The Balancing Act: Margin Resilience Amidst Infrastructure Overhaul

One of the most complex feats of corporate management right now is navigating the high-wire act of maintaining healthy operating margins while simultaneously executing one of the largest capital expenditure (CapEx) cycles in corporate history to feed the AI beast. The market is not naive; it knows this spending is happening. What the market demands now is tangible proof that the company can absorb these massive upfront costs—the AI infrastructure provisioning—without severely compressing profitability in the short term. The definition of a “solid” quarter hinges on the operating margin percentage holding steady or even expanding slightly compared to the year-ago period, effectively showing that the premium pricing power of their software is high enough to cover the immediate hardware drag.

Margin Resilience Amidst Aggressive Infrastructure Investment

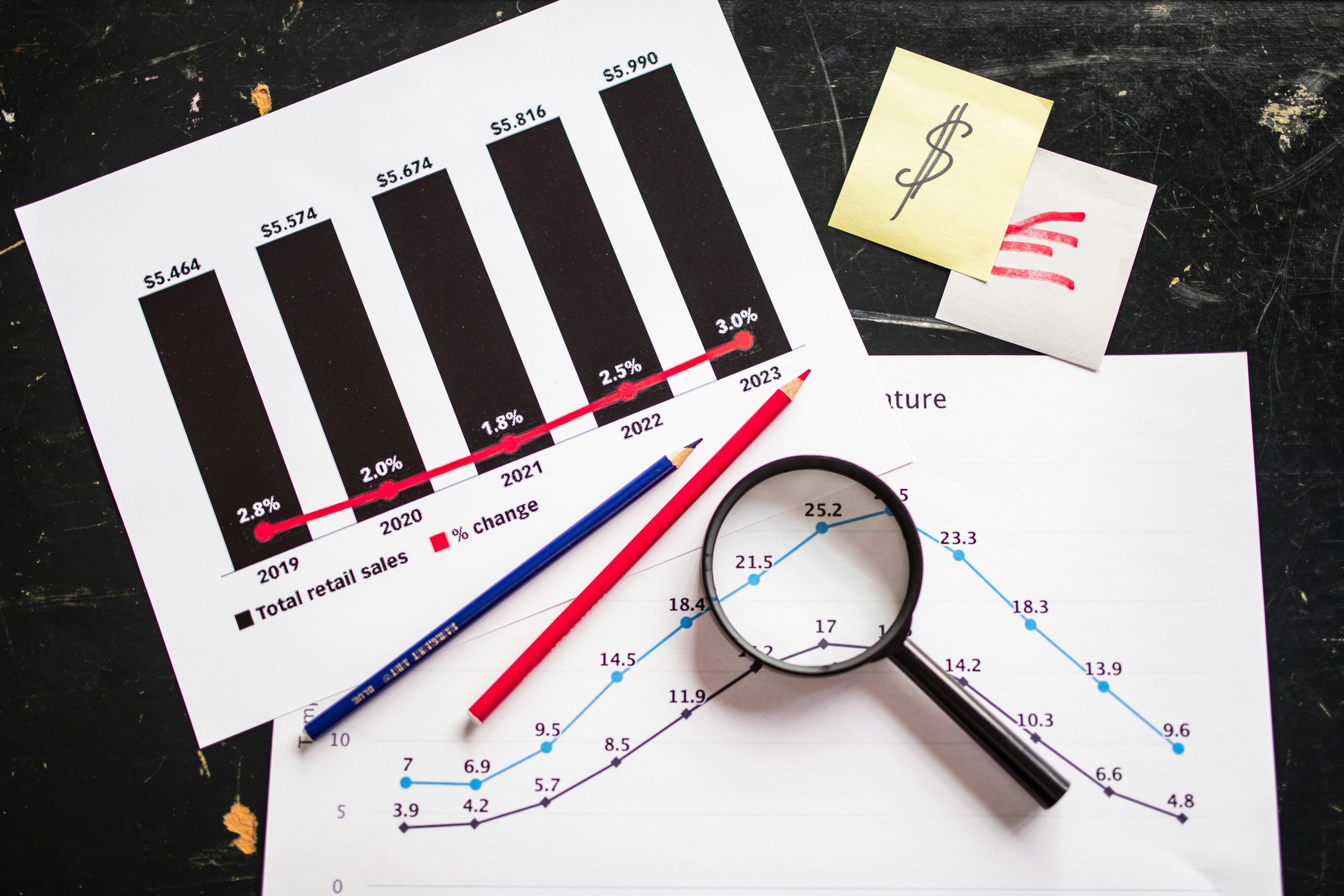

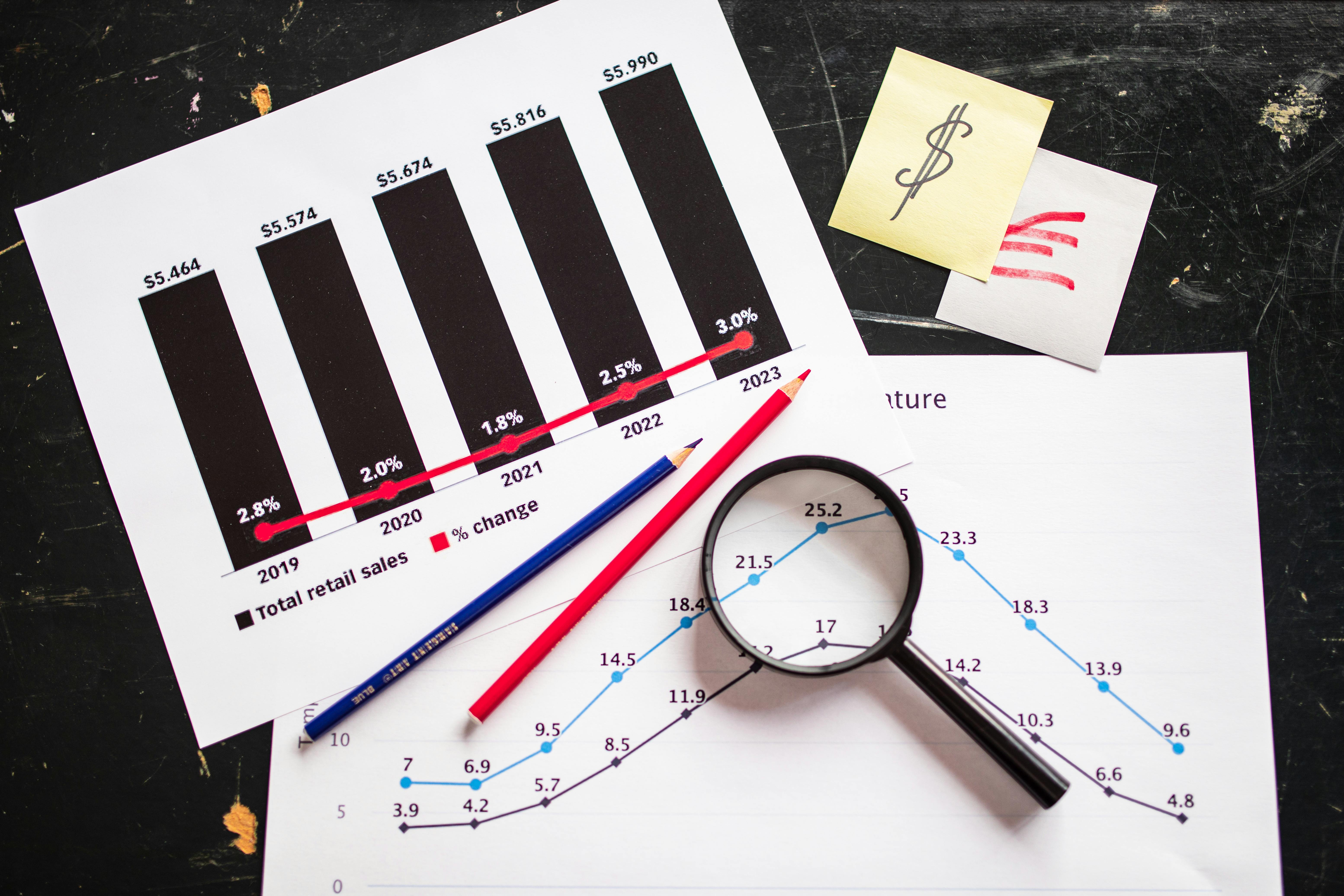

If the overall operating margin percentage dips significantly below the expected range for the quarter, it immediately triggers uncomfortable questions about the efficiency of the ongoing CapEx deployment and the immediate profitability of the AI services being sold into Azure. The validation of the current high trading multiple relies on the thesis that the software revenue is high-quality enough to deliver operating leverage *despite* the CapEx. As of October 2025, the trailing twelve-month (TTM) operating margin stood at a respectable 43.88%, slightly off the FY 2025 margin of 44.73%, which hints at the pressure from the massive infrastructure outlays.

This resilience must be demonstrated in the upcoming report. A steady margin confirms that the *value* proposition of Microsoft 365 and Azure AI is strong enough to maintain premium pricing, even when competitors are aggressively pricing their own compute layers. It’s the difference between a technology company investing for future gain and a technology company executing its plan flawlessly.

