Broader Implications: Ripples Through the Golf Equipment Industry

The introduction of a major platform player like Amazon into a specialized, previously insulated hardware market sends significant ripples far beyond the initial competitive set of budget balls. This launch is not just about golf balls; it serves as a potent, real-time case study in leveraging sheer e-commerce scale and logistics against traditional, slower-moving retail structures. The fact that the Core Soft is reportedly made by SM Global—the very same manufacturer behind Costco’s incredibly successful Kirkland Signature models—adds an almost poetic layer to the disruption.

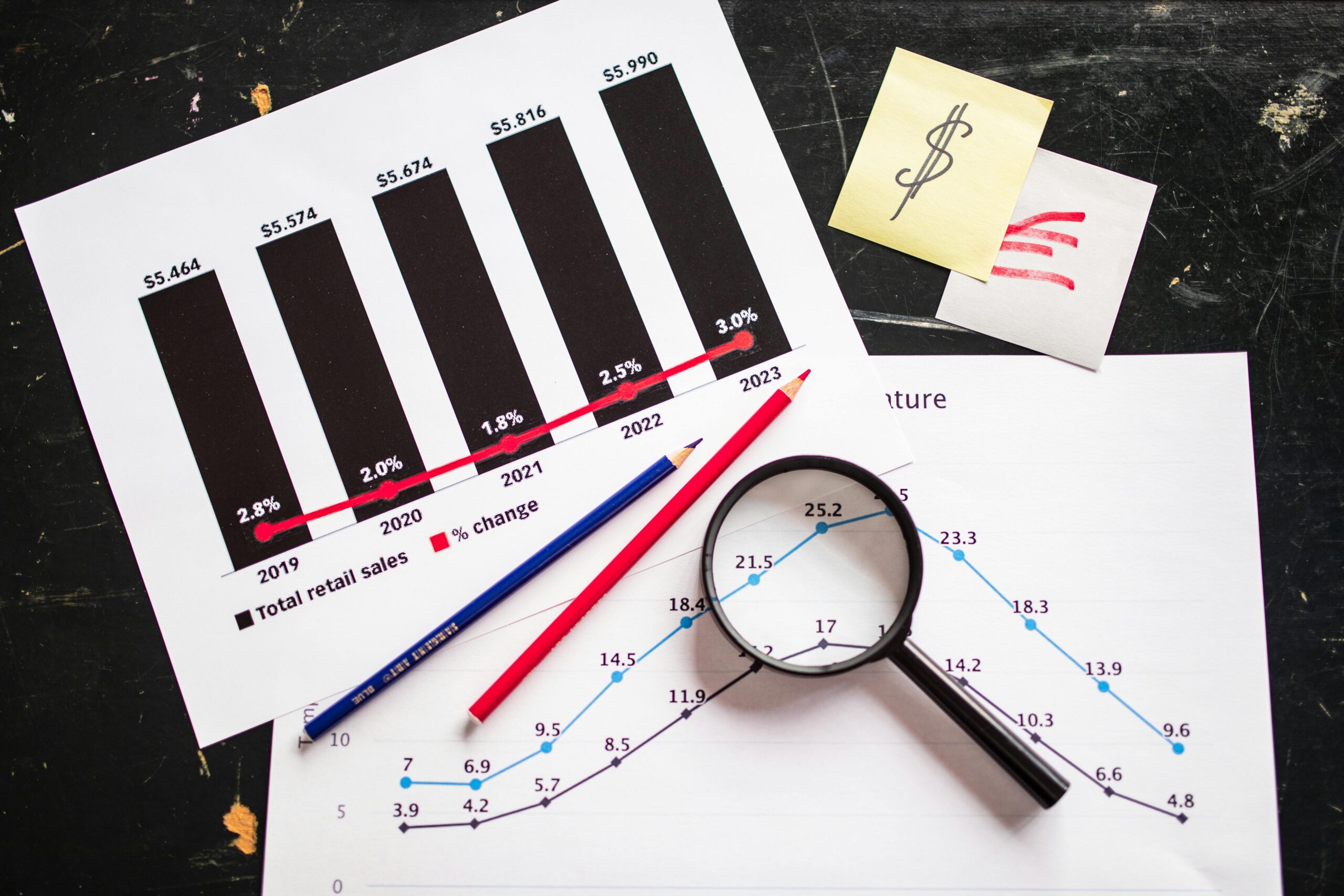

We are seeing a significant shift where the barrier to entry for private label hardware is lowered by existing manufacturing networks. If a company like Amazon can successfully navigate the technical hurdles and build consumer trust with a consumable item like a golf ball—which requires specific performance metrics—it validates the entire business model for expanding the Basics brand into almost any niche, high-margin sporting goods category. The bigger story is Amazon demonstrating the viability of deploying its logistical, branding, and AI infrastructure into specialized product arenas, which has broader implications for the entire global retail landscape, moving far beyond whether the ball is a “steal or a total disaster” for any single golfer.

