2 Artificial Intelligence (AI) Stocks to Buy Before They Soar to $2 Trillion, According to Wall Street Analysts

The investment landscape in the year Two Thousand Twenty-Five is uniquely defined by the accelerating maturation of artificial intelligence technology. What was once a forward-looking concept has firmly established itself as the central driver of capital expenditure and, consequently, market capitalization for the world’s largest corporations. Analysts on Wall Street, whose projections often shape market sentiment, are increasingly focused on which entities possess the foundational components, infrastructure, or dominant consumer engagement necessary to claim the next echelon of corporate worth. This forward analysis suggests that the existing group of companies valued at over two trillion dollars might soon welcome new members, specifically naming two compelling technology stocks poised for a significant upward revaluation. This expansion will explore the underpinnings of this bullish sentiment, dissecting the specific strengths of these two candidates and contextualizing their potential ascent against the backdrop of a fiercely competitive digital economy. The narrative being constructed by leading financial observers points toward a period where an investment made today could potentially yield returns commensurate with stocks that have already achieved legendary status.

The Shifting Sands of Technology Valuation

The concept of a one trillion dollar market valuation, once the stuff of speculative dreams, has become a normalized milestone for established technology behemoths. As of this period in Two Thousand Twenty-Five, a select, elite collection of American corporations has not only crossed that initial psychological barrier but has proceeded to establish valuations reaching two, three, and even five trillion dollars. This new normal reflects a massive concentration of global economic influence in a few key sectors: cloud computing, advanced semiconductor technology, and the platforms that command unprecedented user attention. The sheer scale of their operations, their deep integration into global commerce, and their monopolistic or near-monopolistic positions in critical technological stacks provide a degree of stability and growth potential that few other industrial sectors can match.

Redefining Market Dominance in the Current Economic Cycle

Market dominance is no longer solely about legacy revenue streams; it is about owning the necessary tools for the future. The current economic cycle prioritizes digital transformation, automation, and intelligent systems. Therefore, the companies commanding the highest valuations are those most deeply embedded in the creation, deployment, and utilization of advanced artificial intelligence. This redefinition means that traditional metrics of corporate health must be viewed through the lens of AI readiness and capital deployment. Analysts are looking beyond quarterly revenue beats to assess long-term contracts for specialized hardware, the adoption rates of proprietary AI models, and the expansion of cloud infrastructure to support ever-growing computational demands. This shift in focus elevates companies like our two subjects, which operate directly within this high-leverage technological pipeline.

The Exclusive Citadel of Digital Giants

To fully appreciate the significance of the anticipated shift, one must first understand the current composition of the most valuable publicly traded entities. These firms have successfully navigated multiple technological revolutions and have emerged as the indispensable backbone of the modern digital world. Their influence spans from the foundational code that runs the internet to the physical hardware that processes the most complex algorithms.

The Current Roster of Multi-Trillion Dollar Entities

At the time of this analysis, a handful of pioneers have claimed the apex of market valuation. These titans represent the pinnacle of scale, brand recognition, and operational efficiency. Their continued growth, though perhaps slower than the aggressive pace of emerging players, is underpinned by resilient, diversified revenue streams built upon essential services—search, productivity software, social networking, e-commerce logistics, and consumer electronics. Alphabet Inc., for instance, is reported to be on the cusp of reaching a $4 trillion market valuation as of this day, November 26, 2025. Microsoft maintains a dominant position, with some analysts projecting its valuation could reach $4.4 trillion or even $5.3 trillion. These established positions serve as the benchmark against which all other high-growth technology firms are measured. Any company seeking to join their ranks must demonstrate not merely strong growth, but transformative growth potential across an equally broad or critically strategic technological front.

