency gains can continue to offset the sheer growth in computational requirements.

Tracing the Pre-AI Era Stability in Energy Consumption Patterns

For several years in the mid-past decade, the growth curve of data center energy use was relatively flat. For context, U.S. data center energy consumption hovered around 60 TWh between 2014 and 2016. This period was characterized by the industry successfully implementing strategies—such as optimizing power management for idle servers, increasing asset utilization, and refining cooling techniques—that effectively contained energy needs despite a steady increase in overall digital activity. These accomplishments demonstrated the industry’s capacity for optimization when faced with resource constraints.

Analyzing Past Successes in Operational Refinement and Their Future Applicability

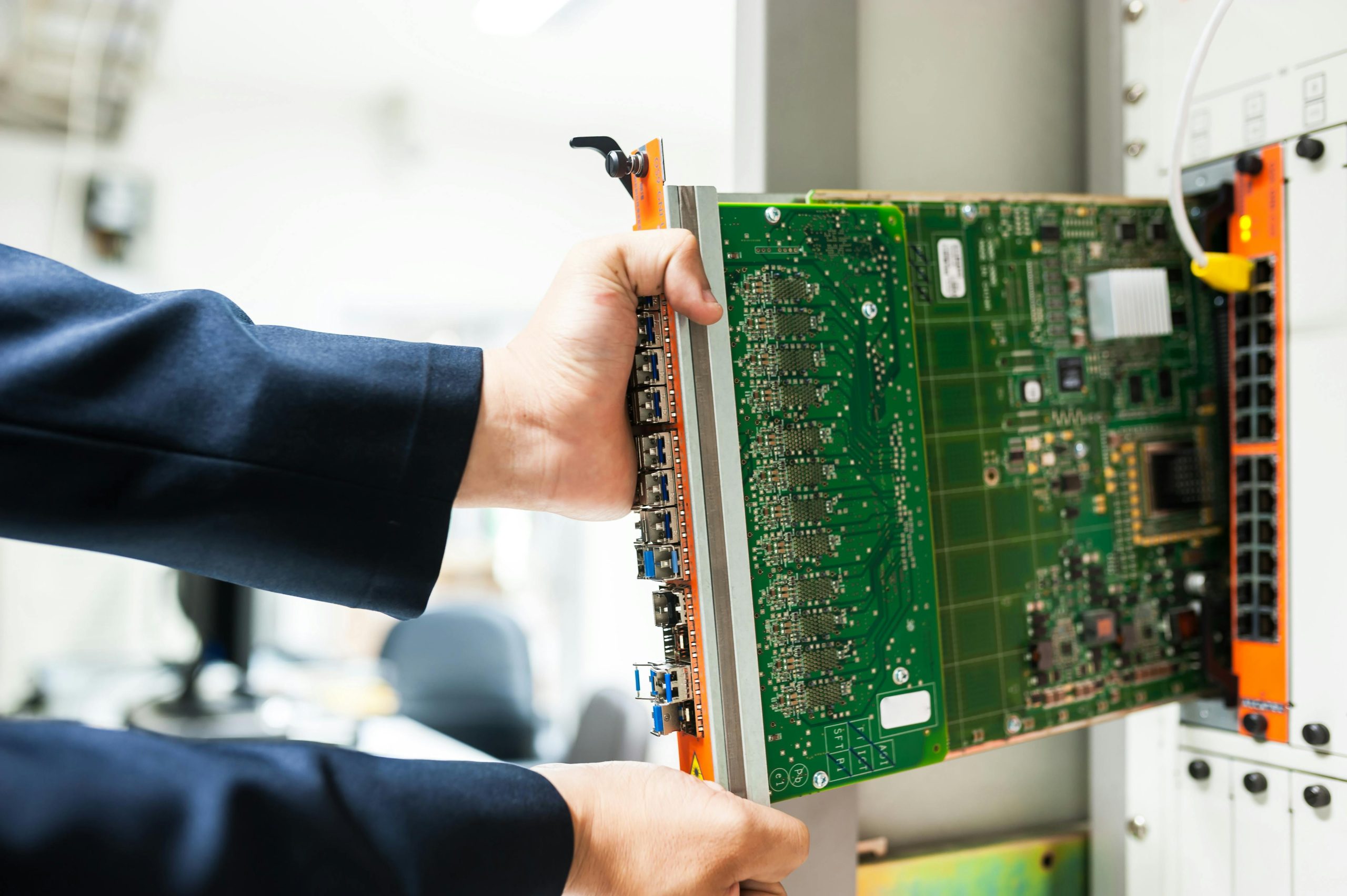

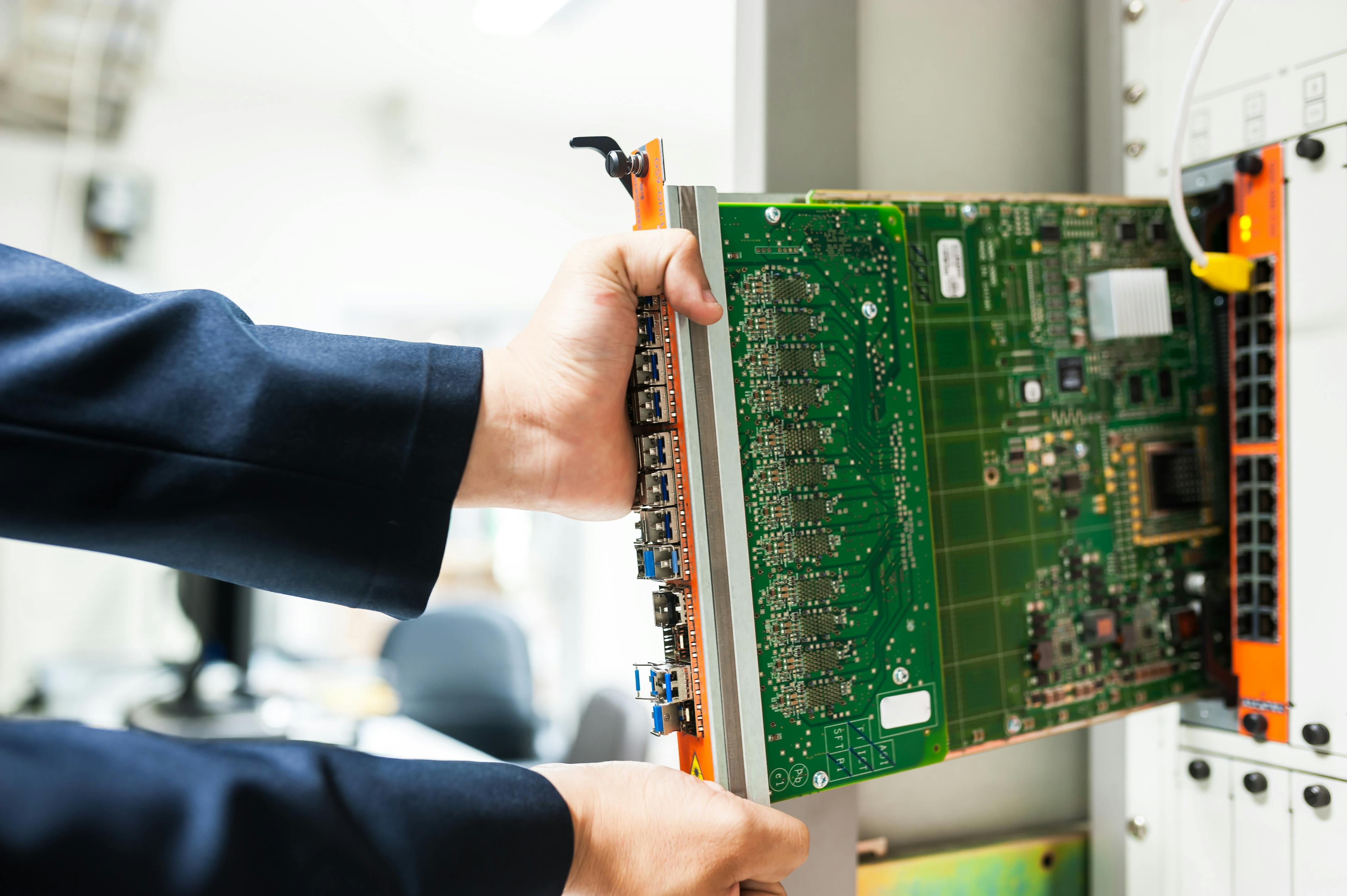

The question now facing energy planners is whether those past efficiency dividends can be replicated in the face of the AI boom. While data center operators continue to tout improvements, such as the increased adoption of liquid cooling systems—with 73% of new 2025 AI facilities deploying them—the underlying hardware is driving demand far beyond these gains.

The fundamental power requirements of next-generation AI hardware are outpacing incremental operational refinements. Servers equipped with advanced chips designed for AI training and inference consume significantly more power during operation than their conventional counterparts, often drawing two to four times as many watts. The total AI computing capacity (measured in FLOPS) has been growing at a rate of 50% to 60% quarter-over-quarter since the first quarter of 2023, a pace projected to continue through the first quarter of 2025. Consequently, the U.S. power demand from data centers could surge by 20–40% in 2025 alone, with strong double-digit growth persisting through 2030, even accounting for reported efficiency measures. This suggests that future reductions in overall energy intensity must likely come from fundamental shifts in hardware design or the energy mix, rather than solely from optimizing existing systems.

