Practical Takeaways for Stakeholders: What This Fight Means for the Market

This legal brinksmanship between a tech titan and a luxury institution sends ripples far beyond the courtroom walls in Houston. Every vendor, every unsecured creditor, and every competitor is watching to see how aggressively a significant minority equity holder can challenge the foundational assumption of a Chapter 11—that the DIP manages its own affairs.

Guidance for the Ecosystem of Saks Global

For those deeply embedded in the Saks Global ecosystem—the fashion houses, the logistics partners, and the landlords—the threat of an examiner or trustee creates a significant governance risk premium.

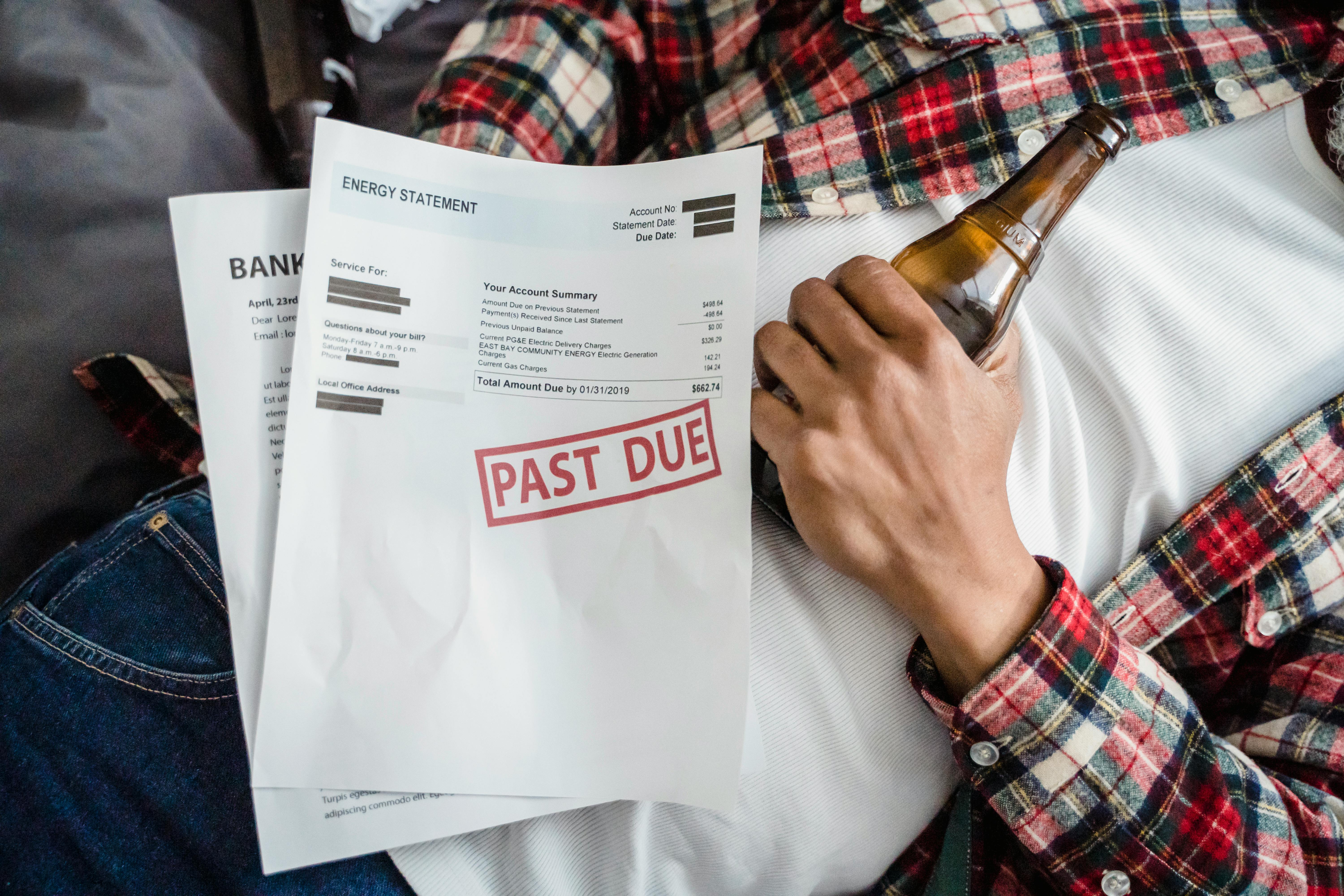

- Vendor De-risking: If Amazon forces an examiner, expect investigations into past payment practices and liability allocations. Suppliers owed money—like Chanel ($136 million) and Kering ($59 million)—must continue to press for security or reduced shipment terms. Relying solely on the DIP’s promises in this environment is risky. Review your **supply chain risk** exposure immediately.. Find out more about Amazon legal battle bankrupt Saks Global.

- Creditor Leverage: The outcome of Amazon’s next motion will determine the leverage of *all* non-secured creditors. If Amazon gains ground, it suggests the court is willing to look past the initial financing structure, potentially opening the door for other creditors to demand better treatment.

- The New Leadership Test: The new CEO, Geoffroy van Raemdonck, faces an immediate, almost impossible test: manage the day-to-day business while simultaneously fighting off a major investor determined to prove your governance is flawed. His ability to stabilize operations *before* a trustee is appointed is his only real defense against Amazon’s most drastic move.

