Is Alphabet a Top Artificial Intelligence Stock to Buy for 2026?

As the calendar turns from 2025 to the precipice of 2026, the investment narrative surrounding Alphabet Inc. is fundamentally reshaped by its aggressive and successful pivot toward deep Artificial Intelligence (AI) integration across its entire technological ecosystem. The question is no longer whether Alphabet is relevant in the AI era, but whether its current valuation appropriately prices the growth trajectory set by its cloud dominance, strategic “Other Bets,” and technological breakthroughs. Based on performance figures from the third quarter of 2025 and management guidance heading into the new fiscal year, the analysis suggests a company performing at an elite level, albeit one that demands a premium for that performance.

The Cloud Computing Powerhouse: A Segment Reimagined

While the search and advertising business remains the primary financial bedrock, the growth narrative for two thousand twenty-six increasingly features Google Cloud as the critical accelerator and differentiator. This segment has transitioned from being a secondary business line focused on infrastructure to a sophisticated, high-margin enterprise solutions provider capable of competing head-to-head with the segment’s incumbents, largely fueled by its AI-centric platform services.

Accelerating Top-Line Revenue in Google Cloud

Google Cloud has consistently posted robust growth figures over recent quarters, maintaining an impressive trajectory that outstrips the overall growth rate of the entire organization in some periods. In the third quarter of 2025, Google Cloud revenue surged by 34% year-over-year, reaching $15.2 billion, demonstrating an acceleration driven by AI offerings. This accelerating revenue expansion is a direct consequence of successful market penetration driven by differentiated offerings, particularly those leveraging the company’s cutting-edge AI models for enterprise applications like Gemini and Vertex AI. The strong demand for AI infrastructure—both the high-performance custom chips the company develops (TPUs) and the readily available AI-as-a-Service platforms—is funneling substantial new contract value into this division. The cloud backlog is a key indicator of this demand, swelling to $155 billion in Q3 2025, a 46% sequential growth, which reflects multi-year commitments from customers reserving capacity for generative AI workloads.

Year-Over-Year Improvement in Cloud Profitability Margins

Perhaps more significant than the revenue acceleration is the steady, demonstrable improvement in the profitability of the Cloud segment. Operating margins within this division have shown a consistent upward trend, climbing substantially from prior year figures. Specifically, the operating margin for Google Cloud reached 23.7% in Q3 2025, a significant leap from 17.1% in the year-ago quarter. This expansion indicates a maturing business model where the initial heavy investment in global data center infrastructure is beginning to pay dividends through operating leverage. As the utilization rates of these massive capital investments increase and the mix of services shifts toward higher-value, AI-enabled software solutions, the margin profile is expected to continue its positive trend, turning the segment into an even larger contributor to the company’s consolidated net income in the coming years.

Strategic Capital Allocation and Future-Proofing Investments

Sustaining a leadership position in foundational artificial intelligence technology requires a commitment to capital expenditure on a scale previously reserved for large-scale infrastructure build-outs like national power grids. The company has openly embraced this reality, signaling a willingness to aggressively fund its AI ambitions, which has significant implications for its short-term cash management and long-term valuation.

Deconstructing the Massive Expenditure on AI Infrastructure

The revised guidance for capital expenditure reflects an aggressive acceleration in spending, explicitly earmarked for the high-performance computing clusters necessary to train and deploy next-generation large models and to support the massive data throughput generated by a global user base. Alphabet now expects its full-year 2025 capital expenditures to range between $91 billion and $93 billion, a notable increase from previous estimates. Furthermore, management has signaled a “significant” increase in CapEx is expected for 2026, with further details anticipated on the fourth-quarter earnings call. This spending is not merely reactive; it is a proactive strategy to build a hardware and software stack that creates an insurmountable lead time for competitors. The commitment to securing advanced silicon, including shipments of NVIDIA GB300-powered A4X Max instances and the ramping availability of its seventh-generation TPU, Ironwood, demonstrates a deep understanding that in the AI race, compute capacity is the ultimate scarce resource. This massive outlay is the price of maintaining the pole position in the technological competition that defines the current era.