The Fundamental Catalyst: Ubiquitous Artificial Intelligence

The singular factor propelling the valuation expansion of the entire technology sector, and specifically these two stocks, is the widespread, near-inescapable implementation of artificial intelligence. This is not merely about sophisticated chatbots; it is about embedding cognitive capabilities into every facet of business and consumer life. From optimizing supply chains and powering complex scientific research to personalizing media consumption and automating software development, artificial intelligence requires an immense, ongoing investment in processing power and specialized infrastructure. The companies poised to hit the two trillion dollar mark are those who are either supplying the core computational resources or building the most sought-after, vertically integrated artificial intelligence applications.

The Prime Candidate One: The Infrastructure Powerhouse

The first stock highlighted by prognosticators as being on the verge of breaching the two trillion dollar barrier operates squarely at the foundation of the artificial intelligence revolution. This entity is not simply an end-user of AI; it is one of the critical architects and suppliers of the specialized physical components required to make modern, large-scale AI models function. This candidate is widely identified as Broadcom (AVGO), whose business model is characterized by high barriers to entry, deep engineering expertise, and crucial relationships with the very hyperscalers driving the current wave of innovation.

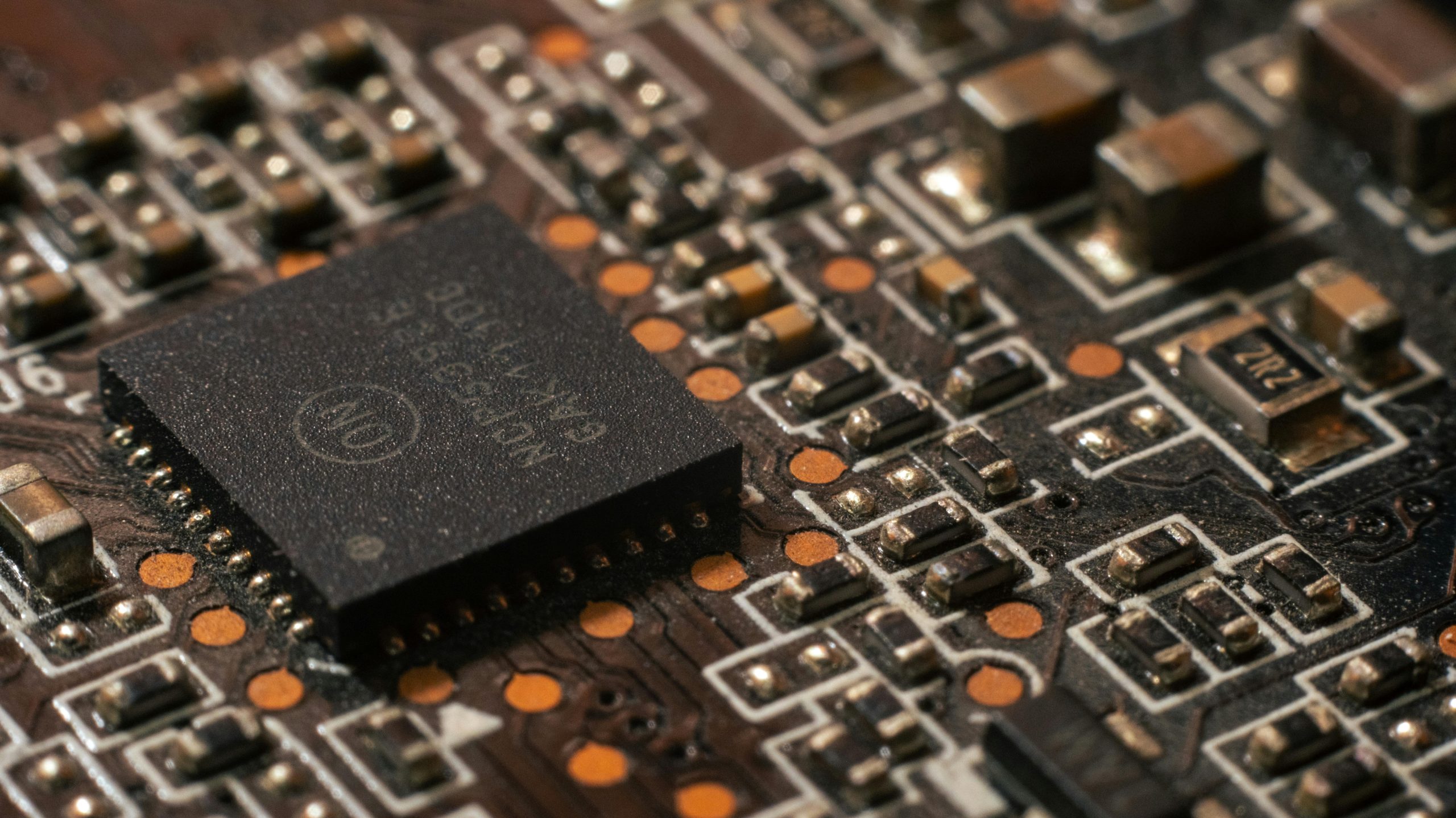

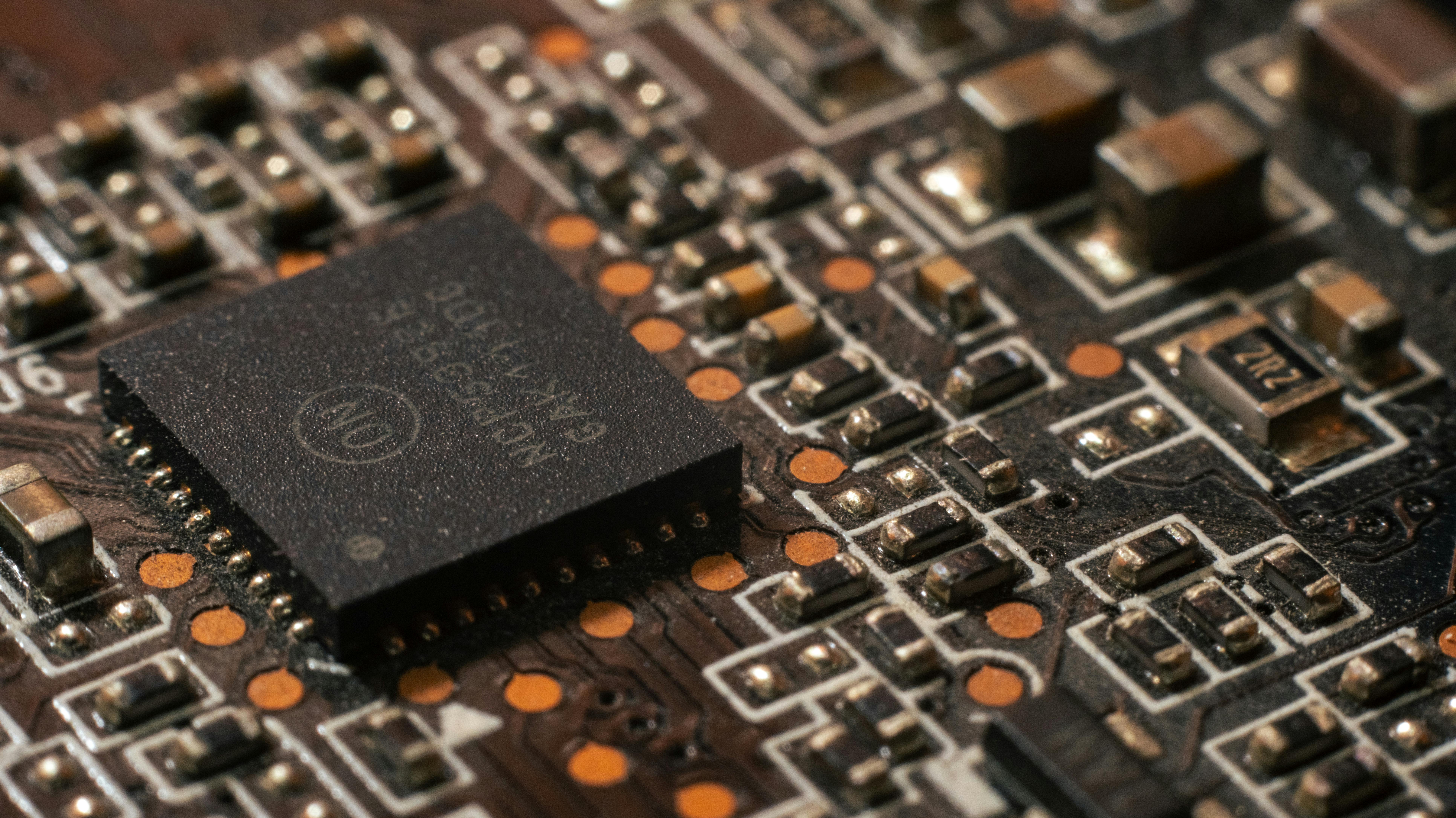

The Strategic Importance of Advanced Semiconductor Fabrication