The Investment Landscape and Corporate Strategies for Sustaining Growth

To address the immediate and projected capacity crunch, the technology sector is engaging in unprecedented levels of capital expenditure directed toward both building new physical infrastructure and securing long-term power commitments, often leading to novel partnerships across traditional industrial divides.

Massive Capital Outflows Directed Toward Infrastructure Buildout

The response to soaring demand is a massive injection of investment capital. The AI-driven data center infrastructure market was already a substantial player in 2025, valued at an estimated \$13.6 billion and growing at a 28.3% compound annual growth rate (CAGR). Financial analysts predict that the total investment poured into these critical areas over the next few years will be staggering, with global asset value financing for new data center development projected to reach roughly \$170 billion in 2025.

This financial commitment is mirrored on the utility side. US energy companies are pumping record amounts into building power plants and transmission lines to meet this demand, with utility capital expenditure expected to reach \$212.1 billion in 2025. This investment underscores the industry’s belief in the sustained, long-term viability of AI, but it also raises concerns about the sheer volume of physical construction and the associated resource consumption. Goldman Sachs Research estimates that supporting U.S. data center growth through 2030 will require about \$50 billion in incremental capital investment in new power generation capacity.

The Exploration and Adoption of Novel or Contested Power Generation Methods

In their search for massive, reliable power sources, major technology firms are actively evaluating and entering into agreements for power sources that were previously considered peripheral or controversial. The immediate need for capacity, which current renewable sources cannot always meet due to intermittency, is driving a strategic pivot toward non-intermittent sources.

The renewed interest in atomic energy is a prime example. A Pew Research Center survey from Spring 2025 found that about six-in-ten U.S. adults now favor expanding nuclear power plants, a significant increase from 43% in 2020, driven by the need for carbon-free, weather-independent power. Tech giants are capitalizing on this sentiment: Microsoft and Meta have signed contracts with Constellation Energy to restart the Three Mile Island plant and expand the Clinton Clean Energy Center, respectively, while Amazon supports a Small Modular Reactor (SMR) facility in Washington State. Google has also signed an agreement with Kairos Power for energy from their SMR reactors, slated for 2035. Simultaneously, the immediate need for guaranteed capacity is driving partnerships that involve integrating data centers directly with localized power generation, including projects where gas pipeline developers are commissioning substantial, dedicated gas-fired electric generation plants specifically to guarantee power supply for a single, large technology campus.

Societal Consequences and the Public Discourse Surrounding Digital Energy Use

Ultimately, the energy decisions made within the realm of AI infrastructure are not confined to corporate balance sheets or engineering facilities; they translate directly into costs, environmental conditions, and quality-of-life considerations for the general populace.

The Potential Financial Burden Passed Down to Residential and Commercial Consumers

The enormous new demand placed upon existing regional power grids, often exacerbated by the necessary, rapid infrastructure upgrades required to prevent brownouts or blackouts, carries a significant financial implication for everyone else connected to those grids. As utilities scramble to secure new capacity, the resulting expenses are often socialized across all consumers. Analysis has indicated that electricity costs for households could rise by an average of 8% nationally over the next five years due to the funding required for new power generation and transmission projects necessary for data centers. In essence, the explosive, high-value growth of the AI industry creates a scenario where everyday families across the United States may find themselves indirectly subsidizing the power needs of these massive digital enterprises through incrementally higher, and perpetually rising, monthly electricity bills. This transfer of cost from tech giants to the general public is a major point of emerging social friction.

Evolving Public Sentiment Regarding Necessary Energy Transformations and Technology Adoption

The broader public’s view on the necessary energy trade-offs is undergoing important shifts. Worries about how AI will affect the environment surpass concerns about other major climate-impacting industries like the cryptocurrency or air travel sectors, according to a September 2025 poll. Furthermore, the connection between daily AI use and underlying energy demand is becoming more tangible, cementing the idea that the energy story is directly linked to the future of work itself.

This evolving awareness suggests that the public discourse will increasingly demand greater transparency and accountability from the industry regarding its environmental and resource stewardship. As an indicator of a potential shift in tolerance for non-traditional energy solutions, support for expanding nuclear power generation has shown measurable growth across the political spectrum since 2020, moving from 43% to nearly 60% by Spring 2025. This suggests a growing public willingness to consider powerful, carbon-free energy options as the reality of energy scarcity, driven in part by the digital sector, becomes more pronounced. However, this is coupled with protest, as evidenced by a national day of action held in September 2025, where activists opposed what they termed “water theft,” rising utility bills, and corporate subsidies related to the data center buildout. The confluence of energy demand, water scarcity, and community finance ensures that the true cost of the AI boom will remain a central, contested issue for the foreseeable future.