The Delicate Balance Between Investment and Free Cash Flow

This intense capital deployment inevitably creates a trade-off with immediately available free cash flow. While the company’s core businesses generate enormous amounts of cash—evidenced by a trailing 12-month FCF of $73.6 billion as of Q3 2025—the sheer scale of the infrastructure investment causes a temporary compression in the metric representing cash available after essential capital spending. The $24 billion CapEx recorded in Q3 2025 alone puts pressure on near-term liquidity metrics. Analysts are carefully monitoring this dynamic, recognizing that while reduced short-term free cash flow is the consequence of a necessary, long-term growth strategy, the market will demand clear evidence that this spending is translating into future revenue capture and margin expansion. Successfully navigating this capital-intensive phase while continuing to exceed earnings expectations—as was achieved in two thousand twenty-five with a record $102.3 billion revenue quarter—is the key factor in justifying the current valuation premium heading into two thousand twenty-six. It is worth noting that Alphabet issued $25 billion in bonds in November 2025 to help fund this buildout, an action common among hyperscalers in the current environment.

Beyond Search and Cloud: Diversified Bets with Exponential Potential

The enterprise is structured as a holding company, with its immense resources deployed not only into its core segments but also into long-horizon “Other Bets” that represent potential future growth vectors or strategic hedges against unforeseen technological shifts. Two of these ventures, specifically those leveraging real-world data and cutting-edge LLM development, stand out as providing tangible, near-term value appreciation.

The Real-World Validation of Autonomous Mobility via Waymo

The autonomous driving division, Waymo, has successfully navigated the shift from being widely regarded as an expensive science experiment to being recognized as a pioneering commercial-scale operation. This unit has achieved genuine, repeatable, large-scale deployment of its ride-hailing service, with executive commentary suggesting plans to open service in 20 additional cities in 2026, including international hubs like Tokyo and London. Crucially, the operational data it collects from millions of driverless miles—with an accumulated 127 million driverless miles through September 2025—is strategically invaluable for training its core AI models. Furthermore, the financial narrative around this unit has improved dramatically, as it is reportedly in talks to raise more than $15 billion in a new funding round, which would value the business near $100 billion, a significant increase from its $45 billion valuation in October 2024. CEO Sundar Pichai has indicated that Waymo will “meaningfully contribute to Alphabet’s financials in 2027,” signaling a view that its growth is now nearing a profitable inflection point.

The Strategic Value and Appreciation of the Anthropic Stake

The company’s substantial strategic investment in an independent, frontier artificial intelligence research organization, Anthropic, represents a calculated diversification of its AI portfolio. This stake, which Alphabet committed roughly $3 billion to initially, has seen its underlying value skyrocket due to subsequent massive private funding rounds. Anthropic publicly confirmed a Series F round in late 2025, establishing a post-money valuation of $183 billion. Given Alphabet’s reported 14% ownership, this holding is conservatively valued on paper at approximately $25 billion. This investment serves a dual purpose: it acts as a strategic hedge against any potential limitations in Google’s proprietary models, and it provides a direct, high-value equity exposure to a leading competitor’s technological progress, ensuring the parent company benefits from the broader ecosystem’s advancement. The explosive accounting appreciation of this holding, which resulted in a $10.7 billion paper gain for Alphabet in Q3 2025, underscores the immense, intangible value being created across the entire advanced AI development sphere. Alphabet has also committed to supplying Anthropic with up to 1 million TPUs starting in 2026, deepening this strategic, synergistic relationship.