Potential Pressure on Original Equipment Manufacturers (OEMs)

The immediate consequence for established OEMs—the giants like Titleist, TaylorMade, and Callaway—is the stark reinforcement of pricing tiers and the increasing pressure on their lowest-end models. They now contend not only with Costco’s volume leader but with a direct, one-dollar-per-unit challenger that uses their proven supply chain partners.. Find out more about best cheap golf balls for weekend warriors.

Consider the landscape: a Titleist Tour Soft or a TaylorMade Distance+ sits at a price point significantly higher than the Core Soft. For instance, the Titleist Velocity is priced near $29/dozen, and the TaylorMade RocketBallz Speed is also in the distance category but far above the $15 mark. [cite: 7 (search 2), 8 (search 2)]. This forces the OEMs’ hand in their entry-level offerings. They must either:

- Lower their own low-tier prices, eroding margins across the board.

- Dramatically increase the perceived value of their offerings through superior marketing, technology narrative, or better omnichannel experiences.

- Risk ceding the massive entry-level and casual player market entirely to the platform giants like Amazon and Costco.

- Logistical Supremacy: Instant availability and rapid delivery are non-negotiable expectations now.

- Branding Trust: The “Amazon Basics” name carries inherent trust in value, even if the product isn’t best-in-class.. Find out more about best cheap golf balls for weekend warriors tips.

- Data Leverage: Amazon knows who buys Kirkland, who buys premium, and who never buys at all. This data informs their next product launch.

- Trade Down: The mid-handicapper might decide the $10 savings justifies the performance drop from a 3-piece ball (like a TaylorMade Tour Response) to the 2-piece Core Soft for rounds where maximum forgiveness is key. [cite: 9 (search 2)]

- Trade Up: Alternatively, seeing the noise around the Core Soft, they might decide to bypass it entirely and invest in a higher-tier value option like the Vice Pro Plus ($37/dozen) or Bridgestone E6 ($24/dozen), believing that the *real* value leap happens above the $1.20 mark. [cite: 7 (search 2)]

- Assess Your “Lost Ball” Budget: If you regularly lose more than 10 balls per season, the Core Soft pays for itself in peace of mind. The cost of anxiety is higher than the cost of the ball.

- Understand Compression: If you are a slower or moderate swing speed player (under 90-100 MPH), this low-compression ball is technically suited to give you the best distance for your effort. If you swing over 105 MPH, you are better served by a mid-tier ball designed to handle higher ball speeds. [cite: 5 (search 1)]. Find out more about Amazon Basics Core Soft golf ball review definition guide.

- Short Game Check: Before fully committing, test the Core Soft around the greens against your current ball. If you rely heavily on spin for short-sided chip-ins, you will notice the difference immediately. This is the performance area you sacrifice for the price.

- Defend the Mid-Tier Story: OEMs must emphasize what the $20-$35 balls offer that the $15 ball does not: better cover material (urethane), more layers for more complex spin control, and proven quality control.

- Embrace Omnichannel Experience: As e-commerce scale dictates price, brick-and-mortar and specialty retailers must double down on experience—fittings, expert advice, and community—things that are hard to automate or replicate through a standard product listing. [cite: 1 (search 2), 4 (search 2)]

- Watch the Accessories: The playbook written by the Core Soft launch suggests that any high-margin, low-complexity accessory category (gloves, towels, tees) is ripe for a platform player to enter with a Basics-branded, aggressively priced offering next.

The fact that the Core Soft successfully replicates the desirable low-compression, soft-feel characteristics means the performance gap at this price point has narrowed dramatically. This polarization forces the premium brands to double down on their story: tour validation, advanced multi-layer technology, and the finesse that the Core Soft intentionally ignores. This is echoed in broader retail analysis where value-seeking consumers often trade down, but strong brands that deliver more than basic functionality maintain their position. [cite: 1 (search 2)]. Find out more about best cheap golf balls for weekend warriors guide.