The Strategic Deployment and Monetization Timeline of Capital Outlay

The trajectory of CapEx isn’t just a backward-looking expense line; it is the most critical forward-looking indicator in the entire report. Investors are looking past the sheer size of the spending toward the strategic timing and the anticipated payback period. The key question being asked in boardrooms is: Are the earliest, most strategic AI-centric data center investments, which were initiated perhaps last year, beginning to contribute meaningfully to revenue generation in this reporting cycle, or is the significant Return on Investment (ROI) still slated for the latter half of the upcoming fiscal year?. Find out more about Microsoft 365 E-Five tier upsells revenue momentum.

A narrative suggesting that early monetization is beginning provides tangible validation for the company’s capital allocation strategy. Conversely, if management confirms that the bulk of the AI-driven CapEx spending will continue without near-term revenue payback, it places immediate short-term pressure on the Productivity segment to overdeliver on profitability to keep the consolidated margin profile looking healthy. We have a clear signal of near-term pressure: Microsoft guided for a massive CapEx outlay in the very next quarter (Q1 FY2026), projecting spending to exceed $30 billion, a number that represents a significant jump of over 75% quarter-over-quarter. Analysts, like those at Bank of America, are expecting FY2026 CapEx to settle around $125 billion, which is roughly 38% of expected revenue, confirming this aggressive spending profile.

Key Insight for Q&A Scrutiny: When listening to the call, look for management to explicitly state which *tranches* of CapEx are now “moving from build-out to revenue generation.” Any ambiguity here will be seen as a sign that the payback period is extending, which is a negative signal for valuation compression.

More Personal Computing: Navigating Cyclical Headwinds and Integration

The More Personal Computing segment—the home of Windows, Surface devices, and Xbox—inherently faces more pronounced cyclicality than the stable, recurring revenue streams of the cloud or productivity divisions. This segment often acts as a bellwether for broader consumer and corporate hardware refresh cycles, making its reporting particularly choppy and sensitive to seasonal patterns.

Seasonal Factors Impacting Windows OEM Licensing Revenue

The first fiscal quarter (Q1, the one being reported), by its very nature, often presents a seasonal trough. It sits in that awkward space between the back-to-school purchasing rush and the major year-end corporate refresh cycle. This positioning naturally imposes headwinds on transactional revenue streams, most notably the Windows Original Equipment Manufacturer (OEM) licensing fees tied directly to new PC shipments.

Analysts are generally modeling for modest, flat growth, or perhaps even a slight contraction in the OEM component compared to the immediate prior quarter. The market is prepared for this seasonality; the key watch point, as outlined in the original investment thesis, is management’s commentary on inventory dynamics within the distribution channel. Are distributors still burning through excess stock from prior quarters, or are they starting to cautiously build inventory for the holiday/next cycle? Any unexpected weakness beyond the widely anticipated seasonal lull will be interpreted as a more profound sign of PC market fatigue.. Find out more about Microsoft 365 E-Five tier upsells revenue momentum guide.

For context, in a previous Q1, the OEM portion of the Windows and Devices revenue *did* manage a slight increase, driven by a favorable mix shift, but the segment as a whole felt the drag from hardware sales. The consensus expectation now is for continued market fatigue following the post-pandemic rebound, confirming the view that this quarter’s results will be muted by hardware cycles, even if the cloud division is delivering record numbers.

Integration Effects from Recent Strategic Acquisitions in the Sector

Another significant, though increasingly normalized, component within this segment’s revenue is the impact of major strategic acquisitions—chief among them being the gaming giant acquired in the previous cycle. The inclusion of these new business lines provided a massive, non-organic lift to the segment’s top line, making direct year-over-year comparisons to the pre-acquisition baseline increasingly less meaningful. In fact, as of September 2025, searches indicate that no major acquisitions have been completed in the current calendar year (2025), meaning the integration of prior large deals is well underway, or at least settled.

This means investors must now dissect the reported numbers to understand the underlying organic performance of the legacy components—the “pure” Windows and Surface business—after accounting for the large, acquired entity’s contribution. The success story here is less about the initial purchase and more about the immediate integration and cross-selling potential. For example, how effectively are the new gaming subscription offerings—now deeply integrated into the Microsoft ecosystem—driving recurring revenue? A smooth transition and a clear articulation of the synergistic value being unlocked are necessary to neutralize any lingering concerns about integration costs or operational disruption eating into the segment’s overall margin contribution.

