The Societal Transformation Foreseen by Mass Automation

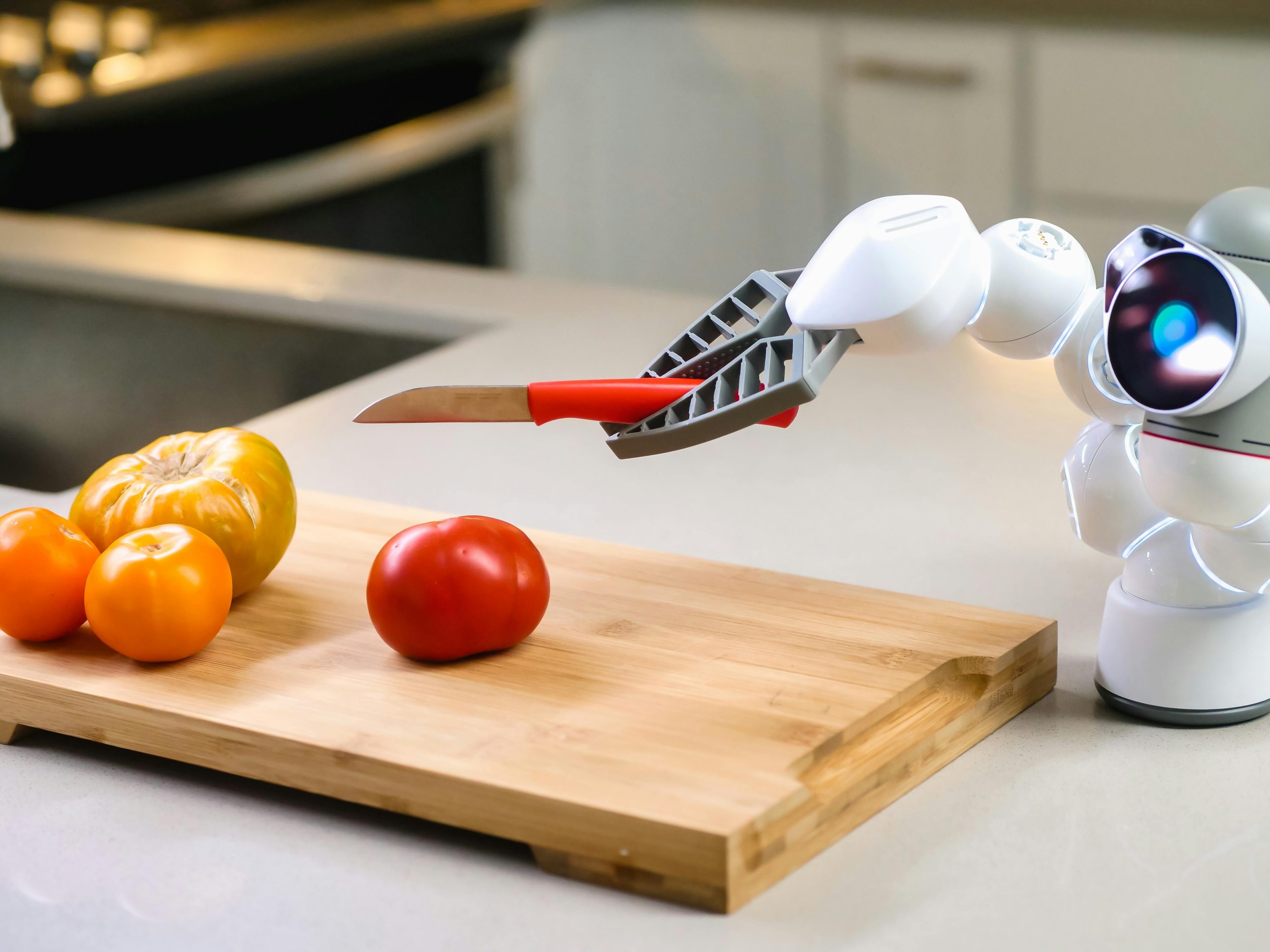

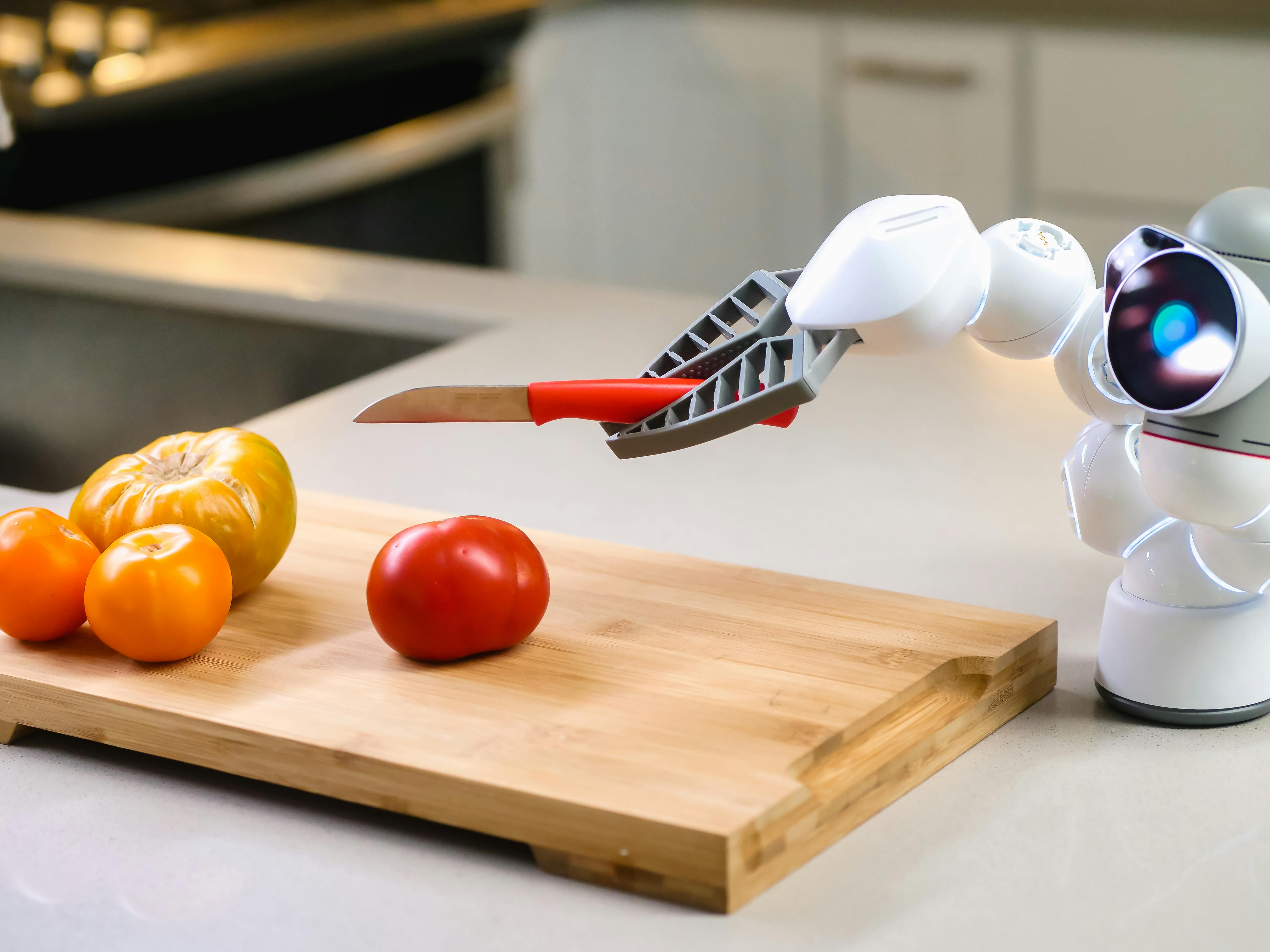

When you combine the software intelligence of FSD with the physical embodiment of Optimus, the projected impact moves from corporate valuation into macro-societal restructuring.

Eradicating Scarcity and the Vision of Universal Wealth

The most sweeping claim associated with the Optimus vision is its potential impact on global economic well-being. The leadership posits that the proliferation of highly capable, tireless, and cost-effective robotic labor is the only viable path toward creating a state of genuine material abundance for all people. By automating the production of goods and services across nearly every conceivable industry—from logistics to personal assistance—the cost of living could theoretically plummet.

This technological singularity in labor directly feeds into the concept of widespread, perhaps even universal basic income (UBI), because the traditional, mandatory link between compensated human labor and access to resources would be fundamentally severed. Imagine a world where scarcity, as dictated by human labor output, becomes obsolete.

Redefining Healthcare Access Through Robotic Precision

A particularly compelling illustration of this transformative power lies within advanced medical care. Projections include the capability for Optimus robots to function as highly skilled medical practitioners, potentially surpassing the finest human surgeons in terms of pure mechanical precision and tireless focus. This is not just an incremental improvement in surgical outcomes; it is the democratization of elite-level medical expertise.