The journey to powerful artificial intelligence begins with silicon. In the Two Thousand Twenty-Five environment, the demand for high-performance, specialized chips—the accelerators—far outstrips the available supply capacity. This company has strategically positioned itself as a leader in the infrastructure components necessary for data center expansion. This includes not only the central processing units but critically, the networking chips that allow thousands of those processors to communicate efficiently, a bottleneck that must be cleared for massive computational tasks to succeed. Controlling a significant portion of this essential, complex plumbing grants the company pricing power and inherent systemic importance within the technology ecosystem.

The Custom Silicon Advantage: Accelerators and ASICs

What truly separates this infrastructure powerhouse is its burgeoning dominance in Application-Specific Integrated Circuits, commonly referred to as ASICs. These are bespoke chips designed from the ground up for the singular purpose of maximizing artificial intelligence workloads, offering superior performance and power efficiency compared to general-purpose solutions for certain tasks. The company has successfully cultivated a small but immensely powerful cohort of clients—major technology firms and leading-edge AI development labs—for whom it designs these custom accelerators. Securing these design wins is tantamount to securing a long-term revenue stream directly tied to the most advanced, bleeding-edge projects in the entire industry. This specialized service demands significant intellectual capital and builds deep, difficult-to-dislodge customer dependency. AI chip revenue has been a central driver, with reports noting significant year-over-year jumps in AI chip sales.

Analyst Projections and Implied Upside Potential