Actionable Takeaway for Deeper Analysis: When the segment breakdown is provided, try to mentally net out the impact of the largest prior acquisition to isolate the true organic growth rate of the core Windows and Search businesses. If organic growth in Search and News advertising (ex-TAC) remains strong—as it has been recently, growing at 20% year-over-year in one prior quarter—it proves the ecosystem’s stickiness extends beyond the large hardware/software bundles.

Beyond Segments: Enterprise Health and Partnership Foundation. Find out more about Microsoft 365 E-Five tier upsells revenue momentum tips.

While the three official segments capture the bulk of the financial story, the long-term enterprise pipeline health is mediated by factors that don’t always get top billing on the income statement—specifically, security integration and the vibrancy of the partner network.

Security and Compliance Offerings as an Accelerant for Cloud Adoption

In the complex, highly regulated operational environment of late 2025, enterprise spending on robust, integrated security solutions has become entirely non-discretionary. It’s a mandatory operational requirement, not an optional IT spend. The market views Microsoft’s unified security and compliance suite—which blankets identity management, endpoint security, and data governance across both Azure and Microsoft 365—as a powerful differentiator that competitors struggle to match holistically.

Strong results in security-related licensing and, more importantly, the attach rates of these security SKUs to base cloud consumption, serve as an indirect, yet powerful, validation of the overarching Intelligent Cloud and Productivity theses. When regulatory pressure mandates better security, it inevitably pulls along underlying cloud consumption, as modern security architecture demands cloud-native deployments. Confirmation of strong uptake in these advanced security modules (like the previously mentioned Purview adoption by Copilot users) is viewed as one of the highest-quality revenue indicators for the ensuing fiscal year because it signifies mission-critical adoption.

The Health of Enterprise Support and Partner Ecosystem Engagement

The stability of the massive global enterprise customer base is largely mediated through the Enterprise Support channels and, perhaps most importantly, the Microsoft Partner Network. These areas are the true long-term indicators of market share and customer satisfaction, even if they are relegated to footnote status in the financial summaries.

A healthy partner ecosystem signifies that thousands of third-party developers and service providers are actively building, selling, and supporting solutions on the Microsoft stack. This creates a formidable, embedded switching cost for customers—it’s no longer just about Microsoft’s product; it’s about the entire ecosystem built around it. Positive commentary regarding partner incentives, the adoption of new training modules for the new **Microsoft AI Cloud Partner Program (MAICPP)** structures (which underwent significant changes effective October 1, 2025), and the volume of high-value contracts facilitated by these external channels suggests a deeply embedded corporate relationship that transcends simple service consumption.. Find out more about Microsoft 365 E-Five tier upsells revenue momentum strategies.

Any signal of partner dissatisfaction or a slowdown in network growth would be a muted, but crucial, warning sign regarding future enterprise pipeline health. The market wants to hear that the $125 billion expected CapEx spend for FY2026 will be deployed not just by Microsoft teams, but by a vibrant, incentivized partner network ready to drive implementation and adoption.

Strategic Point: The partner ecosystem is Microsoft’s primary distribution multiplier. If the transition to the new FY26 partner program structure appears smooth, it signals a high degree of channel alignment, which directly translates into accelerated sales pipeline velocity for the remainder of the year.

Valuation Realities: From Speculation to Earned Confidence

The market’s perception of Microsoft’s valuation is perhaps the most telling indicator of the company’s current standing. The era of purely speculative, massive multiple expansion driven by AI *promise* is waning. The new reality is one of earned confidence, where the premium price tag is now being rigorously justified by quarterly financial execution.

Assessing Current Multiples Against Historical Cash Flow Performance

The current trading valuation, often discussed in terms of forward price-to-earnings (P/E) multiples, is generally perceived as reflecting the company’s current trajectory: a premium is warranted given the quality and visibility of the cash flow, but the easy multiple expansion is over. The analysis strongly suggests that the current valuation range is supported by the sheer strength of the underlying free cash flow generation, which is proving more resilient to the heavy investment cycles than less mature competitors.. Find out more about Microsoft 365 E-Five tier upsells revenue momentum overview.

The “earned rally” thesis rests on the company consistently delivering earnings that grow slightly faster than its revenue, thereby providing a subtle, continuous compression of the forward multiple as the fiscal year progresses. Investors are comfortable paying a premium for certainty, and the near-term outlook promises that certainty. However, a significant overshoot on current expectations would be required for the multiple to dramatically re-rate further in the short term. The market is pricing in a *solid* quarter, not a miracle.

Investor Sentiment: Moving from Euphoria to Hypeless Perfection

The overarching theme in late 2025 is a definitive shift in sentiment—moving away from the explosive euphoria that characterized the initial AI adoption hype cycle to a more grounded, almost detached, **earned confidence** in Microsoft’s execution capabilities. The market is no longer merely betting on the *promise* of artificial intelligence; it is now confirming the quarterly reality of AI integration into enterprise workflows and monetization in the Productivity segment.