The concept is a powerful one: world-class surgical precision is no longer limited by geography or an individual’s ability to afford the world’s best doctors, but is instead available anywhere an intelligent robot can be deployed. This promises an unprecedented level of universal access to life-saving interventions, moving the standard of care far beyond current limitations.. Find out more about Unsupervised self-driving at scale valuation trigger.

The Potential Diminution of Traditional Work Structures

Flowing from the concept of universal abundance is the radical reimagining of the human relationship with employment itself. If machines, driven by advanced AI and embodied by robots, can handle the vast majority of necessary, repetitive, or strenuous work, the necessity for most individuals to engage in traditional employment for survival naturally diminishes. This forecast suggests a future where work becomes, for a significant portion of the population, entirely optional—a pursuit of passion, creativity, or contribution rather than a mandatory means of sustenance. This represents a fundamental cultural and economic shift that pure software alone has rarely promised with such directness. We are moving toward a labor economy where intellectual capital and creativity are the highest-value commodities, while physical labor is handled by machines.

The Benchmark of Success: Nvidia’s Precedent in Semiconductor Dominance

To truly grasp the scale of the ambition, one must look at the company that currently defines the AI gold rush: Nvidia. The context for discussing a “Nvidia moment” is rooted in the current economic reality of late 2025.

Acknowledging the Current Market Leader’s Valuation Stratosphere

The chip manufacturer recently secured a market valuation that placed it among the absolute highest echelons globally. As of mid-November 2025, Nvidia’s market capitalization stands at an astonishing $4.532 trillion [cite: 11 from second search], having briefly surpassed the $4 trillion mark earlier in the year [cite: 9 from second search]. This success is directly attributed to its foundational role in providing the hardware accelerators necessary for training the large-scale artificial intelligence models driving the current wave.

This valuation is so massive that Nvidia’s market cap is greater than the combined market capitalization of Apple and the company under discussion here (which sits around $1 trillion as of recent reports) [cite: 8 from second search]. It is the undisputed kingmaker of the AI revolution.. Find out more about Unsupervised self-driving at scale valuation trigger guide.

The Technological Parallel Between AI Hardware and AI Embodiment

The core parallel drawn by leadership is powerful: while Nvidia is capitalizing on selling the “brain” of artificial intelligence (the compute hardware), Tesla aims to capitalize on selling the “body” (the general-purpose robot). Nvidia’s success validates the enormous financial reward associated with delivering essential, scalable infrastructure for raw intelligence.

Tesla’s proposition is that intelligence, once trained, requires an efficient, general-purpose physical platform—the robot—to translate its computational power into real-world economic utility. The argument suggests that the embodiment of that intelligence in a mass-producible physical form will unlock an economic value stream that is, in the long term, potentially even greater than the hardware that powers the underlying intelligence. It’s about turning abstract computation into tangible, scalable labor.

Ecosystem Collaboration and Broader AI Infrastructure Expansion

The pursuit of embodied AI is not happening in an isolated bubble. The entire tech ecosystem is aligning, which validates the massive investment thesis.

Inter-Company Partnerships in the Robotics Deployment Landscape

Reports indicate that other major manufacturers are rapidly integrating humanoid technologies into their operations, often utilizing the same foundational AI platforms that underpin the robotics research. Significant electronics producers, for instance, are announcing plans to deploy humanoids in their advanced manufacturing facilities within very short timeframes. These deployments are frequently powered by specialized platforms designed for robotics simulation and operation, highlighting a shared technological trajectory across the industry toward embodied AI.. Find out more about Unsupervised self-driving at scale valuation trigger tips.

Major Infrastructure Investments Signaling Future Commitments

Further evidence of the seriousness of this new technological direction comes from major strategic initiatives involving multiple technology leaders. A recent announcement detailed substantial commitments to building massive-scale artificial intelligence data and processing centers—a collaboration involving Tesla’s leadership through its other AI-focused entities and even the very company used as the valuation benchmark. The scale of this investment—hundreds of megawatts of power dedicated to AI infrastructure—underscores a shared, long-term view that computational capacity dedicated to advanced AI and robotics development is the single most important strategic asset for the coming decades, promising exponential growth in capability.

Intersecting Corporate Governance and Executive Compensation Structures

The ambitious technological goals are intrinsically linked to one of the most significant corporate financial agreements in modern history—the massive executive compensation plans that reward these specific outcomes.

