Beyond the General-Purpose GPU: The Rise of Specialized Silicon and Thermal Density

While the flagship, general-purpose GPUs grab the headlines, the underlying truth of high-performance AI is moving toward specialization and the efficient management of extreme thermal loads. The sheer density of compute power being squeezed onto modern accelerator packages creates unprecedented thermal challenges that necessitate a complete rethink of data center design—beyond just adding more chillers.

The 750W Challenge: Managing Heat in the New Age of Density

The headline accelerator TDPs (Thermal Design Power) are now so high that they are fundamentally constraining rack density. We are seeing a conscious design shift, exemplified by custom silicon like Microsoft’s Maia 200 chip, which delivers massive performance (over 10 petaflops of FP4 performance) but is carefully engineered to operate within a 750 W SoC thermal envelope.. Find out more about AI data center infrastructure investment 2026.

This focus on a constrained thermal envelope is not accidental; it’s survival. It reflects an industry trend where maximizing performance per watt, especially for inference tasks that can use lower numerical precision (like FP8 or FP4), is becoming a key competitive differentiator. The ability of a chip architect to maintain or increase performance while keeping the thermal output manageable directly translates to lower data center operating expenditure (OpEx) and higher sustainable density. This is an area where process technology advantage—like TSMC’s reported ability to reduce power consumption by up to 30% with its 3nm node—becomes a massive pricing advantage.

The Custom Silicon Pivot: ASIC Demand and Lower Precision

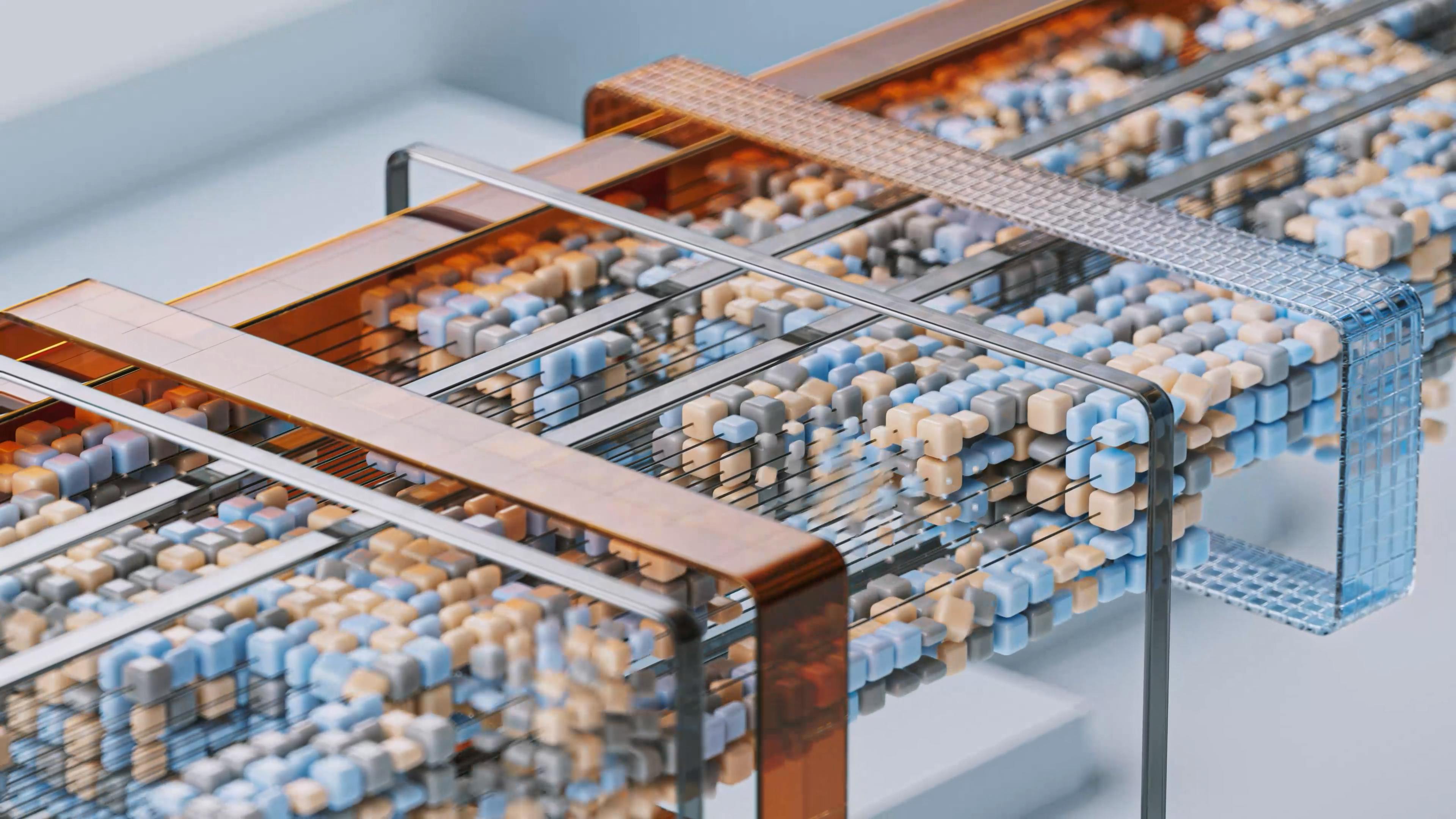

The dominance of the GPU architect is being tested, not by a sudden collapse, but by a steady encroachment from specialized hardware. Large cloud providers, who are also the largest customers, are investing heavily in Application-Specific Integrated Circuits (ASICs) tailored precisely for their own model architectures and deployment needs (training vs. inference). This is why the HBM demand for these custom chips is expected to skyrocket by 82% in 2026.

