Better Artificial Intelligence Stock: BigBear.ai vs. UiPath – Nasdaq: PATH’s Operational Clarity vs. BBAI’s Government Bet

The artificial intelligence landscape in late 2025 presents a study in contrasting business models and execution timelines. For technology investors targeting the AI sector, the choice between BigBear.ai Holdings, Inc. (BBAI) and UiPath, Inc. (PATH) represents a classic dilemma: a high-potential, government-centric pure-play weighed against a large-scale enterprise automation leader successfully pivoting to the agentic era. As of today, December 11, 2025, a detailed examination of recent financial performance, product evolution, and market valuation suggests a clear divergence in risk and reward profiles.

Comprehensive Examination of UiPath: The Agentic Automation Leader

UiPath is currently executing a profound, internally driven technological transformation, which its founder and Chief Executive, Daniel Dines, has framed as the company’s critical “second act.” This strategic shift has culminated in the launch of its next-generation platform engineered specifically for agentic automation, debuting in May 2025. This new offering signals a decisive move beyond its historical foundation in rule-based Robotic Process Automation (RPA) to embrace more sophisticated, autonomous AI agents.

The “Second Act”: Launch of the Next-Generation Agentic Automation Platform

The core innovation of UiPath’s new platform is its sophisticated orchestration layer, designed to seamlessly unify disparate entities—autonomous AI agents, legacy software robots, and human employees—under one governance structure. This unified architecture is the essential framework for enterprises looking to deploy and manage complex, end-to-end workflows at genuine scale while meeting the non-negotiable requirements for enhanced security protocols and stringent compliance standards necessary for large corporate adoption. The confidence in this new direction was underscored by the platform’s debut with an enterprise-grade free trial, signaling UiPath’s intent to immediately prove the value of its agentic capabilities to a massive installed base.

Product Evolution from Foundational RPA to Unified Orchestration

UiPath established its market leadership as a pioneer in RPA, automating repetitive, rule-based back-office tasks to drive down operational costs for businesses. While this foundational RPA technology remains integral, the integration of modern artificial intelligence is fundamentally redefining its market relevance. The company is now heavily focused on developing and deploying advanced AI agents, often called “digital laborers,” which utilize large language models to execute substantially more complex duties with minimal direct human input post-configuration. The strategic emphasis has decisively shifted to agentic orchestration: selling the critical software layer that allows enterprises to securely manage and govern large fleets of these varied AI agents, including third-party models, alongside existing robotic assets. Solutions like Screenplay exemplify this layered approach, aiming to deliver superior automation outcomes by intelligently blending the established reliability of RPA with the advanced reasoning derived from LLMs.

UiPath’s Latest Financial Performance and Market Validation

The strategic pivot toward agentic AI orchestration is demonstrably resonating with the market, as evidenced by UiPath’s powerful financial disclosures in late 2025. The company has delivered operational results that confirm its transition toward financial sustainability is gaining traction.

Exceeding Expectations in Recent Quarterly Earnings Reports

UiPath reported impressive third-quarter fiscal 2026 results, which significantly outpaced Wall Street consensus estimates, leading to a substantial surge in its stock price in after-hours trading following the December 3rd announcement.

- Revenue: The top line reached $411 million, marking a 16 percent year-over-year increase and substantially exceeding the analyst forecast of approximately $392 million.

- Profitability Milestone: Most significantly, the company announced the achievement of positive operating income for the first time, reaching $13 million for the quarter. This was complemented by a significant net income of $198.8 million, representing a dramatic turnaround from a $10.7 million loss reported the prior year. This was cited as the company’s first GAAP profitable third quarter.

- Earnings Per Share: Adjusted earnings per share (EPS) came in at sixteen cents, narrowly edging past the consensus expectation of fifteen cents.

- Forward Guidance: UiPath provided strong forward guidance for the subsequent quarter (Q4 FY2026), forecasting revenue between $462 million and $467 million, positioning itself ahead of prevailing street targets.

Key Indicators of Customer Value and Recurring Revenue Strength

Beyond the headline earnings, several operational metrics underscore deep customer engagement and the strength of the subscription model:

- Annual Recurring Revenue (ARR): This vital metric grew by 11 percent year-over-year, reaching $1.782 billion as of October 31, 2025.

- Customer Scale: UiPath ended the quarter serving 10,860 customers in total. Critically, the cohort of high-value customers—those generating $100,000 or more in ARR—grew to 2,506, and customers generating $1 million or more in ARR increased to 333.

