The Target Customer: Critical Operations and Data Center Backhaul

The technology’s specification sheet tells you *what* it can do; the target market tells you *why* it matters. TeraWave is less about closing the digital divide in the consumer sense and entirely about securing mission-critical global commerce and state functions.

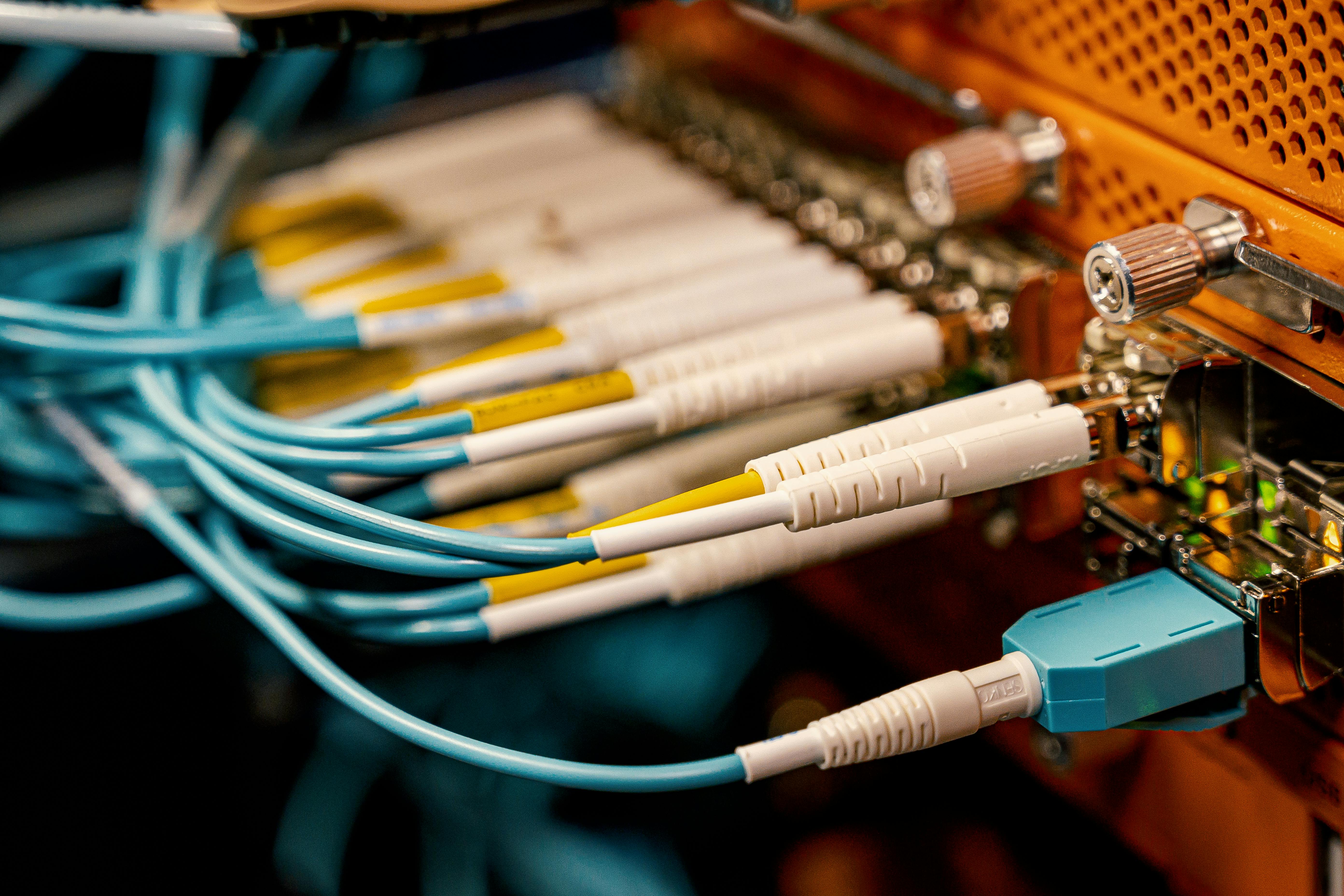

Bridging the Fiber Gaps for Global Enterprise

The core value proposition for large corporations is not replacement, but route diversity and redundancy. Imagine a massive logistics company or a global bank whose primary terrestrial fiber link—perhaps running under the sea or across a complex political boundary—is suddenly cut. TeraWave is being positioned as the instant, resilient orbital network ready to reroute that critical data traffic, providing unparalleled business continuity. This is a transport layer designed to sit alongside existing fiber backhaul, acting as the ultimate insurance policy against terrestrial failure.. Find out more about Blue Origin TeraWave enterprise satellite service.

