Challenges in Scaling AI Compute Requirements

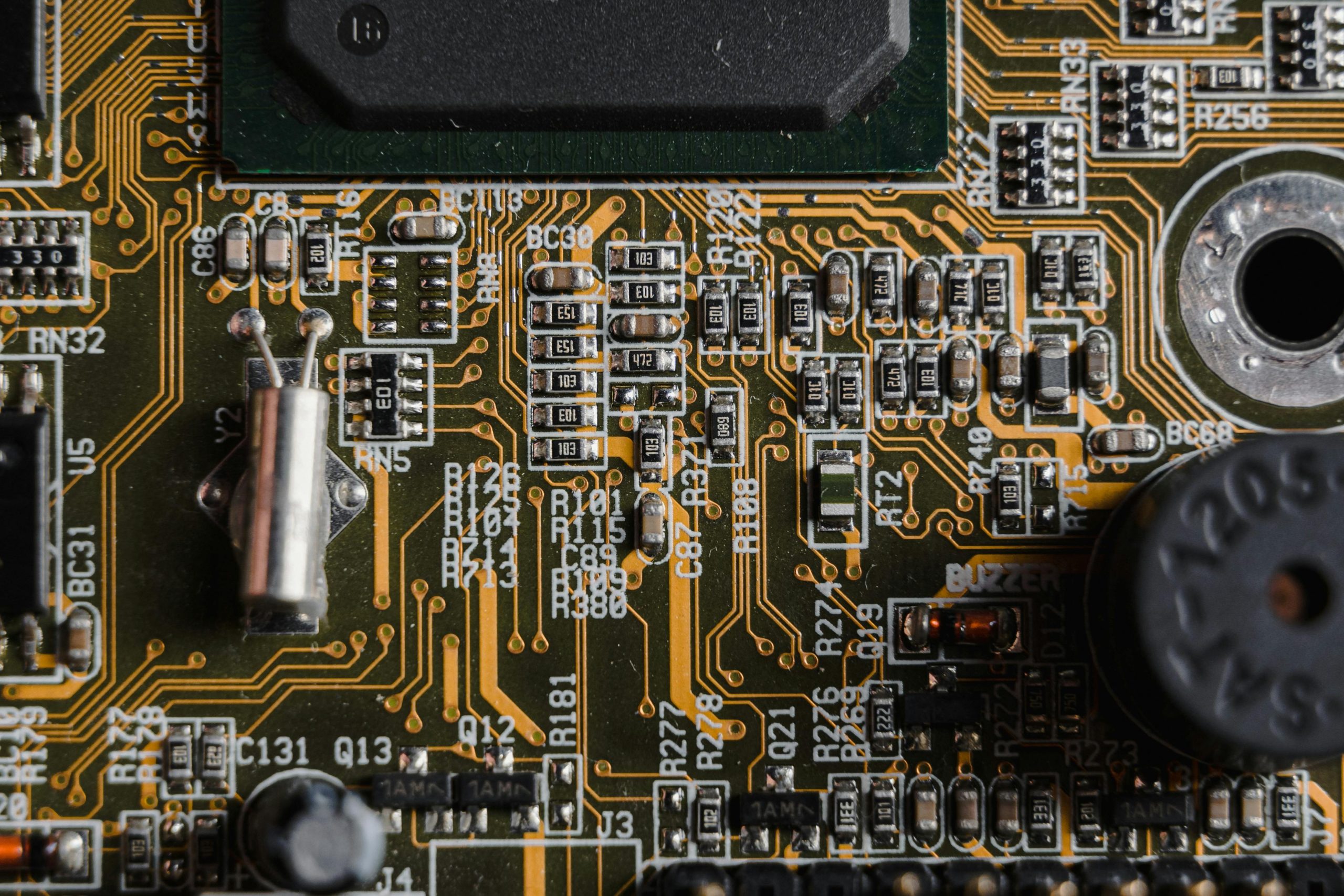

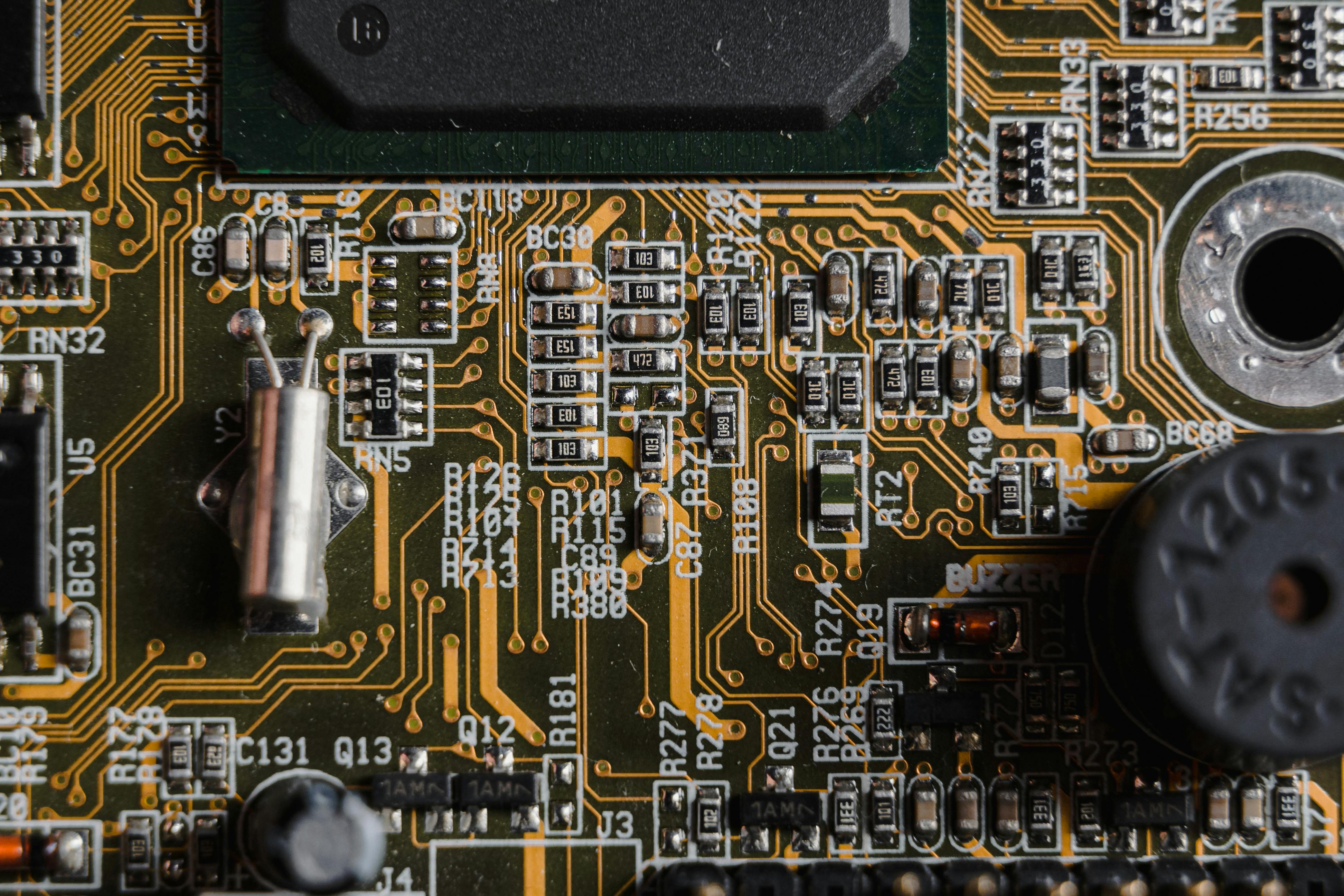

The very success of the autonomous vision reveals its greatest infrastructural bottleneck: the immense computational power required to run the decision-making software across millions of vehicles globally. The required scale shifts the focus from *what* the car is made of to *what powers its brain*.

The Gigawatt Scale of Required Artificial Intelligence Power

The sheer computational appetite for a fully realized, widespread autonomous network is vast, demanding a genuine perspective shift regarding industrial resource allocation. Leadership’s current assessment suggests that reaching the intended scale of global autonomous operation will necessitate provisioning an immense quantity of high-performance computing infrastructure in the cloud and in the data centers. The specific metric quoted publicly points toward a sustained annual requirement measured in the hundreds of gigawatts of dedicated AI chip processing power. This staggering figure highlights that the ultimate bottleneck for scaling the service isn’t necessarily the number of vehicles we can build or even the final bug list in the software; it is about securing the foundational digital engine required to run that complex software across a fleet numbering in the millions worldwide.. Find out more about Tesla robotaxi countdown unsupervised Austin.

This is not a constraint that a standard cloud contract can easily solve, especially given the proprietary nature of the models being run. The need for this level of dedicated, massive processing power changes the supply chain calculus entirely.

Vertical Integration as a Strategy for Supply Chain Control

This recognition of massive, sustained compute demand has triggered a critical strategic realization: relying solely on external vendors—even giants in the chip world—for such a critical, high-volume component introduces unacceptable risk to the deployment timeline and operational control. If the necessary silicon isn’t available or if the geopolitical landscape shifts, the entire robotaxi expansion plan stalls. Consequently, the decision to seriously explore constructing proprietary chip fabrication facilities is a direct, defensive response to this perceived supply chain vulnerability.. Find out more about Tesla robotaxi countdown unsupervised Austin guide.