- Retention: Customer satisfaction remains high, reflected in an impressive 98 percent gross retention rate.

- BigBear.ai (BBAI): Despite recent revenue contraction and high projected growth expectations that are yet to materialize, BBAI carried an estimated enterprise value of approximately $3.1 billion [cite: 5, 19, context in prompt]. This translated to a valuation multiple of approximately nineteen times its projected sales for the subsequent year, pricing in a significant, yet unproven, recovery driven by leadership changes and government contract success [cite: context in prompt].

- UiPath (PATH): With a substantially larger revenue base and demonstrated momentum in enterprise software adoption, UiPath possessed an enterprise value around $8.4 billion [cite: context in prompt]. When measured by the same metric, UiPath was trading at a significantly lower multiple, estimated at a mere five times its projected sales for the next year [cite: context in prompt].

- UiPath: The company has made definitive progress toward financial health, highlighted by achieving positive GAAP operating income in its most recent quarter and a massive surge in year-over-year net income, moving from a loss to a significant gain. UiPath’s consistent execution on cost management combined with accelerating revenue growth is converging toward positive GAAP results, signaling a maturing business model capable of internally funding future innovation.

- BigBear.ai: BBAI continues to grapple with operational efficiency. Its profitability score remains low, with the latest reported quarter showing a dismaying operating loss. The company’s financial standing still requires substantial, consistent revenue acceleration to justify its premium valuation, as it remains projected to operate at a loss for the remainder of the year [cite: 8, context in prompt].

- BigBear.ai’s Narrative: BBAI’s story is one of high-potential capture within federal and defense sectors, supported by recent strategic maneuvers like establishing a UAE office to target international security contracts. However, this narrative is currently overshadowed by anemic revenue growth and margins that reflect significant operational challenges, compounded by shareholder concerns following the approval to double authorized stock, raising dilution fears. Its valuation is heavily dependent on future contract wins to validate its premium pricing.

- UiPath’s Narrative: UiPath’s story is one of successful strategic transformation and market consolidation. It is successfully leveraging its massive installed base of RPA users to transition into the more lucrative and complex agentic automation orchestration market. Its operational reality is marked by accelerating revenue growth, successful new product launches, and the crucial achievement of GAAP profitability. While its hyper-growth phase may be past, its established enterprise foothold suggests a more dependable trajectory as agentic automation matures across the sector.

This financial data strongly suggests that enterprises are actively scaling their use of the platform as agentic AI transitions from concept to widespread enterprise deployment, translating into tangible, recurring financial value for UiPath.