Valuation Context and Peer Comparison as of Year End

After a year of dramatic stock appreciation, which saw the equity rise over 75% since July 1, 2025, the question of whether the equity remains an attractive purchase for the ensuing year shifts from one of if the company can succeed to at what price that success is being purchased. The stock’s valuation has rightfully caught up to its improved operational performance, moving it out of the bargain bin and into a range more consistent with its high-growth, high-quality peers, yet nuances remain when comparing it to the elite group of technology leaders.

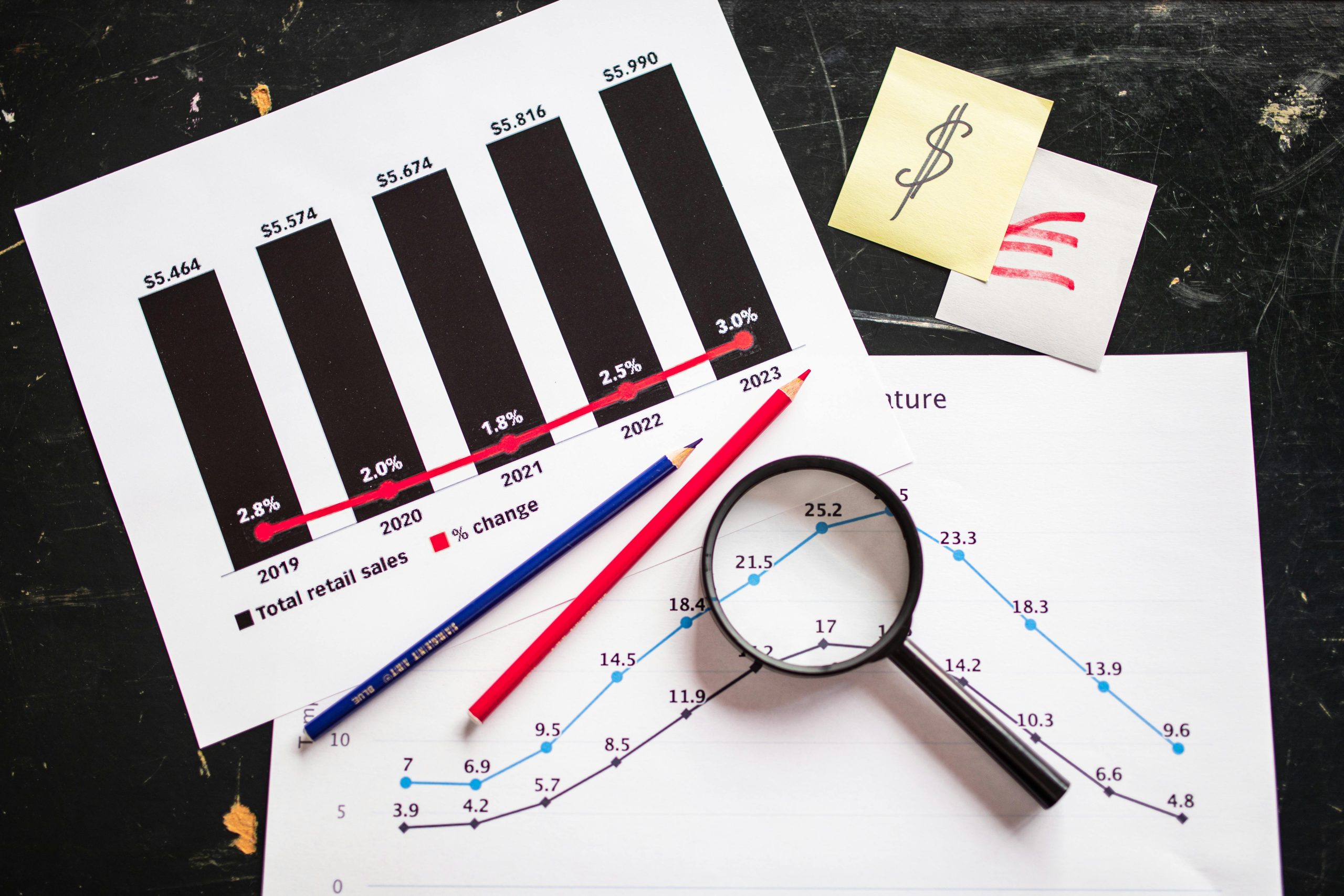

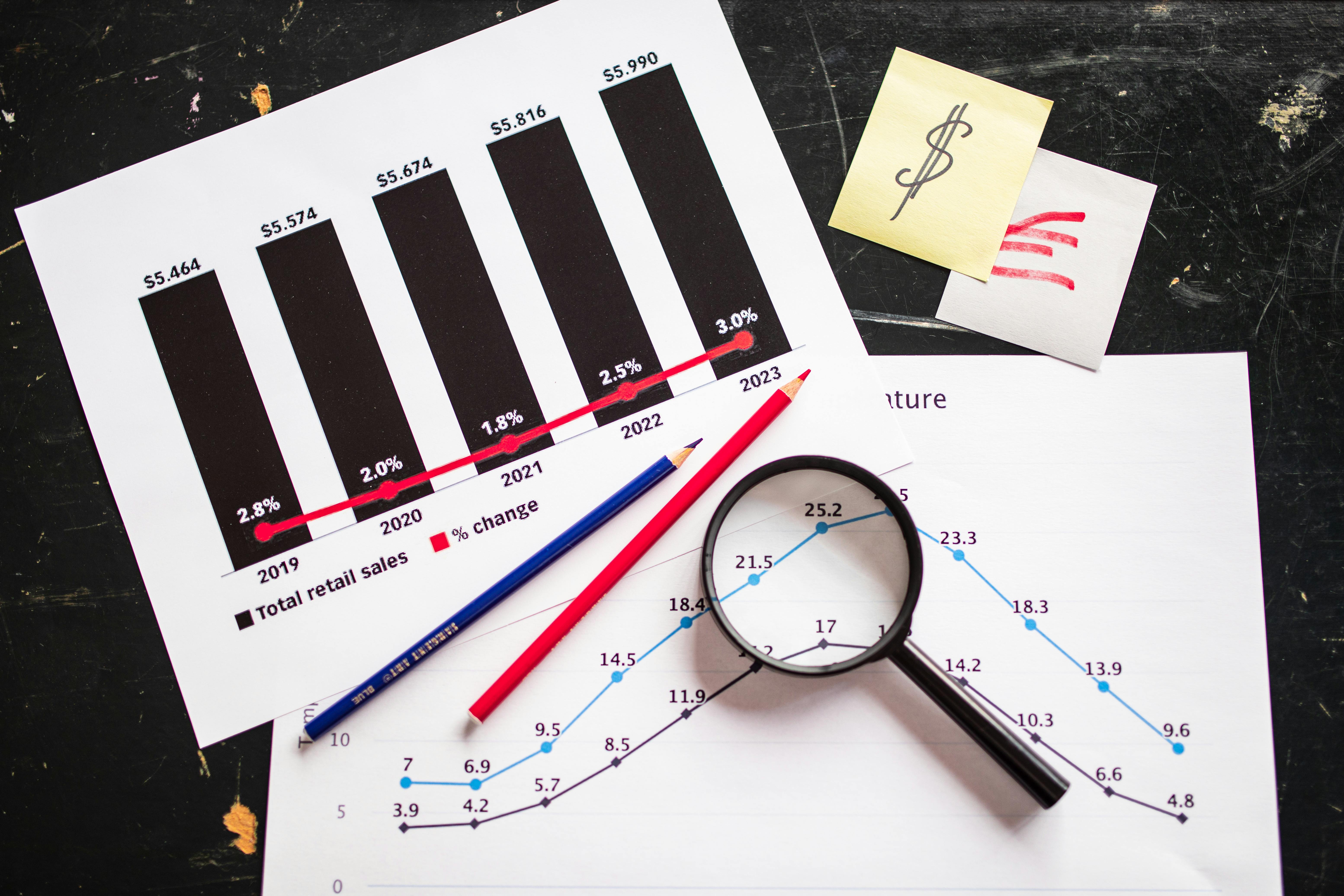

The Shift in Price-to-Earnings Ratio and Market Perception

The valuation multiple, specifically the forward price-to-earnings ratio, has moved significantly higher from the depressed levels seen at the start of two thousand twenty-five—when it traded at a lower multiple suggesting deep structural problems. Currently, in the context of December 2025, the stock trades around 30 times forward earnings. This multiple reflects a recognition of its newfound leadership in the AI sector and its multi-faceted revenue streams, including the profitability of Google Cloud and the unrealized gains from its Anthropic stake. While this is not inexpensive on a historical basis, it positions the stock as trading at or near parity with other industry giants. The market is now pricing the equity based on its demonstrated results rather than its feared potential pitfalls, meaning any further significant upward movement will likely require continued, tangible outperformance against these elevated expectations.

Benchmarking Against the ‘Magnificent Seven’ Peers

