The Double-Edged Sword: Managing CapEx and Compute Bottlenecks

The market’s enthusiasm is based on excellent execution, but maintaining this lead is proving to be immensely expensive and logistically challenging. The very success of AI deployment is creating its own set of intensifying pressures.

The Escalating Capital Expenditure Requirements

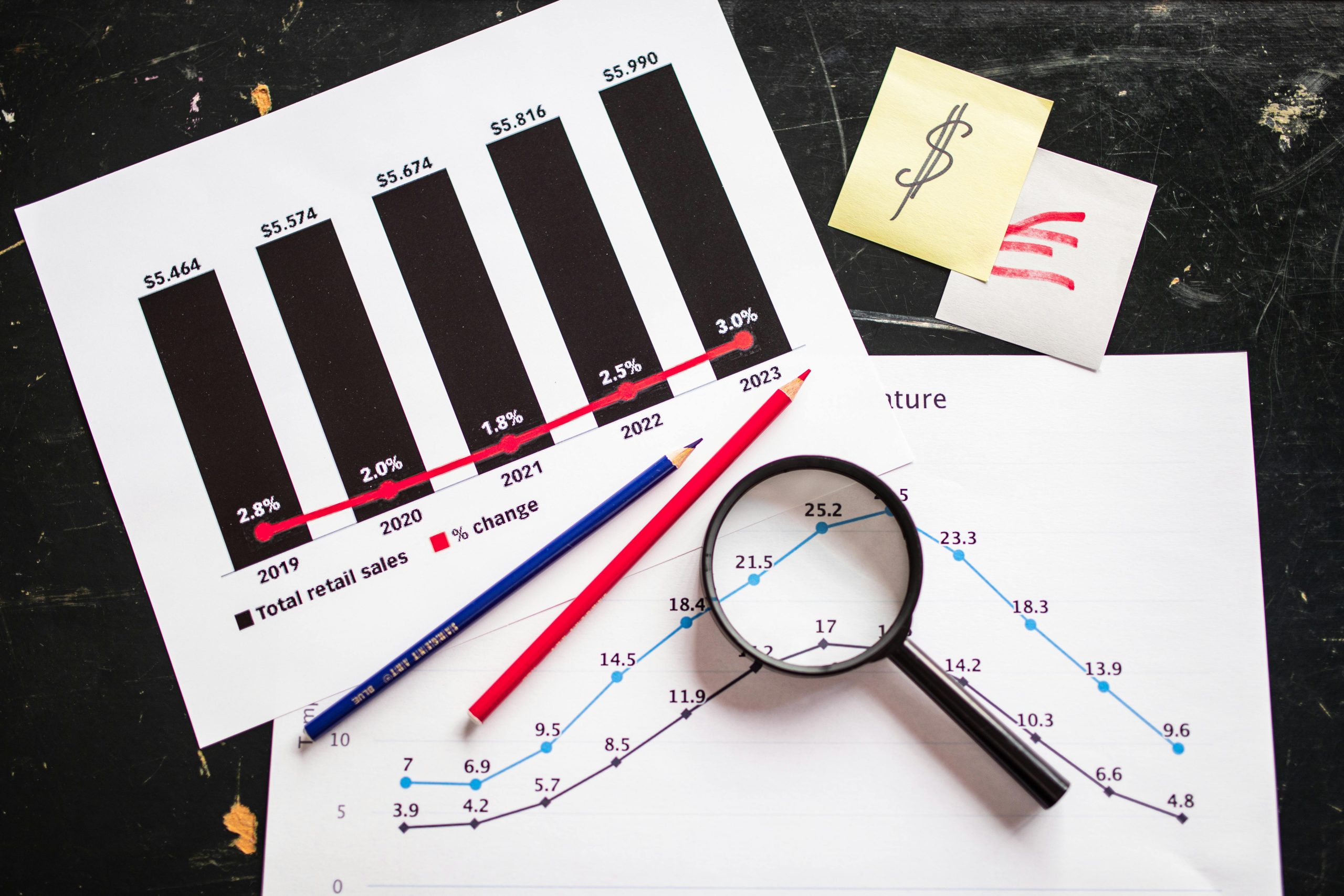

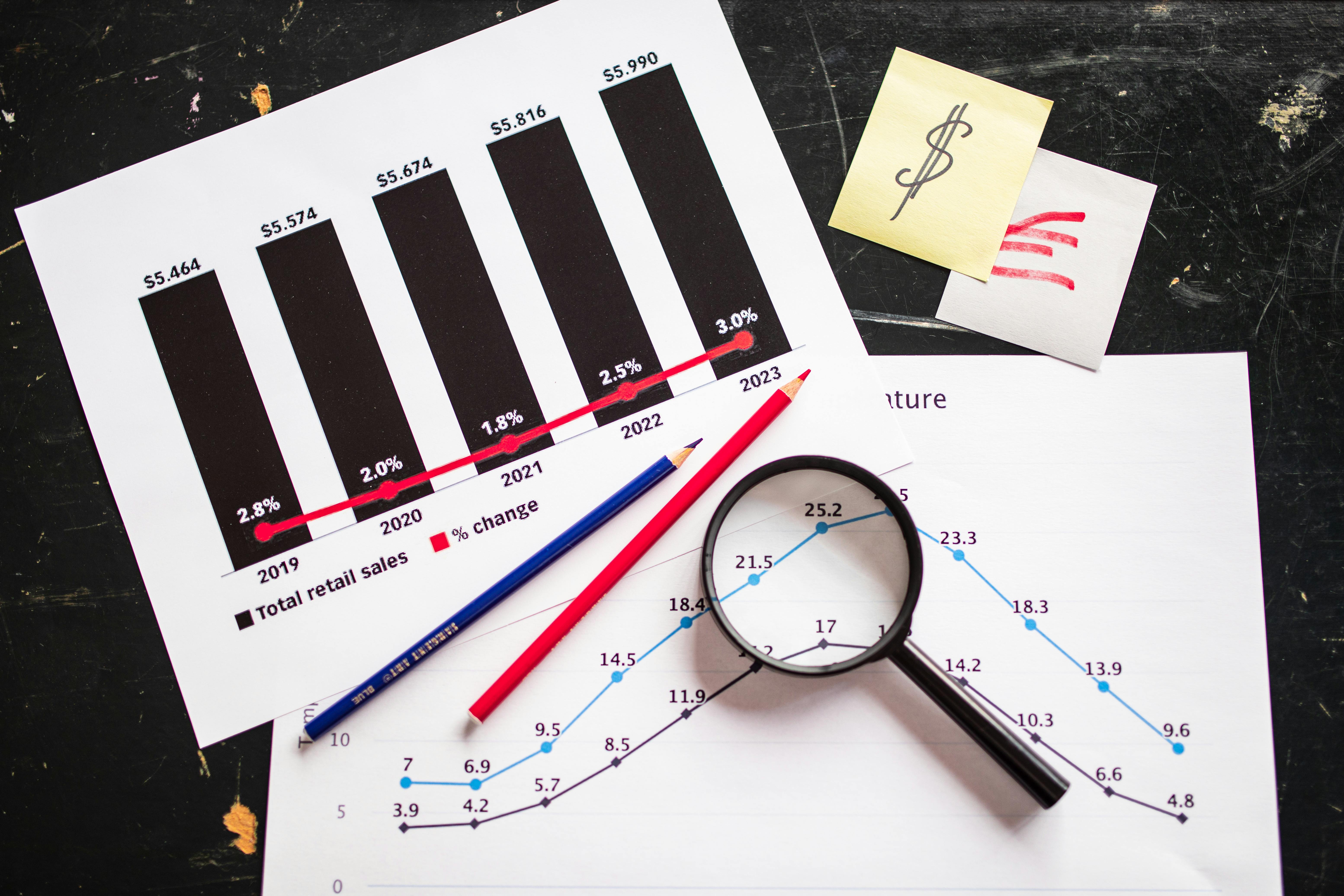

The path to AI leadership is paved with capital—and Alphabet is spending heavily. The company has already signaled an aggressive trajectory for its capital expenditure (CapEx) budget, raising its full-year 2025 forecast to a range between $91 billion and $93 billion, up from earlier projections. CFO Anat Ashkenazi noted that CapEx is accelerating faster than operating income growth, and a “significant increase” is expected again in 2026.

This relentless spending is non-negotiable—it’s the cost of admission to the compute race. The vision involves achieving a 1,000x increase in serving capacity over the next few years, demanding massive, continuous investment in infrastructure and specialized hardware.. Find out more about Alphabet stock surge AI race justification.

The Ongoing Constraint of Compute Supply

A tangible bottleneck, even acknowledged by internal leadership, is the physical constraint on compute supply. The ability to rapidly deploy the newest models, like advanced video tools such as Veo, is currently being capped by the availability of processing power. This reality underscores a massive logistical challenge: winning the AI race is as much about securing physical infrastructure as it is about brilliant algorithms. Until this capacity is resolved through massive capital deployment and architectural efficiency, the pace of user adoption for the most advanced capabilities remains artificially capped.

Practical Consideration: Investors must weigh the near-term impact of this spending on margin expansion against the long-term risk of under-investing and losing ground to competitors. The company is explicitly gambling that the future revenue from secured backlogs will dwarf current CapEx levels.

Decoding the Premium: Justifying the New Valuation in the AI Age. Find out more about Alphabet stock surge AI race justification guide.

The stock’s remarkable surge—with year-to-date gains exceeding 50% or more in some reports—inevitably prompts comparisons to the speculative excesses of the late nineties tech bubble. The market is actively debating whether this rally is fundamental or purely euphoric.