Governmental and National Security Applications

A non-trivial segment of the stated customer base is the government sector, including defense and national security users. Blue Origin is positioning TeraWave to offer secure, high-capacity services “wherever they operate,” suggesting a design heavily focused on encryption and resilience for remote military bases, diplomatic outposts, and disaster recovery efforts. This instantly pits TeraWave as a high-end counterpart to specialized offerings like SpaceX’s Starshield program, focusing on mission assurance.

Navigating the Bureaucracy: Regulatory Hurdles and Spectrum Fights. Find out more about Blue Origin TeraWave enterprise satellite service guide.

Even with the best hardware, a megaconstellation sinks or swims based on regulatory clearance. Launching over 5,000 satellites is as much a legal endeavor as an engineering one.

The FCC Approval Gauntlet

Blue Origin has already engaged with the chief U.S. regulator, the Federal Communications Commission (FCC), filing the necessary technical annexes and applications. The entire 2027 deployment schedule hinges on the speed of approval from the FCC’s Space Bureau. Given the historical spectrum battles other operators have fought, this journey will be closely watched. You can read more about the complex FCC spectrum allocation history to understand the potential friction points.

The Risk of Spectrum Congestion. Find out more about Blue Origin TeraWave enterprise satellite service tips.

Since TeraWave relies on Q/V-band radio frequency links for customer access, securing licenses for its operational bands is paramount. As LEO and MEO orbits become increasingly crowded—with Starlink, Leo, and Chinese constellations rapidly expanding—any new entrant risks encountering legal pushback from incumbents worried about frequency interference or resource infringement. The success of Blue Origin’s timeline rests squarely on its ability to secure these clearances without getting bogged down in protracted legal disputes.

The Scale Dichotomy: Quality Over Sheer Quantity

The competitive narrative is often reduced to simple numbers, but the contrast between TeraWave and its peers highlights a fundamental strategic choice: capacity and quality first.. Find out more about Blue Origin TeraWave enterprise satellite service strategies.

Satellite Count: Leaner but More Powerful

At 5,408 planned units, TeraWave is numerically smaller than Starlink’s nearly 9,500 operational satellites. It’s even smaller than Amazon Leo’s *planned* size of 3,236. Blue Origin’s bet is that superior technology—the high-capacity individual units and the massive optical backbone—can overcome a deficit in raw satellite count, at least for its specialized clientele. This is a clear attempt to maximize the data-per-satellite metric over the sheer number of access points.

User Base Disparity: Targeting the Top Tier. Find out more about Blue Origin TeraWave enterprise satellite service overview.

The gulf in current market penetration is massive. Starlink has established revenue streams from millions of users, while TeraWave is aiming for a niche of only “tens of thousands” of enterprise customers. This confirms the strategy: Starlink built the broadest possible user base first, then works on upgrades; TeraWave enters the arena pre-equipped with extreme performance, targeting the fraction of the market that demands absolute throughput reliability *now*.

Conclusion: The Re-Definition of Global Resilience and Actionable Insights

The TeraWave announcement is more than just another satellite plan; it solidifies the trajectory of Jeff Bezos’ aerospace vision, moving Blue Origin squarely into the infrastructure business alongside launch services. This intense rivalry—Starlink’s sheer scale, Amazon Leo’s consumer push, and TeraWave’s enterprise-grade hyper-capacity—is forcing rapid, positive innovation across the board.

For end-users and businesses, this means the definition of global broadband resilience is evolving at warp speed. Even if you never subscribe to TeraWave, the competitive pressure forces Starlink and Leo to accelerate their own technological upgrades, which is a win for everyone needing reliable connectivity.. Find out more about TeraWave satellite network terabit speeds definition guide.

Key Takeaways and Actionable Next Steps:

The high-stakes contest in the heavens is heating up. TeraWave is positioned to be the orbital complement to terrestrial fiber for the world’s most demanding data consumers. Are you ready for the terabit era? What are your thoughts on this multi-orbit strategy compared to Starlink’s LEO-only approach?

We’ll be tracking the Federal Communications Commission approval process and New Glenn’s flight schedule closely. Let us know your predictions in the comments below—will TeraWave grab the enterprise crown, or will Starlink upgrade fast enough to keep the lead?