When positioned against the highly scrutinized group of the world’s largest technology companies, Alphabet retains a relatively favorable position, even after its monumental two thousand twenty-five run. While some earlier 2025 data suggested a lower forward P/E multiple compared to peers like Meta, the recent surge has brought the valuation into line with the highest-quality cohort. The current forward multiple of approximately 30x places it in a similar valuation bracket as Microsoft and Apple. This means that while the stock is no longer a deep value proposition, it is priced in a manner that rewards the current level of operational excellence and innovation, offering a compelling risk-adjusted entry point for long-term growth-oriented investors who believe the AI growth cycle has years remaining. The key question for 2026 is whether the expected growth rate can justify this premium over its closest competitors.

Prospective Headwinds and Tailwinds for the Year Ahead

No investment thesis is without its associated risks, and for a company of this scale and influence, the challenges are as significant as the opportunities. Successfully navigating these potential pitfalls will be crucial to realizing the optimistic projections set for two thousand twenty-six.

Identifying Regulatory Scrutiny and Competitive Spend Risks

The very dominance that has fueled its resurgence also places a permanent target on its back from a regulatory perspective. Ongoing legal proceedings concerning its market power in advertising and search continue to pose a structural threat; specifically, a September 2025 ruling is reported to prohibit Google from paying device manufacturers to maintain its default search status, potentially causing “traffic leakage” from high-intent queries. Furthermore, the cost of maintaining the AI