Wall Street analysts have quantified this strategic importance with highly optimistic price targets. One prominent firm suggests that the company, recently valued near $1.7 trillion, is perfectly positioned to see its market cap cross the $2 trillion threshold as soon as the next year. Other analyses, focused on maintaining a current price-to-sales ratio against projected revenue growth, suggest market capitalization nearing $2 trillion based on attaining over $89 billion in sales within the next three years, implying significant upside potential from recent levels. This near-term projection of breaching the two trillion dollar mark is seen by these professionals as a realistic short-to-medium-term outcome rather than an aspiration.

The Unfolding Narrative for Broadcom’s Trajectory

While the custom AI chip design business garners the most attention, the durability of the investment thesis rests on the company’s broader, less volatile revenue foundation. The narrative for this infrastructure leader is one of essential utility married to breakthrough innovation, creating a compelling dual engine for growth and stability.

Diversification Beyond the Immediate AI Boom

It is crucial to note that this entity is not a singular-product company dependent entirely on the current AI cycle. Through significant, strategic initiatives, the firm now possesses a sprawling portfolio that includes vital infrastructure software, such as virtual desktop and cloud management platforms (stemming from major late-2023 acquisitions), as well as established positions in enterprise hardware and cybersecurity solutions. This diversification acts as a critical buffer. Should the pace of hyperscaler capital expenditure temporarily moderate, the recurring revenue from its software segment and its broad enterprise footprint provides a level of consistency that many pure-play chip designers lack. This balanced approach is precisely what lends credibility to the higher-end market capitalization forecasts.

