The Path Forward Navigating the AI Arms Race Cost

The aftermath of the earnings report initiated a crucial period of reassessment, compelling the company and the market to establish new metrics for success that could justify the extraordinary financial commitment required to remain at the forefront of the artificial intelligence evolution. The key question now is: How do we judge this multi-billion-dollar bet?. Find out more about Meta stock drop reason high AI spend.

Measuring Milestones Beyond Immediate Profitability

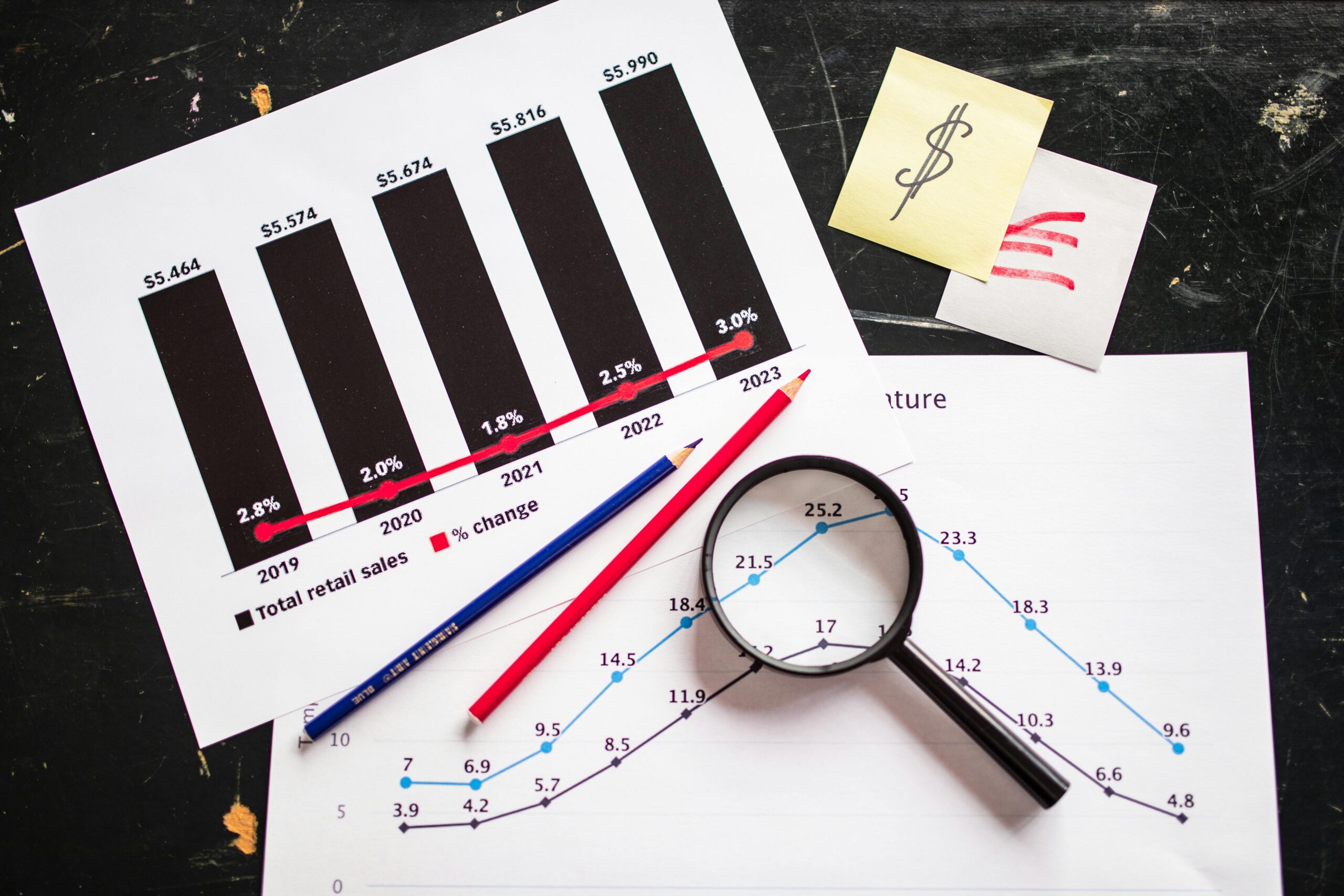

Moving forward, the market’s valuation of the technology giant will likely become increasingly tied to metrics that reflect progress in its long-term vision rather than just quarterly earnings per share, which were distorted by the tax charge. Success will be measured by tangible achievements in the development and deployment of proprietary, foundational models, the speed at which these new capabilities are integrated into the advertising technology stack to drive superior ROI for advertisers, and the actual scalability realized from the massive data center investments.. Find out more about Analyzing Meta Q3 earnings margin compression factors guide.

The concept of “efficiency” may shift from pure cost-cutting, as seen in the prior year, to efficiency in AI output per dollar spent, a far more nebulous and difficult benchmark for external observers to track. This is where deep industry knowledge and access to proprietary metrics become vital for serious investors. Understanding the technical benchmarks—like model training time reduction or inference cost per query—is becoming as important as understanding the revenue figures. To get ahead of this curve, you need to stay updated on foundational AI model benchmarks.

For investors needing to make sense of this, here are the new checkpoints for the coming quarters:

- AI Integration Velocity: How quickly are new AI features showing up in core products (e.g., improved ad targeting, better content recommendations)?. Find out more about Impact of Meta overseas earnings tax charge on net income strategies.

- Reality Labs Progress: Are the operating losses narrowing, or are the new AI-powered devices (like the Ray-Ban smart glasses) generating enough top-line revenue to offset the headset division’s deep losses? (The Reality Labs unit reported a $4.4B loss on just $470M in Q3 sales).

- Cost Curve Flattening: Is the rate of expense growth (especially CapEx) showing signs of peaking, or is management signaling even higher rates for 2026?. Find out more about Meta stock drop reason high AI spend overview.

Potential for Future Revenue Streams from Advanced Models. Find out more about Analyzing Meta Q3 earnings margin compression factors definition guide.

Ultimately, the entire thesis rests on the expectation that this massive, front-loaded capital deployment will unlock entirely new, high-margin revenue streams that are currently unavailable or underdeveloped. This could include entirely new consumer-facing product categories powered by advanced artificial intelligence, enterprise-level licensing of proprietary models, or a quantum leap in advertising effectiveness that allows for significantly higher pricing power across the platform.

Until these revenue-generating inflection points are clearly visible and demonstrably within reach, the current investment paradigm will continue to be viewed through a lens of elevated risk, positioning this period as a high-stakes, existential gamble on securing technological supremacy in the unfolding era of advanced computation. The coming quarters will be a continuous examination of whether the current price paid for market leadership will prove to be a bargain or a significant overpayment. Remember, the market hates uncertainty more than it hates high costs. To succeed here, the company must transition its spending from an expense to an asset with a visible future payoff.. Find out more about Meta AI capital expenditure ROI skepticism insights information.

What’s your take? Did the market overreact to the tax charge, or is the escalating AI spending a genuine threat to near-term profitability? Drop your thoughts in the comments below—we want to hear how the current economic climate is influencing your view on these tech behemoths.