lead—the massive capital expenditure—remains a persistent risk. If the pace of innovation from rivals accelerates unexpectedly, or if the cost of acquiring or developing the next generation of specialized computing chips escalates beyond projections, it could pressure margins more severely than currently modeled, dampening the financial impact of top-line growth. The expected significant CapEx acceleration into 2026 means FCF generation could remain under pressure for the next few years.

The Potential for New Business Unit Openings in Two Thousand Twenty-Six

Conversely, the structural flexibility inherent in the company’s organizational design presents an exciting potential catalyst for two thousand twenty-six. Reports circulating in late 2025 suggest the organization may explore opening a completely new business unit—potentially involving the outright sale or spin-off of its advanced custom AI computing hardware division (TPUs) to other major technology entities. Such a strategic move would unlock substantial, previously unquantified value by crystallizing the market worth of this highly specialized asset, potentially creating a significant new revenue stream or boosting the balance sheet with a large infusion of capital. If this strategic action is combined with the continued, strong growth of the core segments powered by the latest Gemini models, the combination creates a powerful set of tailwinds that could propel the stock to new valuation heights as investors price in the success of a multi-pillar technology ecosystem. The developments in artificial intelligence are clearly worth following, as they are not just affecting one company but are reshaping the entire technological and economic landscape in ways that will have broader implications for years to come.