Future Trajectories and Strategic Foresight in High-Stakes Collaboration

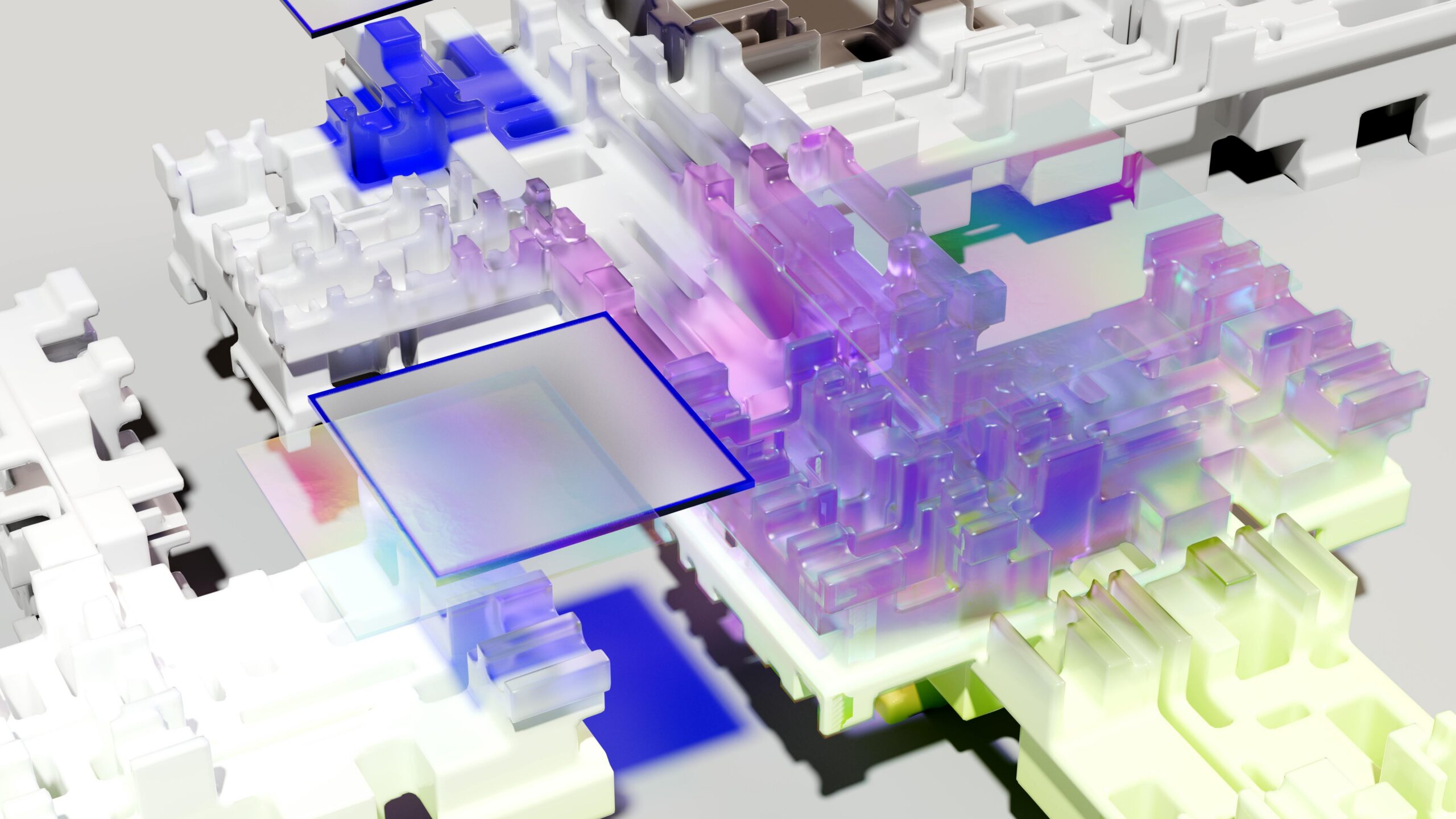

With the AMD deal cementing a competitive path and the incumbent supplier facing recent public caution, the trajectory of the next 18 months in AI compute will be defined by execution and resolution.

The Path Forward: Negotiating Definitive Terms and Conditions. Find out more about Nvidia OpenAI $100 billion pact uncertainty.

The immediate future of this high-profile strategic engagement hinges entirely on the successful conclusion of negotiations leading to the signing of the formal, definitive agreements. The complexities involved in finalizing a deal of this magnitude—spanning power procurement (like the **6GW** commitment), long-term supply guarantees, intellectual property considerations, and financial structuring (like the **10% warrants**)—are substantial.

The market now watches for any indication of progress on these complex terms, as any major sticking point could lead to the opportunity dissolving entirely, reinforcing the risk articulated in the regulatory filing. The stakes are not just billions of dollars; they are tied to the timeline for the next major AI model release.. Find out more about Nvidia OpenAI $100 billion pact uncertainty guide.

The Enduring Quest for Superintelligence and Compute Supremacy

Regardless of the immediate contractual status between any single pair of companies, the underlying drive for massive compute capacity remains constant for the AI developer. The pursuit of developing increasingly sophisticated models and ultimately achieving Artificial General Intelligence (AGI) is fundamentally constrained by access to compute power. This necessity acts as the ultimate leverage.

Therefore, the pressure remains on both organizations to resolve their differences and formalize the supply arrangement, as failure to do so will necessitate a rapid and costly pivot to secure equivalent capacity elsewhere—potentially delaying their long-term research milestones. This high-stakes requirement ensures that the dialogue, even after the cautionary filing, remains intensely focused on resolution. The race for AI compute supremacy demands it.

Implications for the Broader Technology Sector Landscape

The outcome of this high-profile negotiation—whether the incumbent secures its deal or the diversification strategy accelerates—will have reverberations far beyond the two direct participants. It will set a precedent for how future multi-billion-dollar technology partnerships are structured, announced, and legally executed within the intensely competitive technology sector. Furthermore, the success or failure of the hardware supplier to close this deal, especially in the face of a strong rival securing capacity, will be closely scrutinized by investors as a leading indicator of how well the incumbent leader can maintain its central role in the next generation of global digital infrastructure development.. Find out more about Nvidia OpenAI $100 billion pact uncertainty strategies.

The entire ecosystem is currently calibrating its expectations based on the forthcoming formal documentation. Companies like **Foxconn**, which recently announced a partnership with OpenAI to advance the design and U.S. manufacturing of next-generation hardware, are positioning themselves to capitalize on this systemic diversification, showing that the challenge to the incumbent is coming from all angles—from the chip designers to the rack builders.

Actionable Takeaways for Navigating the Compute Chasm. Find out more about Nvidia OpenAI $100 billion pact uncertainty overview.

For strategists, investors, and engineers watching this epic showdown, the immediate landscape provides clear, actionable intelligence:

The game has changed. It is no longer a procurement exercise; it is a geopolitical, financial, and engineering masterclass. The stakes are nothing less than determining who will build the computational backbone of the next decade.

What strategic moves are *you* making to de-risk your compute pipeline based on the current competitive dynamics? Let us know your thoughts in the comments below!

![Pope Leo XIV AI homily directive: Complete Guide [2026]](https://tkly.com/wp-content/uploads/2026/02/pope-leo-xiv-ai-homily-directive-complete-guide-20-1771758410795-150x150.jpg)