By establishing in-house semiconductor production capabilities, the company seeks to transition from being a mere consumer of specialized processors to becoming a producer, thereby securing its technological trajectory against external market shocks. This deep level of vertical integration—a defensive, yet aggressive, move—is designed to insulate the most critical aspect of the robotaxi future—the neural network inference capability—from the macroeconomic and competitive pressures that plague the global chip market. This is a clear signal that compute capacity, not code, will define the winners in the next phase of AI deployment. For more on this strategy, a look into vertical integration in AI compute is warranted.

Future Trajectory and Investor Perspective

As we approach the end of 2025, the market narrative is focused on which company has the most potent combination of realized technology and scalable infrastructure. The success in Austin is not an end point; it is the launchpad for a far broader vision built on a convergence of AI applications.. Find out more about Tesla robotaxi countdown unsupervised Austin tips.

The Interplay of Autonomy and Robotics in the Market Narrative

The ongoing narrative framing the company’s investment case emphasizes a future where Artificial Intelligence is monetized across multiple, seemingly disparate physical domains. While the robotaxi service offers the most immediate, tangible path to high-margin recurring revenue, the simultaneous advancement in general-purpose humanoid robotics complements and strengthens this overall theme. This integrated AI approach suggests that the intellectual property and foundational algorithms developed for navigating complex, dynamic roads can be successfully ported or adapted to control sophisticated physical machines in structured environments, such as warehouses or factories. [cite: Provided Context]

For the forward-looking investor, this duality—a transportation network generating immediate cash flow and a general-purpose labor force offering massive long-term potential—presents a much more robust and multi-faceted growth story than one tied to any single product vertical. It solidifies the company’s position as a key player in the broader technological trends defining the coming years, blurring the lines between transportation and industrial automation. It’s a play on applied general intelligence across the physical world.. Find out more about Tesla robotaxi countdown unsupervised Austin strategies.

Defining the Milestone: Year-End Autonomy in Austin

The success of the short-term three-week countdown in Austin is poised to define the near-term momentum for the entire organization and its stock performance heading into the new year. If the system operates safely and reliably without any human intervention within the specified timeframe—meaning the monitor is gone for good—this will mark a major, tangible milestone that absolutely transcends previous projections. Even if this initial achievement occurs within a tightly constrained operational design domain, it serves as the first public, sustained demonstration of true driverless commercial operation within the company’s own ecosystem.

This event will be the focus of every analyst’s attention because it provides the most concrete evidence yet that the technology has matured sufficiently to justify the massive infrastructure and capital investment required for the next phase of global scaling. This success, or lack thereof, will undoubtedly set the immediate positive or negative tone for the company’s prospects in the subsequent year. The regulatory response to this success will be just as closely watched. If the Austin model is approved for broader scale, it sets a precedent that other cities and states will look toward. If it fails, the entire timeline contracts significantly.. Find out more about Tesla robotaxi countdown unsupervised Austin insights.

Actionable Takeaways for Tracking the Autonomous Revolution

For those monitoring this space—whether as investors, industry professionals, or future riders—the signals are clear. The focus must shift from merely observing vehicle deployment to analyzing systemic readiness for the next level of trust. Here are a few actionable insights:

- Watch the Regulatory Narrative in Texas: The success in Austin is the immediate precursor to expansion into Dallas, Houston, and Miami. Look for statements from the Texas Department of Motor Vehicles or local city councils in Q1 2026 regarding the scope of the *unsupervised* operating area, not just the supervised one.. Find out more about Navigating jurisdictional requirements robotaxi expansion insights guide.

- Compute Capacity Signals Intent: The exploration of proprietary chip fabrication is a direct, aggressive signal that the company believes the AI model is ready for global scaling. Track any updates on new fabrication partnerships or in-house construction timelines; this infrastructure build-out is as important as software releases.

- Contextualize the Mileage: Do not accept FSD total mileage as equivalent to Robotaxi safety data. The key metric to track, following the October leap, is the ongoing “miles to critical disengagement” figure for the *specific* robotaxi software stack once it goes live without monitors. A sustained number over 10,000 miles without intervention post-launch would be a massive confidence signal.

- Prepare for the Cybercab Economics: The vehicle design and target cost (under $30,000) are engineered for mass-market disruption. When volume production begins in the year following the software launch, monitor reports on the “unboxed” assembly throughput. This metric, combined with the removal of driver costs, defines the long-term competitive advantage over incumbent ride-hailing services.

This is not a slow burn anymore. The final checks for the Austin unsupervised launch—expected by late December 2025 or early January 2026—will be the ultimate proof of concept. The road ahead is incredibly complex, governed by geography, policy, and public sentiment, but the technology, as evidenced by the massive leaps in efficacy metrics, is demonstrating a capacity for unprecedented scale. The game is changing from if to when, and the next few weeks will provide the clearest indicator yet.

What aspect of this transition—the regulatory gauntlet or the immense compute demand—do you believe poses the greater long-term barrier to a ubiquitous robotaxi future? Share your thoughts below. For more analysis on how AI investment themes are shaping diverse industries, explore our latest post on AI investment themes beyond transportation.