Why the pivot? Efficiency and differentiation. When you own the hardware *and* the software stack, you can exploit efficiencies unavailable to general-purpose designs. Custom silicon partners utilize architectures with features like dedicated DMA engines and on-die network-on-chip fabrics, specifically designed to increase the throughput needed to feed the compute cores efficiently. This diversification into custom hardware is a strong leading indicator of the sector’s maturity—moving from simply buying off-the-shelf power to designing bespoke efficiency.. Find out more about AI data center infrastructure investment 2026 guide.

The Geopolitical Bedrock: Securing the Supply Chain for the Next Decade

The entire physical manifestation of the AI economy—the concrete empire and the thermal density—rests upon a wafer-thin layer of highly specialized manufacturing capacity. This introduces geopolitical dynamics that are far more durable than quarterly earnings reports. Investment decisions are now being made with a two-to-three-year horizon on manufacturing engagement lead times.

The Multi-Year Moat: Manufacturing Lead Times and Capex Commitments

The timeline for building a leading-edge fabrication plant is measured in years, not months. This inherent lead time creates a structural moat. TSMC, for example, signaled extreme confidence in sustained demand by projecting 2026 capital expenditure in the range of \$52 billion to \$56 billion, a year-over-year growth of 32% at the midpoint. Crucially, 70–80% of this 2026 spending will be allocated to 7nm and below process technologies.. Find out more about AI data center infrastructure investment 2026 tips.

This massive capex spending in 2025 and 2026 is not intended to meet 2026 demand; it is signaling the capacity needed for 2028 and 2029 fulfillment. The key point for market watchers is that engagement lead times for advanced chips are now extended to at least two to three years. This means the current supply—which is already tight—is dictated by capital decisions made years ago. Any new capacity coming online in 2026 is the result of a commitment made around 2023/2024. This is why controlling access to the GPU architect, the custom silicon partner, and the leading-edge manufacturer provides the most comprehensive exposure to durable growth.

For those looking to understand the long-term supply dynamics that underpin this, examining the structure of semiconductor fabrication investment is essential.

Regional Certainty: Where Execution Wins Over Ambition

The supply chain extends beyond the fabs to the physical locations of the data centers themselves. The global market is fracturing into those that can execute and those that are talking about execution. As one research firm stated, “Power availability, planning certainty, and realistic timelines are now what separate markets that scale from those that stall”.. Find out more about AI data center infrastructure investment 2026 strategies.

We are seeing a continuation of the shift seen in 2025: growth is decentralizing away from the most congested, power-constrained primary hubs and into secondary and emerging markets.

- The Power Play: Regions with stable power grids, or those willing to rapidly enact policies to streamline power connection queues, are winning the near-term deployment race.

- Policy as an Accelerator: Government policy is now a direct determinant of speed. Markets offering clear, fast regulatory frameworks for high-density power usage are securing campus builds over areas with ambiguity, regardless of initial land cost.. Find out more about AI data center infrastructure investment 2026 overview.

- Look Beyond the Chip Architect: While the GPU/NPU designers are important, give equal, if not greater, weight to the **leading-edge semiconductor manufacturer** that can reliably yield 3nm/2nm nodes and secure the massive multi-year capex funding necessary for capacity expansion.

- The Memory Moat is Real: The HBM “supercycle” is not speculative; it’s a supply-side constraint backed by massive enterprise spending. Track suppliers who can reliably increase TSV yield and scale advanced packaging capacity—they are dictating pricing power across the entire electronics supply chain.

- Prioritize Execution Over Ambition: For the infrastructure layer, favor developers and real estate players that demonstrate a verifiable ability to convert permits into live, powered capacity, especially in power-advantaged secondary markets, over those with the largest, but stalled, announced pipelines. The ability to manage transformer lead times and power contracting is the new competitive edge.

This structural shift means that the providers who can navigate local utility negotiations and local government planning approvals with speed and consistency are generating outsized returns. This is the civil engineering arbitrage layer of the AI boom.

Conclusion: Positioning for the Compute Epoch

The story of 2026 is clear: the return on investment in artificial intelligence is now so visible that corporations are committing unparalleled amounts of capital—not just for the chips, but for the massive, immovable infrastructure required to run them. The conversation has evolved from the theoretical potential of the next chip to the concrete, power-hungry reality of the modern data center complex. The bottlenecks are now physical and structural: the grid, the cooling systems, the lead times for high-bandwidth memory, and the sheer complexity of construction.

The path to anchoring a portfolio to the most durable growth drivers in this epoch lies not in speculating on every new model release, but in identifying the entities controlling the essential raw materials and production infrastructure. This means looking at the entire stack with a physical lens. Where is the power coming from? Who controls the highest-density packaging and memory integration? Who has secured the manufacturing slots for the next two years?. Find out more about Investing in high-bandwidth memory ecosystem definition guide.

Actionable Takeaways for Navigating the Concrete Empire:

The next wave of digital transformation isn’t happening in the cloud abstractly; it is being built, meter by physical meter, demanding a new level of diligence on energy, real estate, and core manufacturing dependencies. The foundations are being laid right now. Are you building your strategy on the foundation or just admiring the scaffolding?

What structural bottleneck in the AI buildout do you believe will be the most expensive to solve over the next three years? Share your thoughts below—let’s discuss the real cost of compute.

Read more about supply chain resilience in high-performance computing.