Examining the Competitive Moat in Data Center Connectivity

Even within the AI focus, the company maintains an entrenched position in data center networking switches. The most sophisticated artificial intelligence models require colossal amounts of data to be moved between processing units with near-zero latency. This company is the market leader in the high-speed Ethernet switching components that facilitate this massive internal data flow. Competing in this space requires years of accumulated knowledge in high-frequency signal integrity and complex chip design, creating a formidable barrier to entry for newcomers. This established networking strength ensures that as companies build out their AI compute clusters, this firm remains an unavoidable supplier for the critical interconnectivity layer.

Navigating Elevated Valuation Metrics

The very success that fuels the bullish outlook also results in a valuation that appears richly priced when viewed through historical multiples. The implied expectation for sustained, aggressive growth is baked into the current share price. For investors, this means that while the long-term outlook is robust, any hiccup in delivering on the promised growth rates—for instance, a delay in a major custom ASIC design or a slowdown in data center build-outs—could lead to a significant, though perhaps temporary, correction in the share price. Patience, therefore, is presented as a necessary virtue for those entering the position based on the two trillion dollar thesis.

The Prime Candidate Two: The Social-Digital Ecosystem Architect

The second stock positioned to join the ranks of the multi-trillion dollar valuations offers a vastly different, yet equally powerful, pathway to that valuation tier. This company’s strength is derived not primarily from the silicon under the hood, but from the unparalleled global scale of its user engagement platforms and its aggressive, deep investment in generative artificial intelligence capabilities integrated directly into those platforms. This leading candidate is Meta Platforms (META).

The Return on Significant Capital Reallocation

This enterprise has recently undertaken one of the most ambitious capital expenditure programs in corporate history, funneling massive resources into building out its own artificial intelligence infrastructure, including proprietary chips and vast data center capacity. This was a strategic gamble taken to maintain relevance and leadership in the next generation of digital interaction. Early indications from financial reporting suggest that these colossal investments are beginning to yield tangible results, not just in technological advancement, but in bottom-line performance. The market is starting to price in the successful payoff of these prior years of heavy spending, seeing the investments as finally achieving critical mass. Reports indicate that this company is actively engaged in hiring researchers to achieve Artificial General Intelligence (AGI).

AI Integration Across User-Facing Applications

The core value proposition of this company rests on its established network effects across social media, messaging, and digital advertising. The integration of advanced artificial intelligence into these established domains is proving to be a powerful catalyst. From enhancing content recommendation algorithms to powering multimodal creative tools and improving the precision of ad targeting, artificial intelligence is being used to deepen user interaction and simultaneously unlock new efficiencies in its core advertising business. The immediate applicability of artificial intelligence tools directly to its billions of daily active users creates a clear and direct path to revenue uplift and margin improvement. Furthermore, the development of novel hardware interfaces, heavily dependent on sophisticated AI, represents a long-term growth lever.

Wall Street’s Reassessment Following Recent Results

Market enthusiasm for this stock has sometimes been tempered by concerns regarding the cost of its long-term artificial intelligence ambitions or regulatory headwinds. However, recent financial disclosures and product demonstrations have instigated a significant reassessment among analysts. Some observers suggest that recent market hesitancy or any subsequent price dip following earnings reports presents an especially attractive entry point. The argument is that the market is under-appreciating the near-term monetization potential while over-emphasizing legacy concerns or short-term cost pressures associated with the AI buildout. This creates a window where one can acquire shares at a discount relative to their intrinsic, forward-looking value.

The Imminent Ascent of Meta Platforms

The path for this digital architect to reach the two trillion dollar mark appears slightly shorter in terms of percentage gain required, as its market capitalization is already substantially closer to the target threshold than its hardware counterpart. This proximity suggests a more volatile but potentially quicker run-up once market sentiment fully commits to the bull case.

The Potential for Exponential User Monetization

The key to unlocking the final stages of value creation lies in the concept of monetization per user. With hundreds of millions, and in some segments, billions of users engaging daily, even incremental improvements in the efficiency of serving advertisements or the introduction of new premium features powered by artificial intelligence can translate into substantial, high-margin revenue increases. The investment thesis is strongly supported by billionaire investors increasing their stakes during the third quarter of 2025. Moreover, the potential for market-defining hardware interfaces, such as advanced augmented or virtual reality platforms deeply reliant on AI capabilities, represents a substantial, yet still somewhat discounted, long-term growth vector.