Performance Milestones Tied to Trillion-Dollar Incentive Plans

The executive’s substantial performance-based compensation package, which has been the subject of intense shareholder debate, is directly contingent upon achieving a series of exceedingly challenging operational and financial targets. These milestones are enormous in scope, explicitly including:

- Boosting the company’s total market capitalization to a specific, multi-trillion-dollar figure (reportedly $8.5 trillion) [cite: 19 from first search].. Find out more about Unsupervised self-driving at scale valuation trigger strategies.

- Deploying an entire fleet of autonomous Robotaxis (reportedly 1 million in service) [cite: 19 from first search].

- Achieving massive yearly vehicle sales figures (reportedly 12 million more cars) [cite: 19 from first search].

- Crucially, producing 1 million humanoid robots annually [cite: 19 from first search].

- Monitor FSD Intervention Rates: Watch for reliable third-party or internal reports confirming a drastic reduction in human interventions across diverse geographies. The “texting while driving” freedom is a proxy for true unsupervised autonomy [cite: 6 from first search].

- Track Production Ramp Metrics: The 1 million unit target for Optimus is the most visible measure of Pillar Two’s success. Any confirmed manufacturing yield improvements or cost reductions below the $20,000 target will be significant validation points.

- Analyze FSD Subscription Adoption: The software must generate its own revenue stream to validate the capital-light service model. Increased FSD subscription numbers directly correlate to the perceived utility of the software brain.

- Look for Robotaxi Milestones: The deployment of a fully driverless Robotaxi network in even one major city is a non-negotiable step toward realizing the service platform value.

This creates a direct, quantifiable alignment between the CEO’s personal financial incentive and the successful realization of the very breakthroughs that are claimed to trigger the “Nvidia moment” for the stock.

The Scrutiny Surrounding Ambitious Operational Targets

The linkage between this pay structure and the daunting operational goals naturally invites intense discussion and scrutiny from various stakeholders, including shareholders and corporate governance observers. The sheer magnitude of the required increases in market cap, sales volume, and robot production necessitates not just innovation but flawless execution across multiple, disparate, and highly complex industrial domains simultaneously.

This places the executive’s legendary work ethic under an intense spotlight. Can these ambitious, almost futuristic goals be converted into tangible, audited results within the specified timeframe? The market is essentially betting on the CEO’s ability to not just invent the future, but to industrialize it at a speed never before witnessed, fueling ongoing debate about the nature of innovation versus the practicalities of execution.. Find out more about Unsupervised self-driving at scale valuation trigger overview.

Concluding Thoughts: The Trajectory of Tesla Beyond Electric Vehicles

The path forward is clear, and it’s not paved with asphalt alone. It’s a dual-track strategy engineered for civilizational impact.

Synthesis of Autonomy and Robotics as a Unified Vision

Ultimately, the overarching vision serves to fundamentally reframe the entire investment thesis surrounding the organization. The narrative moves decisively away from classifying the company as merely an electric vehicle manufacturer facing stiff competition in a maturing market. Instead, the vision presented is one of a unified artificial general intelligence entity whose primary products are intelligent action, both in transportation (Full Self-Driving) and in general physical labor (Optimus humanoid robot).

The synergy is the story: The data exhaust from the former trains the intelligence, and the embodied robot provides the scalable physical manifestation of that intelligence. The two pillars are co-dependent components of the same AI engine, designed to scale exponentially.

The Long-Term Investment Thesis Centered on General Purpose Intelligence

The company’s future, as outlined by its leader, rests upon its ability to become the foremost producer of general-purpose, adaptable, embodied artificial intelligence systems. The “Nvidia moment” is thus defined not by a single product’s success, but by the validated capability to deploy intelligence—in software and in hardware—at a scale that profoundly alters the economics of labor, services, and productivity across the entire globe.. Find out more about Optimus humanoid robot mass production targets definition guide.

This path promises not just market leadership in an existing sector, but the creation of entirely new, civilization-altering markets where the limiting factor is no longer human capital, but the speed at which these intelligent machines can be manufactured and deployed to serve every corner of the world. This is the bet being placed—a transition from automotive manufacturing to becoming the principal provider of the world’s new automated workforce.

Actionable Takeaways for Tracking This Trajectory

For investors and observers tracking whether this massive valuation is justified, focus your attention not on today’s sales figures, but on verifiable progress against these two core pillars. Here are actionable checkpoints:

The coming 18 to 24 months will either confirm this vision as the most prescient technological roadmap in history or reveal a fatal overestimation of execution speed. The stakes—both technological and financial—could not be higher.

What aspect of this dual AI and robotics future do you think will hit critical mass first: the software freedom of the car or the physical labor of the robot? Let us know in the comments below!

Key Anchors for Further Reading:

Understanding Tesla’s Strategic AI Investment