The Template for Private Label Assaults on Niche Markets

The success or failure of the Amazon Basics Core Soft will serve as a definitive template for future private-label assaults on other niche, high-margin sporting goods categories. Golf is unique due to high consumer loyalty and equipment longevity, but accessories—gloves, alignment sticks, towels, rangefinders, or even basic putters—could be next. [cite: 10 (search 2)]

Why is this template so powerful? Because it utilizes Amazon’s existing infrastructure:

The private label model on Amazon rewards strategic brand curation and identifying niches where the consumer is highly sensitive to price but still demands *some* level of quality. [cite: 11 (search 2)] For a consumer base seeking value due to broader economic headwinds, this model becomes incredibly compelling, forcing retailers to either adopt their own marketplace strategies or risk losing high-volume transactions. [cite: 4 (search 2)] The commitment to a low-cost, high-volume strategy signifies a long-term play to capture the wallet share of the everyday consumer, regardless of their chosen hobby or the current state of golf club membership trends.

The Consumer Loyalty Conundrum: Bridging the Trust Gap

Golf has historically been a sport defined by brand loyalty—the Titleist bag, the Callaway driver. Many golfers grow up with a brand, and that familiarity breeds comfort that transcends pure performance metrics. [cite: 10 (search 2)] However, the search results clearly indicate that while loyalty exists, it is heavily moderated by the perception of value for money in sporting goods. [cite: 11 (search 2), 13 (search 2)]

For the consumer targeted by the Core Soft, that loyalty is transactional and flexible. They are looking for the right tool for the job at the right price. If a traditional OEM offers a “distance-focused” ball like the Callaway Supersoft or Srixon Soft Feel at $25-$35 a dozen, the $15 Core Soft presents an almost insurmountable value hurdle. This group prioritizes cost, with price/value being the primary reason for brand choice over quality or reputation, especially in team sports where costs accumulate rapidly. [cite: 11 (search 2)]. Find out more about best cheap golf balls for weekend warriors strategies.

The Mid-Range Squeeze: Where Do Mid-Handicappers Go?

The most interesting segment under pressure is the mid-handicapper—the player who wants *better* than a two-piece ball but can’t justify a premium tour ball. This is the demographic that flocked to the original Kirkland Signature. They are looking for the performance of a $40 ball at a $25 price point. Now, Amazon has inserted a $15 option right below them. This creates a squeeze:

The OEMs must successfully market their mid-tier offerings not just on performance (distance, feel) but on *durability* and *consistency*—qualities that a private label often struggles to guarantee across massive production runs. [cite: 1, 2 (search 2)]. Find out more about Best cheap golf balls for weekend warriors overview.

Actionable Takeaways for Golfers and Industry Watchers

Whether you’re a consumer or an observer of market dynamics, the Amazon Basics Core Soft launch offers clear, actionable insights as we wrap up 2025.

For the Golfer (The Consumer):

For the Industry (The OEM & Retailer):

Conclusion: A Steal for the Swinger, a Warning for the Stock Market

So, is the Amazon Basics Core Soft a steal or a disaster? For the millions of golfers who play for fun, lose balls without flinching, and prioritize distance and a soft feel over tour-level wedge control, this is an unmitigated steal. It’s a brilliant piece of market segmentation, acknowledging the player’s true need and meeting it with an aggressively priced, appropriately engineered product, manufactured by a familiar source.

However, for the established Original Equipment Manufacturers (OEMs) and the traditional retail ecosystem, it is a severe warning—a harbinger of increased price pressure across the board. It proves that an e-commerce behemoth can successfully deploy its logistical might into niche hardware. The game has fundamentally changed: it is no longer just about product innovation, but about the efficiency of the *supply chain* and the *psychology* of the casual player. Amazon isn’t just selling a golf ball; they are selling volume, accessibility, and the permission to enjoy the game without financial anxiety. The platform player is here to capture the wallet share of the everyday consumer, and this time, they’ve brought their own golf ball to the party.

What do you think? Are you dropping your current budget ball for the Core Soft, or is your loyalty to a specific feel too strong to break? Share your first impressions or predictions for the next private-label assault in the comments below!