Analyst Targets and the Path to the Next Milestone

Leading brokerage houses have issued specific targets that place the stock firmly above the two trillion dollar valuation. One notable projection from a major firm suggests an upside potential exceeding forty percent from recent trading prices, a figure that would place the company’s valuation firmly in the upper reaches of the two trillion dollar club. Another analytical consensus, which reflects the aggregate view of numerous covering analysts, supports a “Strong Buy” designation, pointing to substantial remaining appreciation before the stock price fully reflects its current technological achievements and future opportunities.

The Broader Ecosystem and Industry Spending Projections

The investment theses for both recommended stocks are intrinsically linked to the overall health and expected trajectory of the wider artificial intelligence sector. Understanding the macroeconomic environment for technology spending provides the necessary context for these specific company forecasts.

Estimates for Global AI Infrastructure Investment Over the Medium Term

The capital being funneled into the necessary infrastructure—the chips, the cooling, the networking, and the cloud services required to train and run large language models and generative AI applications—is immense and, critically, projected to continue growing at an aggressive pace. One influential market research firm, Gartner, has forecast that global spending on the core components of this infrastructure, including specialized semiconductors and data center build-outs, is expected to surpass $2 trillion in 2026 alone. This massive, committed pool of capital ensures a significant revenue runway for companies like our two selections that provide essential enabling technology, whether through hardware supply or essential platform access.

Positioning Relative to Other Hyperscalers and Chipmakers

While dominant players like the current leader in the five trillion dollar bracket (Nvidia, recently receding from that peak) and other cloud providers are also benefiting immensely, these two chosen stocks occupy distinct, strategic niches. Broadcom supplies the essential, custom-designed “picks and shovels” for the entire industry by engineering the accelerators and connectivity. Conversely, Meta commands an unparalleled user base ready for immediate, large-scale deployment of AI features that drive advertising revenue. This positioning avoids the direct, zero-sum competition for the *end user* revenue captured by the largest platform companies, instead focusing on the high-margin, high-demand supply side or the direct integration into established digital advertising real estate.

Concluding Perspectives on Near-Term Portfolio Positioning

The consensus forming among forward-thinking analysts suggests a convergence of opportunities centered on the foundational elements of the artificial intelligence transformation. The decision to highlight these two specific entities stems from their proven ability to execute on complex engineering challenges while simultaneously possessing market positions that grant them significant pricing power in a demand-constrained environment.

Synthesizing the Investment Theses for Both Selections

The infrastructure powerhouse, Broadcom, offers a compelling investment through its essential role in custom silicon and data center networking, providing a diversified, foundational play on the AI arms race. Its story is one of engineering excellence creating durable technological lock-in. Conversely, the digital ecosystem architect, Meta Platforms, presents a faster-moving narrative of successfully deploying massive capital into user-facing artificial intelligence, poised to dramatically increase revenue efficiency against a backdrop of a highly engaged global audience. Both narratives point toward valuations that will be significantly higher by the time the next cycle of major market adjustments occurs.

A Prudent Outlook on Risk Management in High-Growth Sectors

While the promise of reaching the two trillion dollar valuation is significant, investors must approach these high-growth, high-multiple stocks with an awareness of the inherent volatility. The market’s current enthusiasm sets a high bar for continued performance. Any misstep in product delivery, any unexpected deceleration in capital spending by major cloud providers, or any unforeseen competitive development could lead to pronounced downward pressure on valuations, even if the long-term trajectory remains positive. Therefore, adopting a long-term horizon, as suggested by the multi-year analysis underpinning these targets, is the most prudent approach to capturing the full extent of the anticipated upward movement suggested by the wisdom of Wall Street experts as we move further into the latter half of this decade. The opportunity presented by these two artificial intelligence leaders is framed as one of the most compelling capital allocation decisions available in the current market environment.