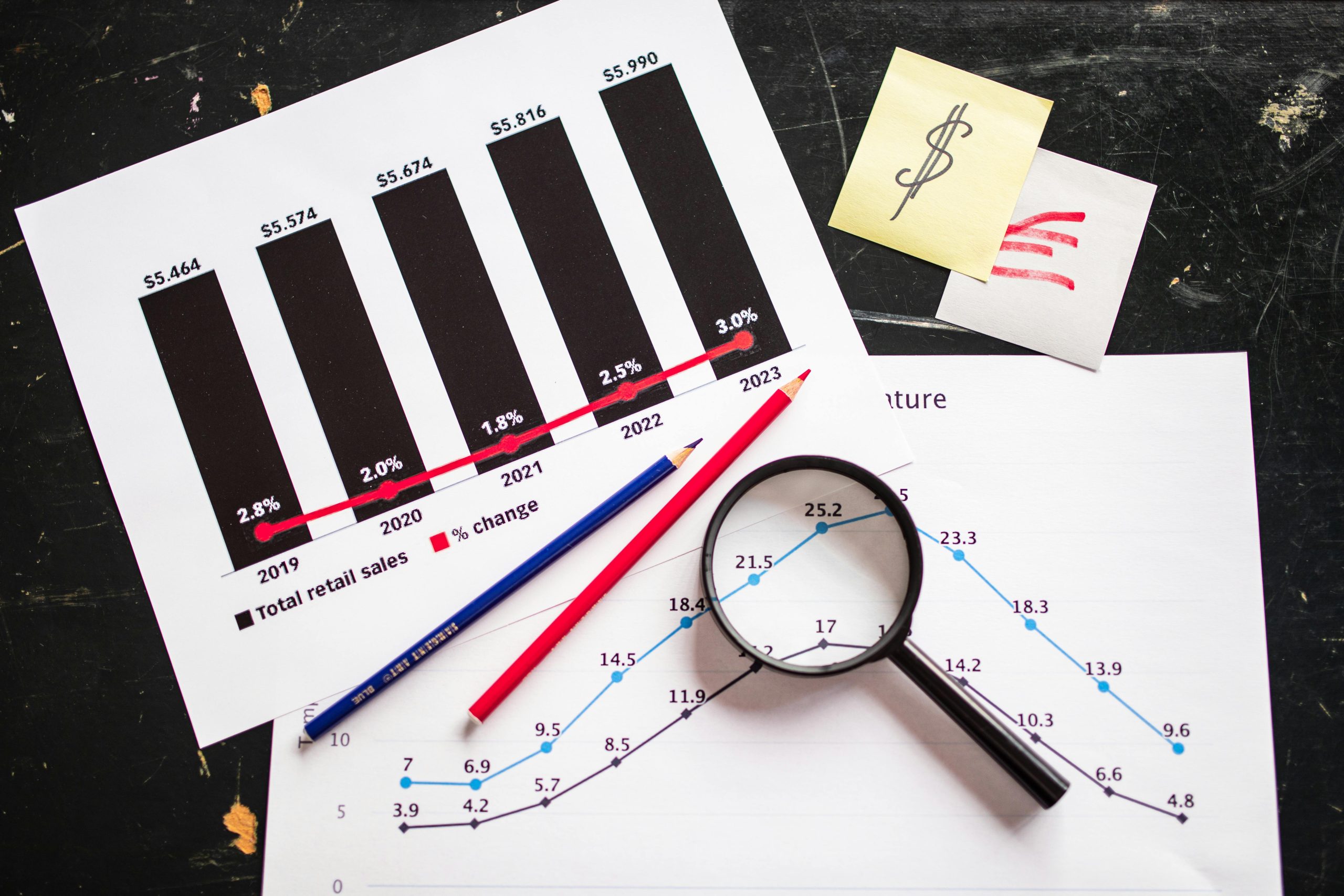

Comparative Valuation Metrics and Investment Attractiveness

The analytical comparison between the two stocks frequently hinges on their starkly contrasting market valuations and their respective paths to bottom-line profitability as of late 2025.

Contrasting Enterprise Value to Forward Sales Multiples

The market’s perception of each company’s growth potential is clearly reflected in their valuation multiples:

This disparity indicates that the market is valuing UiPath’s established, scaling enterprise automation growth at a far lower premium relative to its revenue base compared to the high-risk speculation currently embedded in BigBear.ai’s pricing structure [cite: context in prompt].

Analyzing Profitability Status: Path to GAAP Earnings

A crucial differentiator in the investment calculus is the contrasting trajectory regarding financial sustainability:

For an investor prioritizing near-term financial stability and a clear line of sight to positive bottom-line results, UiPath’s demonstration of profitability and its lower forward sales multiple present a materially less speculative profile than BigBear.ai’s current financial standing [cite: context in prompt].

Concluding Perspectives on the 2025 AI Stock Showdown

The choice between BigBear.ai and UiPath in late 2025 requires a clear assessment of risk tolerance against proven operational reality.

Synthesizing Growth Potential Against Operational Realities

The analysis reveals a trade-off between a highly specialized government/defense bet with high-stakes potential and broad enterprise adoption with validated, reliable growth.

Final Considerations for the Discerning Technology Sector Investor

Ultimately, the determination of the “better buy” rests on the individual investor’s risk tolerance and investment horizon as of December 2025.

For the investor willing to accept a higher degree of risk in pursuit of potentially massive upside contingent upon the successful, large-scale realization of government and defense contracts, BigBear.ai presents a highly specialized, high-leverage bet on federal technological adoption.

However, for the investor seeking a more balanced proposition—one that couples established market dominance with clear, positive momentum in the next wave of enterprise technology—UiPath appears to offer a more compelling risk-reward profile at this juncture. Its dominance in its niche, consistent organic revenue expansion, the inflection point of rising GAAP profitability, and its significantly more conservative valuation multiple—trading at a fraction of BigBear.ai’s forward sales multiple—all converge to present a stronger case for immediate investment capital deployment [cite: 1, 3, context in prompt]. The broader implications of AI adoption suggest long-term expansion for both, but UiPath’s current operational execution and financial discipline position it more favorably to capitalize on that expansion with greater stability.