The pressure Amazon is exerting is forcing a market re-evaluation of the viability of the combined luxury entity. If the dispute drags on, the market perception—the one thing luxury retail cannot afford to lose—will suffer irreparable damage, regardless of who ultimately “wins” the legal battle.. Find out more about Amazon legal battle bankrupt Saks Global guide.

To better understand how other large entities have managed such internal warfare, it’s worth looking at the playbook used in other major retail restructuring events—the lessons learned from past **large-scale retail bankruptcies** can offer clues about potential timelines and outcomes in this high-stakes showdown.

Historical Context and Precedent: Why This Case Matters for Future Investments. Find out more about Amazon legal battle bankrupt Saks Global tips.

The conflict between Amazon and Saks Global isn’t just about $475 million; it’s about setting precedent. When a technology and e-commerce giant makes a strategic equity investment into a legacy physical retailer, they are effectively buying a seat at the table—or at least, they *expect* to have one that matters when things go south.

The “Equity Security Holder” as a Disruptor

Historically, Chapter 11 was often dominated by secured lenders and bondholders. Equity holders, like Amazon in this context, typically have the lowest priority in repayment and thus the least power to direct the proceedings unless they convert debt to equity or are an essential strategic partner whose goodwill is necessary for the debtor’s survival. Amazon, by threatening examiner or trustee appointments, is forcing the court to acknowledge that their strategic investment carries *governance* weight far exceeding their nominal position in the creditor hierarchy.

The legal concept that an examiner can be mandated if qualifying unsecured debt passes a threshold—currently $5 million—is a critical piece of leverage for Amazon. This statutory backup ensures that even if the judge is hesitant about the merits of the mismanagement claim *today*, the debt threshold itself could force the appointment later. It acts as a constant, ticking clock for Saks Global management.

If Amazon succeeds in installing an examiner or trustee, it signals to every future strategic investor in the retail space: “Your equity stake, no matter the commercial agreement attached to it, will be protected by the threat of full judicial oversight if mismanagement occurs.” This is a powerful, albeit painful, lesson for the entire sector regarding **investment oversight in distressed assets**.. Find out more about Amazon legal battle bankrupt Saks Global strategies.

This case is a modern iteration of the tension between new-economy capital and old-economy management. Amazon is not merely seeking to recoup its money; it’s seeking to impose a standard of operational accountability that it believes the legacy luxury sector has consistently failed to meet. This is a battle for the right to enforce covenants—and the right to intervene—when the promised synergies fail to materialize. The resolution here will undoubtedly shape how future multi-trillion-dollar companies embed themselves into physical retail through strategic equity partnerships.

The Inevitable Crossroads: Negotiation or Litigation Armageddon

As we stand on January 18, 2026, Saks Global has a temporary lifeline, but the storm clouds are gathering, fueled by Amazon’s stated intent to escalate. The debtor and the existing creditor groups now face a clear choice, one that will define the next phase of this bankruptcy.

The High Cost of Pushing Forward Alone. Find out more about Amazon legal battle bankrupt Saks Global overview.

The debtor can choose to proceed with the existing restructuring plan, betting that the initial DIP financing approval gives them enough momentum to weather Amazon’s next legal challenge without giving up substantive control. This path courts **litigation armageddon**. Defending against a formal motion for an examiner or, worse, a trustee, will drain critical operational cash, distract the new leadership team, and generate negative press that further erodes consumer and vendor confidence. In a luxury retail environment where brand equity is everything, this protracted, public fight is a slow-motion catastrophe.

The more pragmatic path—the one Amazon’s threat is designed to coerce—is serious, good-faith negotiation. Amazon is essentially using the specter of a trustee, which the court *could* order, to force the secured lenders and the debtor to re-evaluate the treatment of Amazon’s equity stake in the final plan. They need to sit down and ask: Can we structure the plan such that Amazon feels their $475 million investment is being treated with respect, thus compelling them to drop the motion for drastic remedies?

Key Takeaways and Your Next Move. Find out more about Seeking appointment of trustee in Chapter 11 definition guide.

The central lesson from this rapidly evolving situation is that in modern corporate restructurings, strategic partnership terms often carry more weight than simple creditor seniority—but only if you are prepared to enforce them aggressively.

- For Amazon (and similar strategic investors): Your warning shot has been fired. The next move must be decisive—file the motion for an examiner if negotiations stall, or risk losing all leverage.

- For Saks Global Management: Immediate, transparent engagement with Amazon is paramount. Focus resources on demonstrating clean governance and measurable operational improvements to counter the narrative of “incompetence.”

- For Suppliers and Competitors: Assume the uncertainty will continue for the first half of 2026. Monitor the court docket daily for any motion to appoint an examiner (the next likely step). This level of internal conflict signals operational fragility that could impact inventory flow for the critical Spring/Summer retail seasons.

The fight for Saks Global’s soul is now a battle over governance, and the main weapon is a motion filed with the bankruptcy court. Whether Amazon pulls the trigger on that motion remains the single most important variable in the short-term fate of this luxury empire. Will they accept a negotiated settlement on their $475 million, or will they force the court to install an independent overseer? The answer will rewrite the rules for **strategic investment enforcement** in distressed M&A for years to come. The next filing date on this docket is not just another date on the calendar—it’s a potential inflection point that could change who runs Saks Global before the end of the quarter.

What do you see as the most likely next legal step Amazon will take? Will they compromise on the financing structure, or are they already drafting the papers to demand a trustee? Share your analysis in the comments below—this saga is far from over.