Navigating Investment Strategy Amidst Digital Intelligence Narratives

Given the prominence of these AI-generated narratives in the current financial discourse, investors are compelled to develop strategies that successfully incorporate this new information stream without becoming subservient to it. The goal is to utilize the forecasts as one more data point—a powerful, high-resolution one, but only one—in a multifaceted decision-making matrix. A disciplined approach requires mapping the scenarios, not just reading the headline number.

Integrating AI Scenarios into Comprehensive Due Diligence

The most prudent approach involves treating the high-end AI target as an aspirational ceiling—a representation of a relatively smooth, ideal adoption path where no major risks materialize. This figure should be contrasted sharply with the model’s bearish contingency (the $76,000 danger zone) and with independent, human-derived fundamental valuations based on projected cash flows or utility metrics (if applicable to the asset class).. Find out more about ChatGPT 2025 Bitcoin price prediction.

A practical, actionable takeaway here is to use the AI’s *reasoning* to stress-test your own thesis. If the AI says the price will hit $X because of ETP inflows, you must ask: What if ETP outflows resume next week? If your own fundamental analysis can withstand the AI’s downside model, you have a robust position. If your thesis crumbles below $85,000, you need to adjust your risk parameters immediately, regardless of the high-end target.

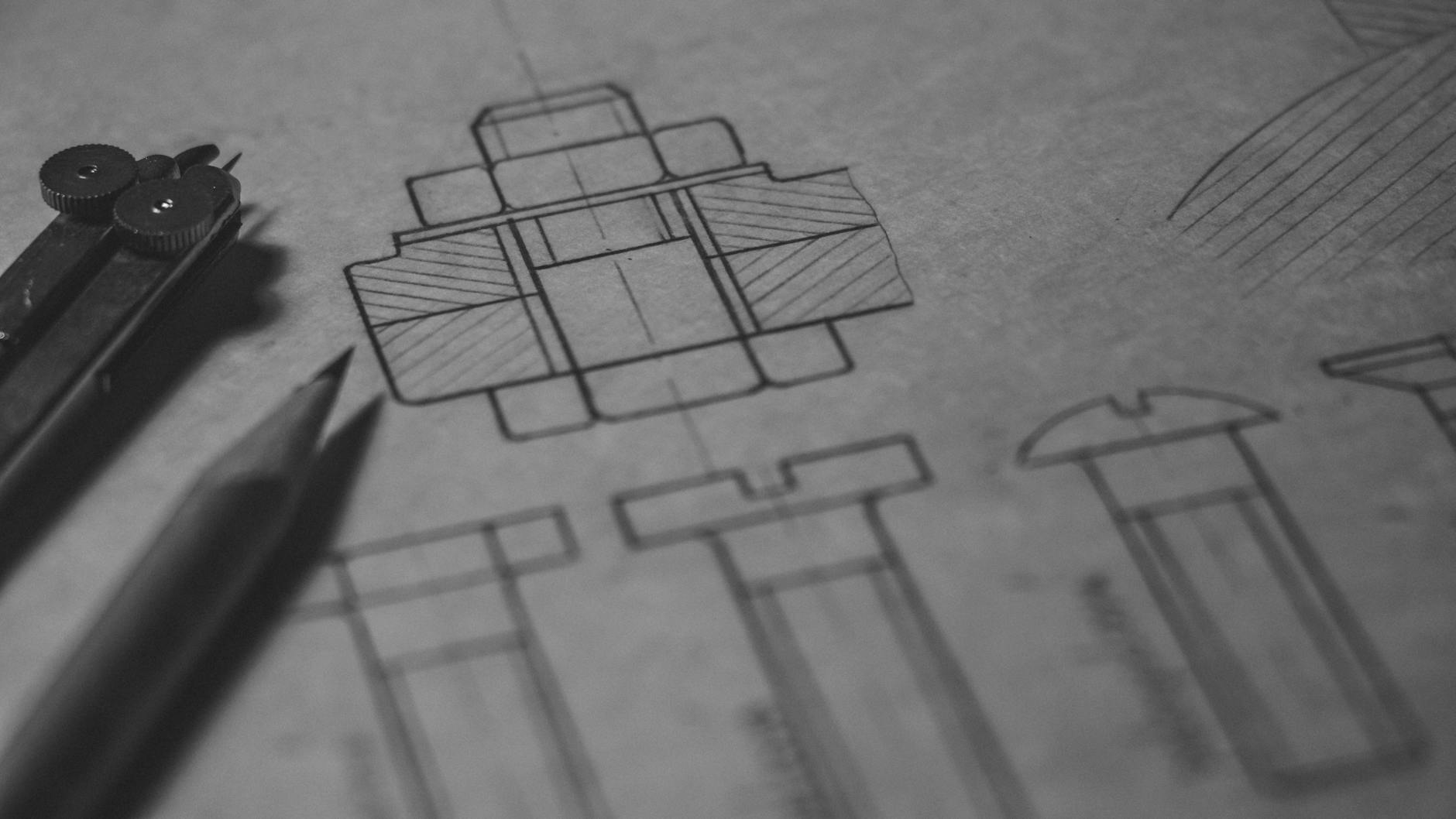

The process should look like this:

This level of integration leads to a more stress-tested investment thesis, moving beyond a simple buy or sell signal based on a single quoted number from any source.

The Future Trajectory of AI Model Refinement in Finance

Looking ahead, the true disruptive potential lies not just in the current predictions but in the speed at which these models will learn and adapt. As the data from this current, volatile cycle—the pause, the outflows, the sharp reversal—is fed back into future iterations of the AI, their accuracy, especially in predicting inflection points and risk tolerances, is expected to increase dramatically.. Find out more about ChatGPT 2025 Bitcoin price prediction strategies.

The next generation of these tools will likely incorporate even deeper layers of sociological and political modeling, moving closer to fully integrating the “human context” that currently represents their greatest weakness. Imagine an AI that can process the subtle political positioning of a central bank governor during a press conference or the historical implications of a specific geopolitical tension on risk appetite. That is the future.

The current news cycle, dominated by Bitcoin’s dance around the $90,000 level and the tug-of-war between institutional inflow and outflow records, is merely the opening act of a much larger story. It is a story detailing the collaboration—or perhaps the competition—between human expertise and algorithmic foresight in shaping the future valuations of global assets. The real winners will be those who learn to read the output of the machine not as prophecy, but as the most detailed weather report ever created.

Conclusion: Key Takeaways for Navigating December. Find out more about ChatGPT 2025 Bitcoin price prediction insights.

As we confirm the date—December 6, 2025—and review the current data streams, the momentum engine for digital assets appears to be transitioning from a state of liquidation stress back toward structural accumulation, driven by the regulated ETP rails.

Actionable Insights:

The AI models suggest that the math supports a trajectory toward the year-end target, assuming the structural capital inflows continue to outweigh short-term fear. Your job as an investor is to diligently monitor the *assumptions* underpinning that math. Do not simply trade the number; trade the confluence of liquidity, technical strength, and macroeconomic stability.

What is the one risk factor—macro or technical—that concerns you the most as we close out 2025? Drop your thoughts in the comments below—let’s see how human context shapes the narrative from here!