Analyzing the Historical Parallel of the Dot-Com Frenzy

The key difference today, analysts argue, lies in the revenue component. The 1999-2000 valuations were largely promise-based; this rally is substantiated by record-breaking financial results. Alphabet achieved a historic milestone in Q3 2025, reporting over $100 billion in revenue for the first time ever ($102.3B total). Furthermore, the company delivered four consecutive earnings beats, and its pretax profit expanded by 39% in the third quarter, all while increasing its AI-related spending.

This performance, particularly the margin expansion achieved despite elevated CapEx, lends a layer of inherent stability that the prior bubble lacked. The market is essentially arguing that AI is not a future possibility but a present economic reality, one that Alphabet is currently monetizing better than its peers. Learn more about market bubbles and fundamentals in our analysis of asset valuation in transformative technologies.

The Necessity for Continued Innovation Velocity

To justify its premium valuation multiple—which, while high, is still considered relatively cheap compared to some peers—Alphabet faces the grueling expectation of perpetually exceeding performance benchmarks. The market has factored in continued high growth rates across all segments, driven by AI integration. This places immense pressure on R&D to not only maintain the lead established by Gemini Three but to consistently unveil the next generation of foundational models that keep the competition permanently off-balance. Any perceived deceleration in product innovation could lead to a swift, severe reassessment by investors predicated on the assumption of continued, high-velocity technological superiority.

The Long View: Research Moat and Societal Responsibility

Sustaining this position requires looking past the immediate financial quarter and addressing the structural and societal underpinnings of its market dominance.. Find out more about Alphabet stock surge AI race justification strategies.

The Role of Foundational Research in Sustaining the Lead

The core of Alphabet’s enduring strength is its historical, uncompromised commitment to deep, foundational scientific research [cite: N/A]. This long view, which led to the initial concepts now central to modern generative AI, forms a competitive moat that is exceedingly difficult for fast followers to cross [cite: N/A]. Sustaining this lead requires continued, unflagging funding for “blue-sky” research—the kind that doesn’t guarantee an immediate return but ensures a pipeline of future disruptive capabilities that keep Alphabet ahead of those merely acquiring cloud resources [cite: N/A]. This dedication to the scientific base is a non-financial advantage that is harder to measure but essential to long-term success.

Navigating the Ethical and Societal Implications of Scale

As the dominant platform for deploying global AI, the company shoulders immense scrutiny regarding the ethical and societal implications of its technology. The scale at which its models influence information, commerce, and daily interaction means that issues surrounding bias, data governance, and job impact are now inextricably linked to its stock performance [cite: N/A]. Successfully navigating the complex web of evolving global regulatory frameworks while mitigating real-world harm caused by powerful AI outputs will be essential for long-term investor confidence. Failure to adequately address these non-financial risks could create unpredictable, high-impact vulnerabilities in its otherwise robust operational structure. To read more about the regulatory landscape for major tech firms, review this piece on global technology regulation outlook.

Final Assessment of Market Positioning and Future Trajectory

The current market reality reflects a decisive re-balancing of power within the upper echelons of the technology industry as of November 25, 2025. The narrative suggesting the permanent decline of historical incumbents has been overturned.

The New Equilibrium in Big Technology Power Dynamics

Alphabet has not only defended its territory but aggressively expanded its influence by successfully marrying its dominant distribution platforms (Search, YouTube, Android) with demonstrably superior, custom-built AI technology. This confluence—leading-edge models, proprietary infrastructure, and unparalleled global reach—places the company in a position of unprecedented leverage, capable of dictating terms across the enterprise cloud and consumer internet sectors.. Find out more about Gemini Three superior performance metrics versus OpenAI definition guide.

Concluding Thoughts on Sustainability and Growth Multiples

Ultimately, the core question moving forward is whether the premium valuation multiple assigned to Alphabet can be justified by the *sustained* growth curve of its AI-driven revenue. The market has voted ‘yes’ for now, recognizing the company’s unique, integrated stack. The challenge ahead is one of consistent, flawless execution, converting this perceived AI race victory into decades of demonstrable commercial superiority while managing the colossal internal demands of capital reinvestment and the external pressures of competitive reaction and macroeconomic shifts.

The entire dynamic was heavily informed by initial reports, including those disseminated by organizations tracking its operational breakthroughs in infrastructure efficiency and model performance, like the recent benchmarks confirming Gemini 3 performance versus the latest rivals.

Key Takeaways & Actionable Next Steps:. Find out more about Alphabet cloud revenue growth driver AI products insights information.

- Monitor CapEx vs. Margin: Does the company maintain its aggressive spending without crushing short-term margin expansion?

- Track Backlog Conversion: The $155 billion cloud backlog is the tangible anchor; watch its conversion rate for signs of real-world adoption.

- Watch for the Response: The market is pricing in continued technological superiority. Any major stumble or slowdown in innovation velocity will invite immediate downside reassessment.

What do you think will be the next major bottleneck—is it compute supply, or regulatory oversight? Let us know in the comments below what metrics you are watching to see if this new equilibrium holds!