This transition leads to what some analysts are calling the “hypeless” descriptor: the market *expects* perfection because the story is so well understood and widely covered. Confidence is exceptionally high, but expectations are similarly tethered to reality. This is not the sentiment of a speculative growth stock requiring multi-quarter miracles; it is the sentiment afforded to a dominant infrastructure provider delivering its methodical commitments. This very steadiness, while perhaps less exciting day-to-day than a speculative biotech launch, is precisely what underpins the long-term institutional conviction in the stock. Analysts continue to project significant upside, with some expecting the stock to clear new highs by the end of the fiscal year based on this consistent delivery.

Potential Areas for Positive or Negative Earnings Surprises

While the base case for the upcoming report is a solid delivery that meets consensus, potential vectors for minor surprises always exist. Keep these on your radar:

- Positive Surprise Vector: A significant upward revision to the full-year CapEx guidance, *framed specifically as an acceleration to meet surging customer demand* rather than a sign of unforeseen supply chain costs, could excite the market. This would signal demand strength surpassing even internal expectations. Another positive surprise would emerge from the productivity segment if the monetization of the highest-tier Copilot/security bundles shows an unexpectedly rapid increase in attach rates beyond current models.. Find out more about Copilot integration adoption rate penetration metrics definition guide.

- Negative Surprise Vector: The primary downside risk remains a slight deceleration in the Azure growth rate, falling just shy of the crucial low-to-mid-thirties percentage band. Such a miss would immediately trigger concerns about immediate AI capacity saturation relative to demand, despite the massive CapEx spending underway. A less-than-ideal holiday quarter for More Personal Computing device sales could also slightly pressure the consensus, though the muted impact would be buffered by the sheer scale of the cloud segment’s contribution.

It is worth noting the expectations for the next quarter (Q1 FY2026) are for approximately 14.9% YoY revenue growth and an EPS of $3.67, suggesting a relatively priced-in report.

The Outlook Beyond the Immediate Quarterly Report

Ultimately, this upcoming report serves as a critical reference point, a check on the operational pulse, but the true investment thesis remains anchored firmly on the long-term horizon. The key takeaway for sustained shareholder value creation lies in management’s outlook for the remainder of the fiscal year, particularly concerning the maturation of the massive AI infrastructure investments.

Investors will be seeking clear signposts indicating that the massive spending today will translate directly into tangible margin expansion tomorrow. The story is evolving from “Can Microsoft deliver this quarter?” to the more challenging, yet rewarding, question: “How effectively can Microsoft convert its massive cloud footprint and deeply embedded productivity ecosystem into a durable, high-margin AI annuity over the next three to five years?”

The solid, hypeless quarter the market anticipates is merely the necessary next step in confirming that the structural advantages—in cloud scale, enterprise trust, and AI integration across M365—are being translated flawlessly and predictably into the financial statements that drive long-term capital appreciation. This predictable performance builds the foundation for continued, albeit more measured, gains moving forward. We are moving from betting on potential to confirming execution against an industry-defining roadmap. For more on how these enterprise strategies map to long-term IT strategy, you might find this analysis on enterprise IT roadmap planning useful.

Conclusion: The Foundation of Future Growth is Today’s Recurring Revenue

So, what should you take away from this deep dive into the current dynamics, as of October 23, 2025?

The company’s stability is not in question; it’s cemented by the Productivity and Business Processes segment’s high-margin, recurring revenue streams. The primary excitement rests on the monetization of embedded AI via Copilot and the aggressive upsell to premium suites like E5, both of which are showing clear, accelerating momentum. The infrastructure build—evidenced by the massive forward capital expenditure strategy—is the necessary price of leadership, and management must show margin resilience to justify the current valuation.

The More Personal Computing segment will likely continue to be a mixed bag, presenting seasonal weakness in OEM sales, which is expected behavior for Q1. The key will be organic strength in Search and the normalized impact of prior acquisitions like Xbox content and services growth.

Finally, look for evidence of ecosystem health. A strong partner network and an accelerating security attach rate are the quiet indicators that the foundation is solid for years of annuity revenue. Are you tracking these key metrics for your own business planning? What is your organization seeing regarding the mandatory nature of advanced security and compliance tooling?

Call to Engagement: The time for hedging on AI is over; the time for analyzing its financial manifestation is now. What do you see as the single biggest risk to the “earned rally” thesis heading into the rest of fiscal year 2026? Share your thoughts below—let’s dissect the real-world impact of these enterprise transitions!